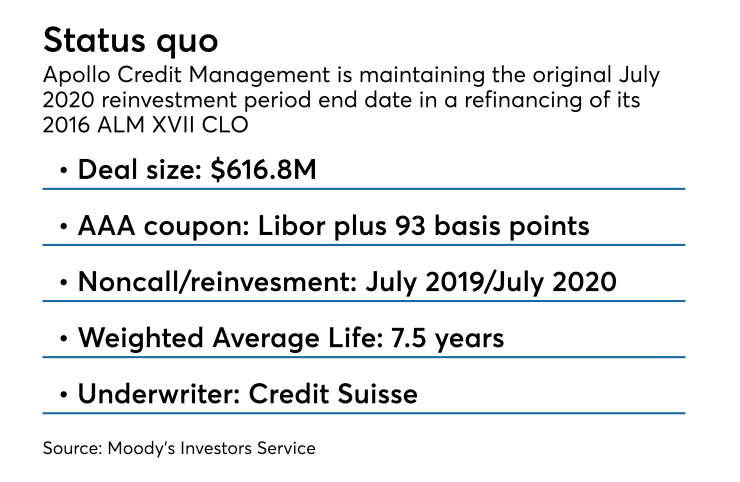

Bucking an industry trend, Apollo Credit Management is not taking advantage of the refinancing of a $600 million CLO to extend the life of the transaction.

According to a presale report issued by Moody’s Investors Service, the $600 million ALM XVIII will issue new notes and use proceeds to repurchase existing securities paying higher rates of interest. However, investors in the new notes are not being asked to agree to extend the reinvestment period of the deal of its legal final maturity. Apollo will still be restricted from buying and selling assets after July 2020.

In fact, Apollo agreed to new stricter parameters on asset purchases following the reinvestment period. The new terms enact a one-year limit on the use of excess principal to add new collateral to the deal; under the original deal, Apollo was permitted to use proceeds from prepayments or loan sales to acquire new assets throughout the amortization period, so long as the new loan purchases maintained credit quality and coverage tests for investors.

Apollo is extending the period during which the deal cannot be called, or repaid early, but only by one year, to July 2019, according to Moody’s.

That's unusual.

Apollo is still cutting its financing costs significantly.

The refinancing, via Credit Suisse, tightens the spread on the upsized triple-A tranche of $375 million in notes. The replacement A-1a-R notes are set at three-month Libor plus 93 basis points (based on short-term maturity), compared with the original spread of 155 basis points when the notes were sized at $369 million.

An $18 million, 3.42% fixed-rate senior note tranche is being swapped out for a new $12 million floating-rate note class priced at 130 basis points over Libor. The new A-1b-R notes remain Aaa-rated by Moody's.

In another change in the capital stack, Apollo consolidated two tranches of Class B notes into a single, A-rated (Moody's A2) tranche that pays basis points over Libor, down from the 340 point basis spread from its January 2016 issuance.

The weighted average life loans used as collateral was extended 1.5 years to 7.5 years, according to Moody’s. The current portfolio has a weighted average spread of 3.56%, denoting the difference between the average funding costs of the notes and coupons paid to investors.

The final legal maturity remains January 2028.

Along with the limited reinvestment period, another credit strength to the deal is the inclusion of all Caa-rated assets – most notably, current-pay status loans – when calculating the 7.5% pool limit on C-rated loans, according to Moody’s. Apollo, similar to other CLO managers, included provisions in which only delinquent triple-C rated loans (two notches above a default rating) count against the cap.

While investors permitted an increase in the allowance of cov-lite loans in the pool lacking maintenance agreements (an increase to 85% from 60%), Apollo agreed to a stricter limit on second-lien and nonsecured loan collateral by raising the minimum first-lien senior secured level to 95% of the pool from 90%.

ALM XVII is the second deal reconfiguration for Apollo Credit in the past month. In June, it reset a 2015 vintage $1.1 billion CLO, ALM XVI, for the second time. That deal was previously refinanced in July 2017.

ALM XVII isn't Apollo's only CLO that is exiting its original non-callable period; another deal, the $450 million ALM XVIII, which closed in June 2016, is eligible to be called or refinanced on July 15.

In all, Apollo Credit has 16 CLOs under management totaling $12.3 billion.