Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

-

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

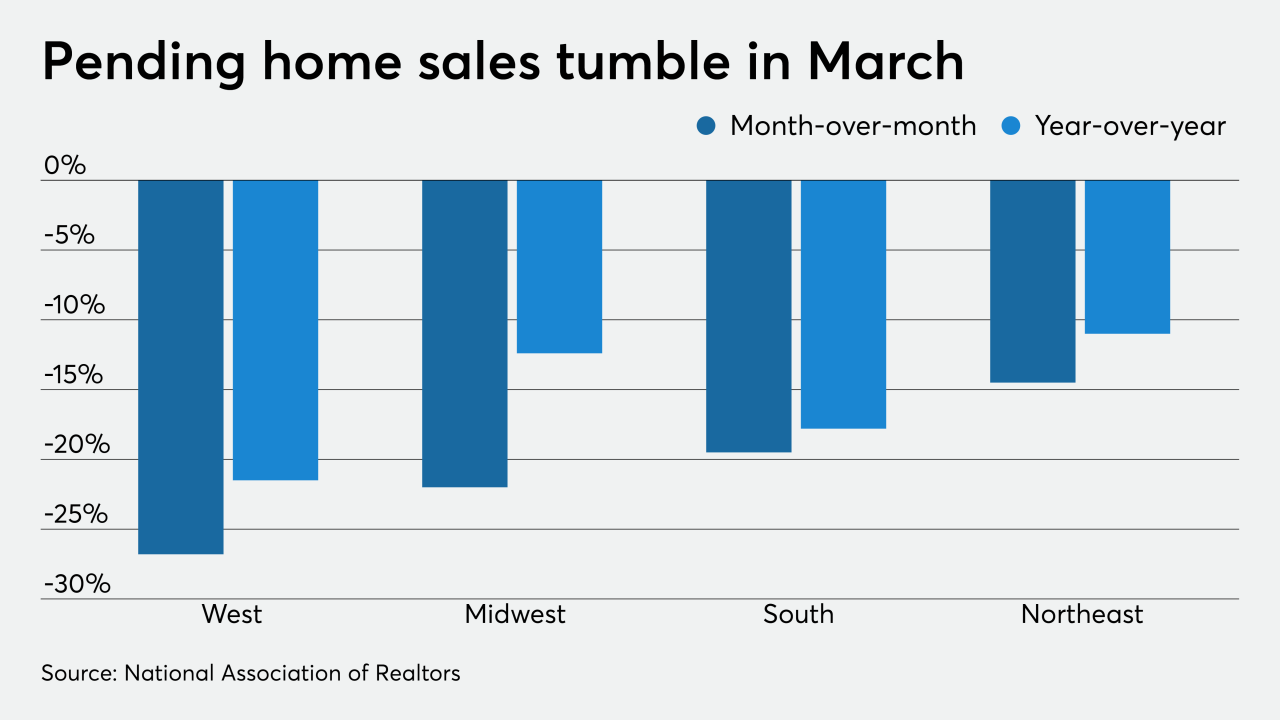

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

Hertz and Avis will likely each have to seek to relief from lenders – including asset-backed securities investors that make up the bulk of funding for both companies’ fleets, Moody’s stated in research reports.

April 29 -

The Consumer Financial Protection Bureau's chief operating officer will take a similar position at the Federal Housing Finance Agency, fulfilling one of the multiple recruiting goals the FHFA announced in January.

April 28 -

Falling used-car values, loan forbearance programs and economic uncertainty are weighing on the lower-end of the subprime auto finance sector.

April 28

-

The government-sponsored enterprises are focusing on how loans can be repaid after the federal forbearance period ends, and projections for loan modification volumes suggest the larger industry should, too.

April 28 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The agency stated it’s concerned that securitization payment cash flow for the notes could be disrupted by deals’ stop-advance features that limit the period in which servicers must cover principal and interest payments on delinquent loans to MBS noteholders.

April 27 -

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

April 24 -

Correspondent loan sellers are hoping the new GSE purchases will help to open a market frozen by coronavirus-related risk — but the prices offered so far aren't too promising.

April 24 -

Rising default levels have produced strain on many collateralized loan obligations, many of which are now approaching breaches of covenant tests on minimum weighted-average ratings factors and maximum holdings of triple-C rated loan assets.

April 23