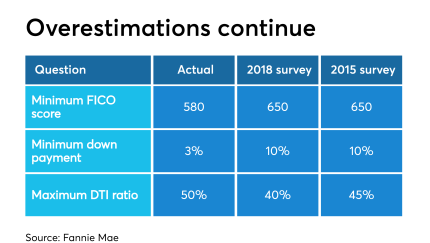

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

-

The agreement is expected to solidify a lending partnership whose status had been in doubt for more than a year. But it raised as many questions as it answered.

July 1 -

Former Freddie Mac CEO Donald Layton has joined the Harvard Joint Center for Housing Studies as a senior industry fellow focused on reform of the government-sponsored enterprises.

July 1 -

Despite rising delinquency levels, borrower performance on the underlying mortgages in GSE credit-risk transfer securitizations is strong enough to warrant ratings upgrades to more than half of nearly 1,200 outstanding note classes.

June 28 -

In a downturn, some fintechs, such as independent lenders, will be more vulnerable to economic forces than those working to service banks' regulatory needs.

June 28 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27

-

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

The global alternative asset manager is buying a majority stake in the investment advisory of CM Finance, which lends and makes equity investments in middle-market companies.

June 27 -

The $354.9 million Battery Park CLO Ltd. is a broadly syndicated loan portfolio that is the first “CLO 2.0” deal sponsored by Goldman Sachs Asset Management (GSAM).

June 26 -

The deal is backed by an underlying pool of 1,724 fixed-rate mortgages originated by Blackstone-owned Finance of America Mortgage.

June 26 -

The refinance share of mortgage applications climbed to the highest level since January 2018 as the average 30-year fixed interest rate continued tumbling, according to the Mortgage Bankers Association.

June 26 -

The publicly traded real estate investment firm is backing the securitization via Citi with 156 properties in 28 states.

June 25 -

There is bipartisan agreement in the Senate that Fannie Mae and Freddie Mac are "too big to fail," but some lawmakers are skeptical that a SIFI designation is appropriate.

June 25