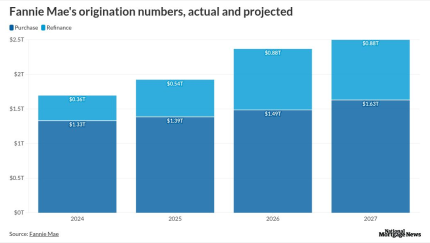

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

-

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

Janus brought several innovations to the asset management market, including the asset-backed securities ETF (JABS) and the fixed-rate CLO ETF (JAAA).

December 23 -

Democratic senators are attributing a recent decline in lending activity to a Trump administration regulation that puts new restrictions on borrowers with foreign ownership.

December 23 -

The national mortgage delinquency rate jumped to 3.85% in November, up 15% month over month and 2.79% year over year, according to ICE Mortgage Technology.

December 23 -

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

December 22

-

Redaptive EAAS Issuer 2025-1's structure includes overcollateralization, a cumulative net loss trigger and an average delinquency trigger.

December 22 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

December 18 -

While the 30-year average has hovered near the same level for weeks, the past year brought with it promising trends that may ease affordability in 2026.

December 18 -

CLIF Holdings' capital structure includes overcollateralization and a liquidity account of $1 million.

December 18