State regulators felt they were strung along by the mortgage servicing giant Ocwen Financial after years of promises that were never fulfilled, resulting in successive enforcement actions against the company.

-

The Blackstone Group is tapping the commercial mortgage bond market to help finance the purchase of 11 multifamily properties from IMT Capital, according to Kroll Bond Rating Agency.

June 28 -

Synchrony Financial and Alliance Data Systems are particularly vulnerable to recent shifts in Americans’ shopping habits, according to new research from Moody’s Investors Service.

June 28 -

Lea Overby was formerly managing director, research; she replaces Charles Citro, who left the credit rating agency to pursue other opportunities.

June 28 -

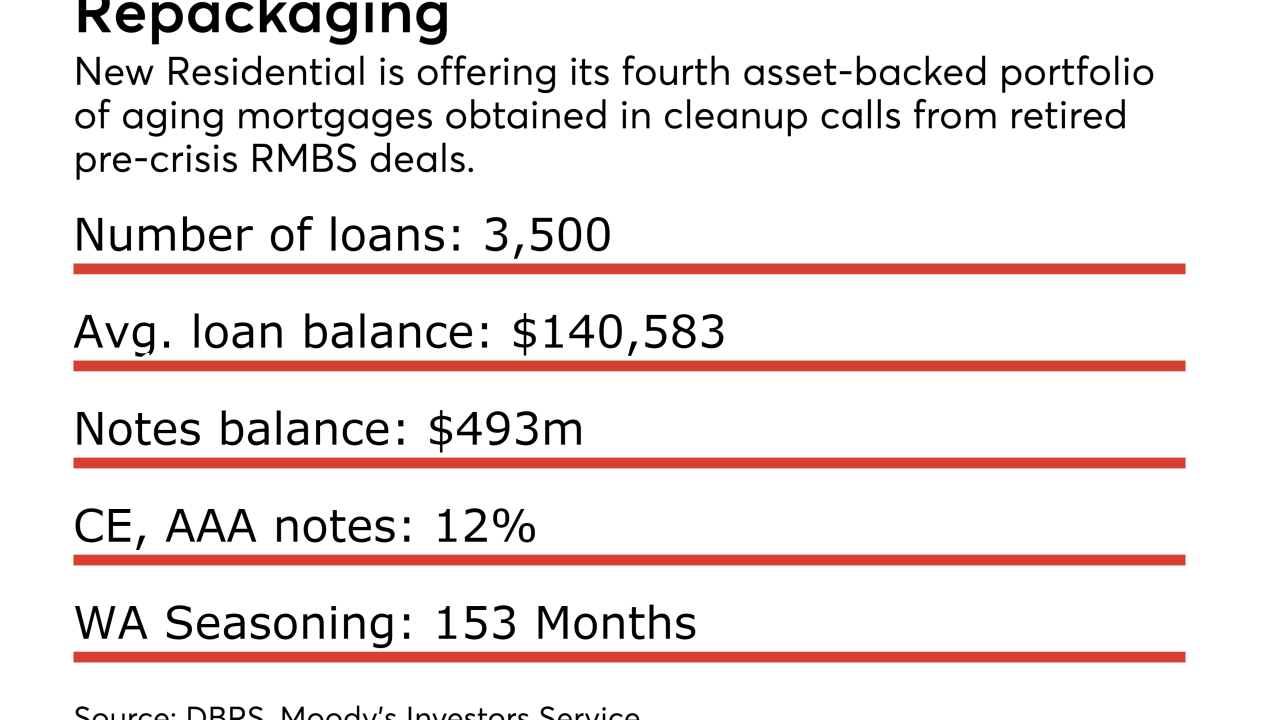

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

June 28 -

The Senate is set to begin teeing up housing finance reform discussions at a Banking Committee hearing on Thursday, but many are skeptical that Congress will be able to succeed where it has failed in the past.

June 27

-

College Ave, founded by two former Sallie Mae executives, makes both in-school and refinance loans; borrowers have the option of making payments before they graduate

June 27 -

Popov comes to Carlyle with 20 years of private equity experience backing non-investment grade firms

June 27 -

It's the sponsors fourth securitization, and includes 33,972 contracts to small and medium-sized companies as well as to government clients.

June 26 -

Sponsoring securitizations of the loans funded on its platform will give LendingClub more control over its reputation in the market and make it less beholden to direct loan buyers.

June 26 -

The NCUA is letting federal credit unions securitize and sell assets. Such transactions would free up capital at credit unions, allowing them to make more loans.

June 26 -

The transaction is backed by apartment properties, hotels and office buildings in a state of transition.

June 26 -

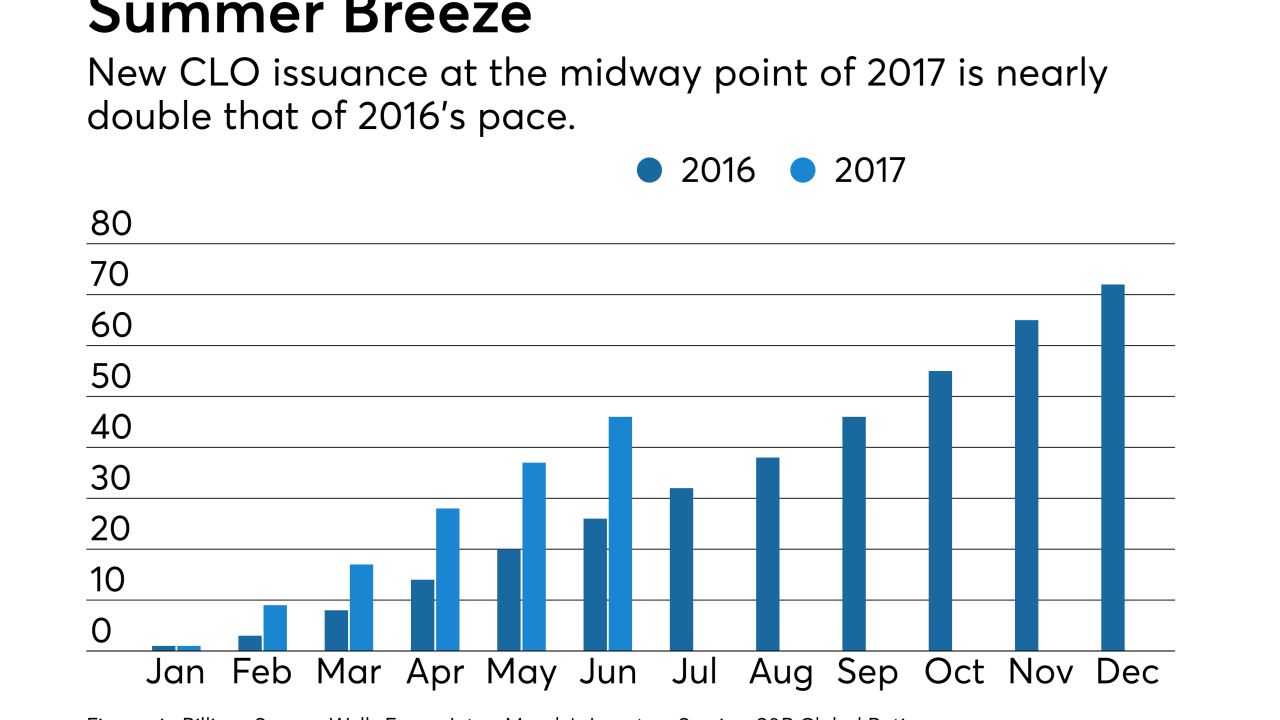

The $15 billion upward revision puts the bank's projection in line with that of JPMorgan; four new CLOs were printed last week, and another six were refinanced or repriced.

June 25