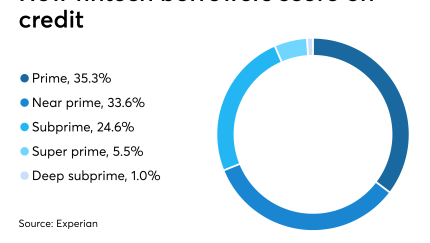

Digital-first lenders more than doubled their market share in the last four years, according to a report by Experian.

-

CommonBond is coming to the securitization market again with another trust that uses the highly selective prefunding period feature to issue notes backed by private, refinanced student loans.

October 23 -

CarMax Auto Owner Trust, 2019-4 is bringing $1.1 billion to the asset-backed securities market with slight decreases in overall credit enhancements. Yet those credit enhancement changes reflect a stronger pool of loans, not increased risk-taking.

October 23 -

The $757.2 million Chase 2019-CL1 will be structured to sell notes that are tied to a reference pool of 979 residential mortgage loans – all of which will remain on JPMorgan’s books rather than being transferred to a trust.

October 22 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

Air Lease Corp. is making a straightforward trip to the asset-backed securitization market with two trusts that will raise $437 million to purchase aircraft for its aircraft lease and management business.

October 22

-

S&P's review of leveraged-loan deals across multiple sectors found only 17% of lenders have provisions that would disallow borrowers from transferring collateral assets to unrestricted subsidiaries outside lender reach.

October 21 -

The attractions of Grande Canal Shoppes, a luxury shopping center property in Las Vegas, are not just bringing in the tourists. It is the 14th-largest loan in the GS Mortgage Securities Trust 2019-GSA1, a Goldman Sachs deal.

October 21 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

The $450 million DT Auto Owner Trust 2019-4 has a pool balance of $519.7 million, an average balance of $17,125 per account and an 84.21% share of loans with terms over 60 months.

October 20 -

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

The high court will decide how much latitude a president has to fire the director of an independent agency.

October 18 -

According to Kroll, this is the middle-market lender's first securitization of growth-opportunity loans made to venture-capitalized software firms that have yet to develop earnings or substantial assets.

October 18