The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

-

According to ratings agency presale reports, the $398.7 million Flagship Credit Auto Trust 2019-4 includes a 23% share of collateral loans originated through the company’s growing dCarFinance.com direct financing channel.

November 6 -

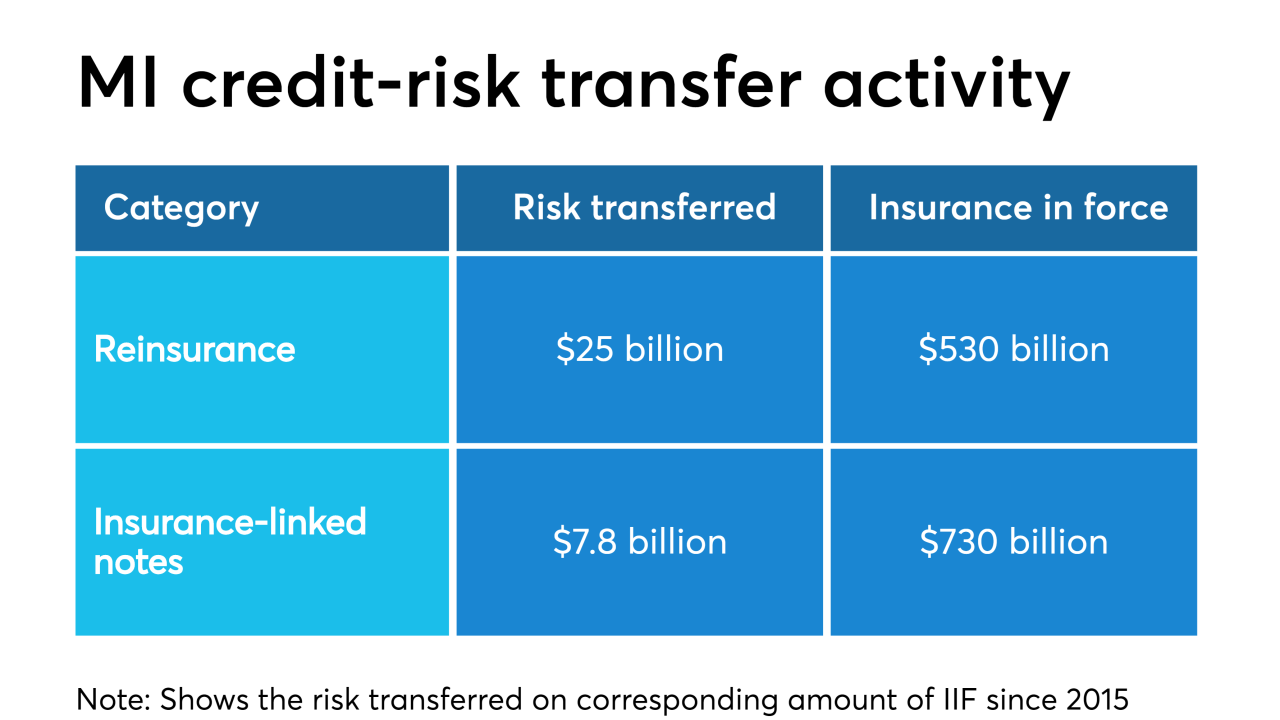

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Many in the space are seeking the creation of a "flexible" supervisory regime that relies on existing authorities and a hands-off approach from state agencies, but such a plan faces an uphill battle.

November 5 -

Instead of marketing securities backed by commercial property mortgages, STORE Capital chooses the more esoteric option of securitizing the income from its triple-net leases – a similar strategy to REITS such Spirit Realty Capital and SCP Financial.

November 5 -

Sixty percent of the loans were underwritten with just 12- or 24-month bank statements, according to ratings agency reports.

November 5

-

The loans have principal balances ranging from $2.2 million to $66 million, with the largest loan belong to the GNL Office and industrial portfolio of 12 single-tenant industrial and office properties in 10 state

November 4 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

The San Francisco fintech company has agreed to pay a $110,000 fine for failing to comply with a 2017 state law that requires mortgage servicers to be licensed.

November 4 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

A diverse mix of well-performing assets in its collateral pool is helping CCG Receivables Trust 2019-2 secure a strong credit profile, as it brings $317.2 million in asset-backed securities to market.

November 1 -

The Volvo Financial Equipment LLC, Series 2019-2, brings to market ABS notes, backed by trucking and construction equipment loans, categories that analysts view as solid performers outside of severe macroeconomic pressures.

November 1