-

The $450 million Thunderbolt II Aircraft Lease transaction involves 18 aircraft representing the younger planes in Air Lease's $13 billion portfolio of owned and managed passenger jets.

By Glen FestJuly 11 -

The $109.3 million CLEAN 2018-1 is also the first deal to be marketed as a Rule 144A transaction under securities regulation making it available to wide base of institutional investors.

By Glen FestJuly 10 -

The fast-growing national health club chain plans to market between $1.23 billion and $1.33 billion of bonds backed by franchisee royalty and fee payments; proceeds will be used to pay off bank debt and fund a dividend to shareholders.

By Glen FestJuly 10 -

The lack of concrete lobbying victories had become an issue with some members in the group, possibly leading to a splintering of support among members and the board for continuing the executive director's tenure.

By Glen FestJuly 9 -

Most managers are looking to add three to five years of investable life through CLO resets and refis, but Apollo is sticking with a four-year reinvestment window in a refinancing of its 2016 ALM XVII portfolio.

By Glen FestJuly 6 -

As more new-vehicle buyers flock to General Motors' high-ticket trucks and SUVs, GM Financial has to supply riskier 60-plus month loans to finance them. That's prompting higher net ABS loss projections from Fitch.

By Glen FestJuly 5 -

Annisa CLO was originally issued in August 2016, just before risk retention regulation took effect, but was the firm's first deal to be dually compliant with both U.S. rules (which no longer apply to CLOs) and European rules.

By Glen FestJuly 3 -

GoldenTree Loan Opportunties XII was one of nine CLOs that were reset or refinanced on Friday alone, as managers rushed to lower payment prior to July quarterly payments to investors; the tally for June as a whole is $30.9 billion.

By Glen FestJuly 2 -

Richard Sandor has been called the father of futures trading and carbon trading. His latest passion is a fledgling reference rate that is being used by a collection of small U.S. banks to price wholesale interbank financing.

By Glen FestJune 28 -

With sales recovering from the the fading diesel-engine emissions scandal from 2015, Volkswagen's U.S. captive finance arm is inviting prime auto-loan investors out for a drive for the first time since 2014.

By Glen FestJune 25 -

That level is wide of the six new-issue CLOs that priced last week at triple-A spreads of 110 basis spoints; CLO senior notes have widened 10 basis points, on average, over the past three months.

By Glen FestJune 22 -

It's the sponsor's first transaction since risk retention rules took effect; proceeds from the new five-year and 10-year notes will be used to repay note issued from the master trust in 2010.

By Glen FestJune 21 -

It's another example of what appears to be tailoring tranches to meet the tenor and yield requirements of specific investors; the deal, GMS Euro CLO 2014-1, was also upsized to €508 million from €368.3 million originally.

By Glen FestJune 20 -

LTC Global is one of the market leaders in a "relatively new" esoteric asset class of acquiring and financing insurance commission assets of life and healthcare insurance products, says DBRS.

By Glen FestJune 19 -

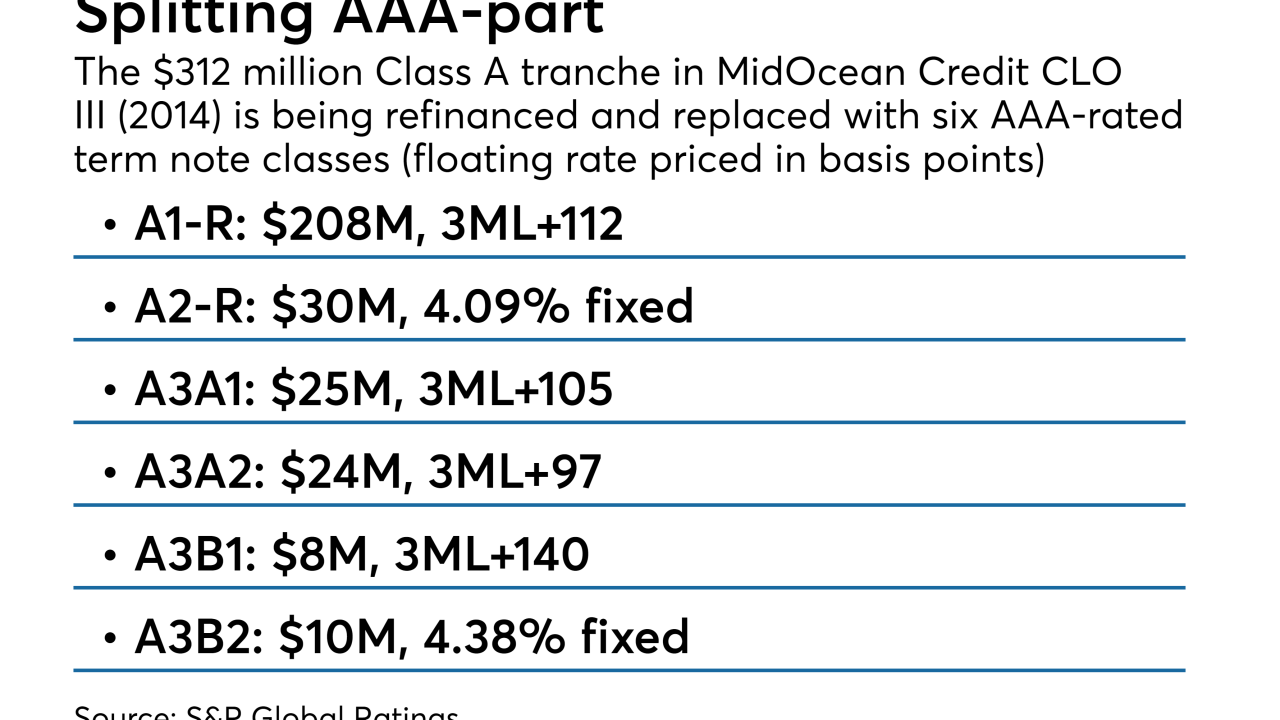

The original $312 million triple-A notes are being replaced with six separately priced Class A note tranches, including two fixed-rate securities classes

By Glen FestJune 18 -

The concentration of loans with terms of 73-75 months has breached 13%, after ranging from between 10-12% from five previous AART issues since 2016.

By Glen FestJune 18 -

The $100 million Series 2018-1 notes will rank on an equal basis with the $900 million of notes Coinstar issued from the same master trust in May 2017, all are collateralized by nearly 20,000 coin-counting kiosks located in major retail stores.

By Glen FestJune 15 -

In Santander Consumer USA's third subprime shelf offering of 2018, new cars represent 55.8% of the collateral. In previous deals dating to 2013 new-car concentrations did not exceed 40.9%.

By Glen FestJune 15 -

Five classes of notes will be issued in the transaction, BBVA Consumer Auto 2018-1, which is backed by a pool of well-seasoned loans on new and used cars that will revolve for an initial period of 1.5 years.

By Glen FestJune 14 -

CLO securities pay out interest pegged to the three-month London interbank offered rate, but loans used as collateral are increasingly switching to one-month Libor and the spread between the two benchmarks has widened significantly.

By Glen FestJune 14