College Avenue Student Loans, an online lender founded by two former Sallie Mae executives, is making its first trip to the securitization market.

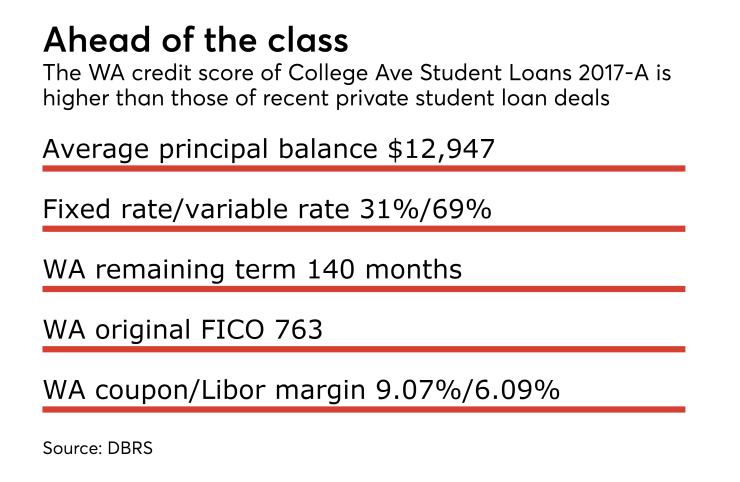

The transaction, called College Ave Student Loans 2017-A, will issue for tranches of notes totaling $160.89 million, according to DBRS, which is rating the deal. Two senior tranches, one fixed-rate and one floating-rate, are provisionally rated A; there are also two subordinate, fixed-rate tranches, one rated BBB and the other BB. All of the notes have a final maturity of November 2046.

Credit enhancement for the Class A notes initially consists of 16.75% subordination; however, it will build to a target of 36.75% as the result of the diversion of excess spread.

College Ave was founded in August 2014 by Joe DePaulo, Sallie Mae’s former CFO and chief marketing officer, and Tim Daley, the student loan servicer’s former CIO and senior vice president. The duo also worked together at CreditOne Financial Solutions.

In a press release issued around College Ave’s launch, DePaulo stated, “We believe that getting a quality education is a foundation for the future. Our goal is to help students fund that education as easily and affordably as possible.”

As of May 31, 2017, College Ave had originated $197 million of in-school student loans to approximately 12,000 borrowers with 0.3% of student loans defaulting.

Loans are made in partnership with two banks, Firstrust Savings Bank and The Middlefield Banking Co.

Borrowers in the pool of loans being securitized have weighted average credit score of 763, which DBRS stated is “significantly higher” than the average credit scores of other securitizations of private student loans. A table in the presale report compares with the most recent deals completed by Sallie Mae (746) and Navient (720).

Almost all of the loans were made out to students attending four-year undergraduate institutions. According to DBRS, these types of loans have the lowest default rates when compared to other types of undergraduate student loans. The top five states with borrowers in the pool comprise 45.8% of its total composition, which DRBS highlighted as a positive in its ratings process because an economic downturn in one area will likely not affect the performance of the trust as a whole.

Because College Avenue has only been servicing loans for about three years, the company’s historical performance data is limited. Since College Avenue has never originated loans in a recession, DBRS utilized performance data from similar student loan companies in stressed and benign environments in its analysis of College Ave 2017-A.

Pennsylvania Higher Education Assistance Agency will act as the backup servicer for this transaction and will assume the servicing responsibilities of the primary servicer, University Accounting Service, under certain circumstances.