(Bloomberg Markets) -- In the early 2000s, before I became a reporter, I worked for GE Capital, which made loans to companies owned by private equity firms. It wasn't glamorous: I traveled to the suburbs of Milwaukee to kick the tires on a vitamin shop and oversaw a loan to a Christmas tree farm that the credit committee hated for being seasonal. When I tried to explain my job at parties, people gave me quizzical looks.

Flash-forward to September 2023. Stephen Schwarzman, the billionaire chief executive officer of investment giant Blackstone Inc., was speaking on a panel in Paris about the charms of making loans to companies—or, in the current argot, private credit. "If you can earn 12%, maybe 13% on a really good day," he said, "what else do you want to do in life?"

No longer a backwater, private credit is now the buzziest corner of Wall Street. These loans to companies charge floating rates, and the Federal Reserve's tightening campaign has lenders collecting double-digit yields where they used to get 7%. By some measures, investors in this kind of credit are earning higher returns than the buyout artists of private equity, and the market is now worth $1.6 trillion and climbing. Alongside Blackstone, financial titans including KKR, Ares Management and Oaktree Capital Management are making enormous bets. The asset management company BlackRock Inc. forecasts private credit ballooning to a $3.5 trillion market in five years.

Just as private equity managers organize funds to buy up companies, private credit firms collect cash from investors to make corporate loans. The fees are juicy: Credit fund managers may earn an average of 3.5% of assets per year after performance fees are included, according to research from investment adviser Cliffwater. Yields are high because the loans tend to be riskier. Some go to growth-stage companies that eat through lots of cash. Many fund private-equity-driven leveraged buyouts, which leave lots of debt on the balance sheet of the target company. You'll notice that many of the companies in private credit—see Blackstone and KKR & Co.—are also big in private equity. It's not unusual for one private equity firm to buy a company using debt provided by another private equity firm.

The private credit boom has come at a cost to investment bankers, who are losing out on the lucrative fees from raising money for risky debt. And it's making private equity firms—many rebranding as alternative asset managers–even more pivotal in markets and the economy. About 12 million people work for private-equity-owned companies in the US. The industry is buying or rolling up businesses large and small—and now it's collecting fees on the loans, too.

The upside: Companies have more places to turn when they want to borrow. Buyout shops also say they can bring better management to the companies. Critics argue that their leverage-driven model rewards flipping companies for a quick profit. And if central banks aren't able to engineer a soft economic landing, these expensive debts could lead to a surge of defaults, bankruptcies and job cuts.

Sound familiar? Private credit is, to some extent, a new label on an old wine. It's the newest phase of the "junk" debt revolution that started in the bond market with Michael Milken in the 1980s, spread to syndicated loans in the 1990s and turned the market loose on the staid business of lending. The history of leveraged debt is the history of the modern financialized US company—one worth revisiting as private credit kicks into high gear.

The Origins of Junk

High-yield debt predates Milken. But he and his group at the investment bank Drexel Burnham Lambert transformed and popularized it. Previously, a junk bond was typically the result of a mistake. A banker's job was to divine which companies could meet their financial commitments and avoid the ones that looked risky. So bonds with low credit ratings were usually so-called fallen angels—once-safe companies that ran into trouble.

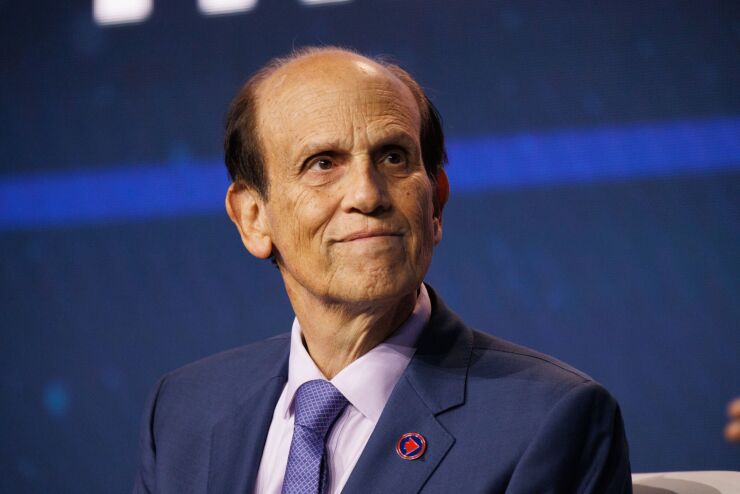

Milken's insight was that companies with weak credit had lower defaults than people perceived and could be profitable so long as yields were high enough. "My research showed that everything people were saying about credit was wrong," says Milken in an interview. Armed with data spanning centuries, he spent a decade promoting lower-rated corporate debt as an investment. The 1974 recession was seismic. "From December 1974 to December 1976, investors earned a 100% return on a portfolio of non-investment-grade debt," says Milken. "That lent credibility to our research."

Drexel began issuing high-yield bonds in the late 1970s, and other investment banks followed suit. The rise of high-yield debt markets opened up a new avenue of financing for telecom upstarts, cable companies and hotels in Las Vegas. "When you see companies that can't get money, and then you raise it for them, they become your friend for life," says Lorraine Spurge, who headed capital markets at Drexel from 1983 to 1989. But the group that perhaps benefited the most from the new market were the leveraged buyout barons.

High-yield bonds supported the deal of the '80s, KKR's takeover of tobacco company RJR Nabisco. These debt instruments were controversial; that's one reason the junk label stuck. Investors who purchased them could well be placing their careers on the line. And they became a shorthand for the fast-money spirit of the decade, by providing the backing that enabled corporate raiders such as Carl Icahn to set their sights on ever bigger and more disruptive deals.

Milken and the people who worked with him say they were bringing a tough-minded approach to a sleepy business. "Historically, raising money for high-grade companies was done more on the golf course than in the conference room," says Tony Ressler, formerly responsible for new issue and syndicate at Drexel, who went on to co-found Ares. In its heyday, Drexel had half of the market for new junk debt. "We had a party on the trading floor when the high-yield bond market hit $50 billion in the late '80s," says Mark Attanasio, a Drexel alum who co-founded Crescent Capital Group and owns the Milwaukee Brewers.

But then the good times screeched to a halt. Milken and Drexel came under federal investigation tied to insider trading. Drexel pleaded guilty to six felonies and paid a $650 million fine that contributed to its collapse in 1990. Later that year, Milken also pleaded guilty to six felonies, including securities fraud but not insider trading. He served 22 months in prison and was barred from the securities industry for life. (Then-President Donald Trump pardoned him in 2020.) The high-yield bond market froze up for a while.

A New Business for Bankers

Across the Pacific from Drexel's Los Angeles office, Japan was seeing its miracle decade of economic growth come to an end. While Drexel's fall and Japan's bust were separate events, they combined to create an enormous headache for US commercial banks. The solution would eventually create another market for high-yield debt.

During the buyout craze, big banks weren't content to leave the profits to bond underwriters like Drexel. They made their own junk-grade loans, committing to holding a portion of them on their own balance sheets while selling off chunks to other banks. Japanese banks accounted for about 40% of such buyout-loan purchases, but then they pulled back.

That left Jimmy Lee and his group within Chemical Bank in a jam. In 1989 the bank held a $1.72 billion senior loan for the buyout of hospital chain American Medical International. They were struggling to sell it off. "Most of the lending appetite in what was a bank-only market disappeared," says AGL Credit Management LP founder Peter Gleysteen, who was then Lee's No. 2. (Lee died in 2015.) "We still had several hundred million more than we were supposed to." They started marketing loans to insurance companies, tweaking them to pay down at maturity rather than over time, a structure insurers preferred.

At first an emergency measure, selling leveraged loans to institutional investors rather than to banks became a business unto itself. Chemical, which later merged into today's JPMorgan Chase & Co., hired a trader and created a secondary exchange for the debt, making it more liquid and more similar to high-yield bonds. (The main differences are that loans are floating rate and offer better protections to lenders.) The investor base widened. Asset managers started buying them, sometimes repackaging them into collateralized loan obligations, a type of securitization. "Lee ushered in the era where banks were more distributors of credit and held on to less risk," says Andy Gordon, who invested in leveraged loans at Chemical and is co-founder of Octagon Credit Investors. "The old saying was they weren't in the storage business, they were in the moving business."

Soon enough came another buyout era, running from the early 2000s till the onset of the financial crisis. Private equity set its sights on ever bigger targets, including hospitality chain Hilton Hotels, electricity company TXU and drugstore chain Alliance Boots.

The Irresistible Rise of Private Credit

Underneath those headline-grabbing transactions was a flurry of smaller-scale buyouts. Deals for less than $1 billion or so wouldn't get the attention of either bond investors or big leveraged loan buyers. That's where so-called direct lenders stepped in, though at the time the business was often called merchant banking. An early iteration was dominated by GE Capital, my old employer. Using the sterling credit rating of Jack Welch-era General Electric Co., the finance arm of the conglomerate could borrow cheaply to make high-yield loans.

Goldman Sachs Group Inc. was another early entrant, carving out a niche left by commercial and regional banks. "It was so obvious that this market was going to develop because there was a big gap between traditional bank lending and private equity," says Alan Waxman, who wrote the business plan to build out the firm's hybrid credit unit. (Today Waxman runs Sixth Street, a $75 billion asset manager.) Goldman Sachs is now a major private credit player via its asset management arm.

In 2008 the music stopped. For everyone. Although the financial crisis centered on the mortgage market, it cast a pall over all kinds of lending. Wall Street banks were stuck with hundreds of billions of dollars in "hung" debt—loans and bonds they originated for buyouts but couldn't sell off. Fears about GE Capital and its inscrutable finances sent GE shares spiraling downward. (GE Capital was broken up into many pieces, and the direct lending unit was sold off.)

This sounds like it would have been the end of the leveraged corporate lending business. But in fact it set the stage for further growth of high-yield bonds, leveraged loans and private credit. Regulators clamped down on banks to make them less risky, and that limited the amount of their own money they were willing to provide or underwrite for leveraged lending. On the other hand, central banks pushed benchmark interest rates to near zero to get economies moving again. Investors were desperate for yield, and many were willing to get it by taking more risk. The public junk debt market doubled in size, then tripled. So did the leveraged loan market.

Private credit was quietly evolving into its modern form. The private equity industry jumped into direct lending. Firms like Ares and Golub Capital used vehicles including publicly traded business development corporations and collateralized loan obligations to raise money for loans. They were able to lock up capital for years. Long-horizon investors such as pension funds and university endowments, following the lead of Yale University's David Swensen, were increasingly willing to invest in private markets. "People needed to meet obligations, and they started to look at private credit as a yield enhancement to fixed income," says Ian Fowler, co-head of the global private finance group at Barings.

In 2016, Doug Ostrover, Marc Lipschultz and Craig Packer— who'd been top executives at Blackstone, KKR and Goldman Sachs, respectively—started Owl Rock, a firm lending to midsize companies. Soon they were awash with $12 billion of institutional capital. "Doug teases me about how long and thorough our discussions were before I was able to make the decision to leave Goldman Sachs," says Packer. The firm merged with Dyal Capital to become Blue Owl Capital Inc., which manages $80 billion in credit, alongside real estate and other assets.

Blackstone pivoted in 2017. Its existing credit group shut down two profitable business lines to focus more on direct lending to private-equity-backed companies. It also began to tap the so-called mass affluent with a fund available to individuals through financial advisers. Private credit assets soared, and the size of individual loans got bigger and bigger, too—hitting $2 billion, then $5 billion. Industry watchers say $10 billion is in view. "Private credit will continue to take share from the syndicated market," says Alan Schrager, who runs Oak Hill Advisors' credit business. "I predict that direct lending will likely go from 20% now to 40% in the next few years, due to refinancing debt as well as winning new private equity transactions."

The competition is on the back foot. When rates spiked, many investment banks had to deal with unsold hung debt again, and the failures of Silicon Valley Bank and Credit Suisse have traditional lenders feeling cautious. Regulators are also raising their capital requirements. "There are moments where events like the global financial crisis or the regional banking crisis opens up new white spaces for new capital," says Ares CEO Michael Arougheti.

Can the companies paying today's high rates handle the mounting debt without buckling? With more money flooding into private credit, lending standards and protections for investors in new deals may be getting weaker. The modern iteration of private credit has yet to be fully tested by an economic slowdown or recession. The Federal Reserve says regulators have little visibility in the growing industry, although it believes the risk to financial stability appears low. Since private loans trade very infrequently, they can be less volatile— but it's possible that losses could build up out of view. Armen Panossian, incoming CEO at Oaktree, says private credit is still a "no-brainer" investment. Default rates are low. But he's looking for red flags. "For some of the older deals, there's stress building up in portfolios that will manifest in different ways," he says. Companies may start asking creditors to loosen the terms of loan covenants or to accept forms of payment besides cash. "And then the last step is you'll see capital-D defaults."

Milken looks at private credit, leveraged loans and junk bonds as different sides of the same story. "I don't think there are three markets—it's one market," he says. "As conditions change over time, companies should change their capital structures, sometimes choosing fixed income, sometimes floating rate, sometimes public markets, sometimes private." The constant is that on Wall Street, credit is now where the action is.

More stories like this are available on bloomberg.com