Technology

Technology

-

The court struck down a 2015 update to the Telephone Consumer Protection Act, which permitted robocalls to cellphones for government-related debt collection.

July 6 -

Jane Gladstone, new president of Promontory Interfinancial Network, says the recession will accelerate the shakeout among the nonbank disruptors and that small banks have an opportunity to forge new bonds with the survivors.

July 6 -

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

July 6 -

The investment manager has completed phase one of a pilot instituted with tech firm Symbiont, seeking to prove the potential for launching—and closing—asset-backed securities deals via distributed ledgers.

June 30 -

The language most frequently spoken by LEP consumers is Spanish, followed by Chinese, Vietnamese, Korean and Tagalog. The Federal Housing Finance Agency's online clearinghouse translates CARES Act forbearance information into these languages.

June 17 -

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5 -

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 -

The other parts of the Day 1 Certainty program regarding income and asset verifications remain in effect.

May 6 -

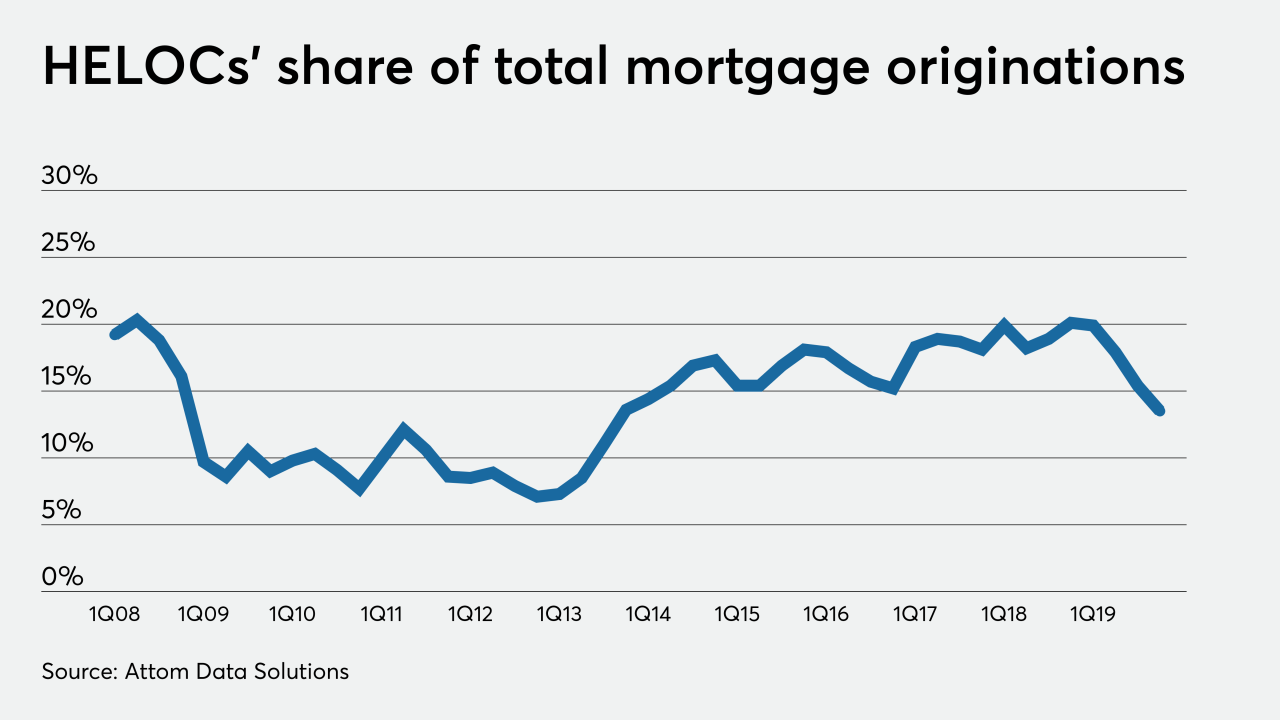

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

April 21 -

A financial planning expert from a Goldman Sachs team weighs in on choosing benefits, and communicating those concepts during COVID-19.

March 24 -

The coronavirus card will include real-time updates from the Centers for Disease Control regarding support and testing.

March 16 -

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 -

Terry Wakefield, a technology consultant who helped launch Fannie Mae's mortgage-backed securities business and form Prudential Home Mortgage, has died. He was 70.

March 11 -

Compliance, risk management and staffing will likely come under added scrutiny as regulators lay out a framework for future fintech-bank mergers.

March 5 -

The heads of the two companies explain how the deal came about, what hurdles they face and how they plan to mash up their very different operations.

February 20 -

The deal for Boston-based Radius would be the first in history in which an online lender buys a mainstream bank.

February 18 - LIBOR

Federal Reserve Chairman Jerome Powell told senators that the central bank is willing to explore a credit-sensitive interest benchmark in addition to the secured overnight financing rate, which some banks say could cause problems during economic stress.

February 12 -

In another sign of state officials trying to outdo the Consumer Financial Protection Bureau, governors in California and New York want greater authority to license and oversee the debt collection industry.

January 15