California green-energy lender Solar Mosaic is planning a debut $138.95 million securitization of loans financing residential solar-panel system installations.

-

PineBridge Investments has priced its first collateralized loan obligation of the year.

February 26 -

Fannie Mae is planning another transaction that shifts credit risk on mortgages before it acquires them.

February 26 -

Issuance volume for asset-backed securities for the year through February 24, 2017.

February 24 -

Värde Partners, a Dallas-based firm with over $12 billion in existing or previously distressed acquisitions, has pooled 201 of commercial, vacant land and residential properties in the $348.2 million VSD 2017-PLT1 asset-backed transaction rated by Kroll Bond Rating Agency.

February 24 -

Mariner Investment Group has launched offering of private-label resident mortgage bonds, but its hard to characterize the collateral.

February 23

-

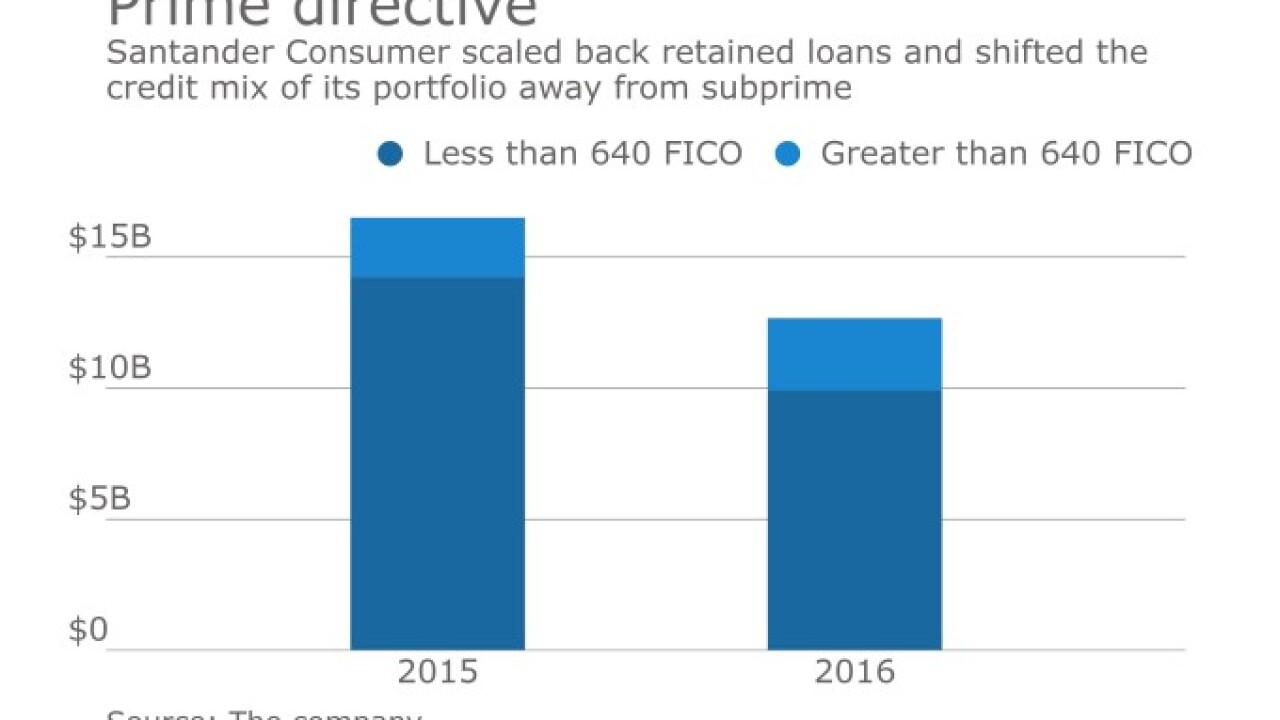

Santander Consumer USA Holdings plans to increase lending to consumers with solid credit scores after being squeezed by higher losses on its subprime auto book.

February 23 -

-

The Prime Collateralised Securities Initiative is aiming to boost synthetic securitization, which offer an alternative way for European banks to free up capital for more lending.

February 23 -

Wells Fargo Goes It Alone on 1st Risk Retention Compliant CMBS

February 22 -

Middle market lender Madison Capital Funding is preparing its first collateralized obligation of the year.

February 22 -

Volkswagens U.K. finance arm is marketing £750 million ($884 million) of bonds backed by auto leases.

February 22