Raising the capital gains tax and code changes could have more of an impact on the public debt market than rising interest rates, according to a panelist at the Urban Land Institute's Spring event.

-

DMB Financial, a debt-settlement firm near Boston that operates in 24 states, agreed to pay $5.4 million in restitution to consumers for allegedly charging upfront fees before providing any service, the CFPB said.

May 17 -

Financial institutions said they needed more time to weigh in on issues such as how they use artificial intelligence for fraud prevention and underwriting.

May 17 -

Avant Loans Funding Trust 2021-REV1 is a $200 million note offering backed by loans underwritten through its Avant platform. The $500 million OneMain Financial Issuance Trust 2021-1 is the first deal of the year for OneMain, which has previously issued 23 consumer loan securitizations and five auto-loan ABS deals.

May 17 -

The initial $1.31 billion pool may be potentially upsized to $1.53 billion.

May 17 -

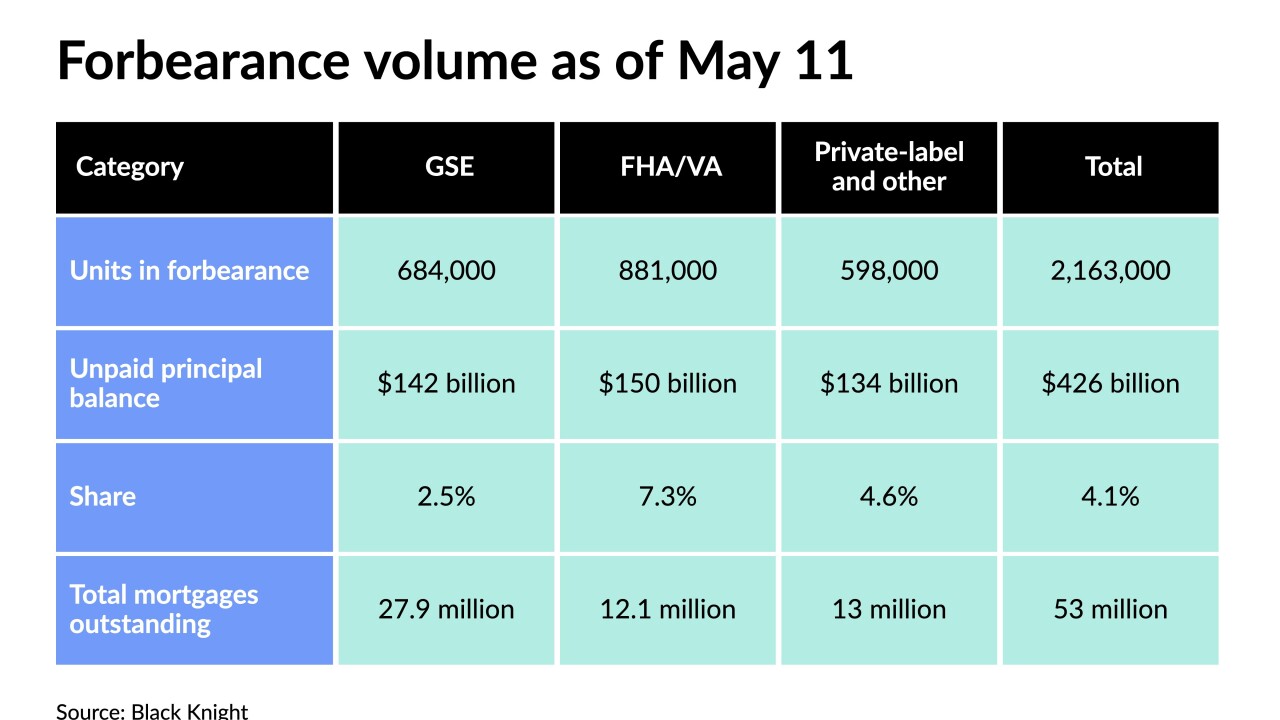

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14

-

This week, Moody’s Investors Service projected elevated credit-loss expectations for a new subprime auto-loan securitization from Veros Credit, even though the new deal has several improved credit metrics compared to the company’s prior ABS offering in March 2020.

May 14 -

Verizon Master Trust, Series 2021-1 is the first series from the new platform which will periodically issue notes that – similar to bank credit-card ABS structures –will be designated to specific groups of accounts.

May 14 -

Deals, trends and research in structured finance and asset-backed securities for the week of May 7-13

May 13 -

The legislation, which the chamber passed Thursday, would ban collectors from making threatening statements to military service members and prevent credit bureaus from including debt arising from certain medical procedures.

May 13 -

Raising the capital gains tax and code changes could have more of an impact on the public debt market than rising interest rates, according to a panelist at the Urban Land Institute's Spring event.

May 13 -

Some worry the Senate’s rejection of the OCC rule hampers efforts to clarify legal standards for banks selling loans to fintechs.

May 12 -

If the lender's trust opts to upsize its second bond offering of 2021, the $2 billion-plus transaction would be Santander's biggest in the post-crisis era.

May 12