-

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

April 22 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

The pandemic has upended staffing plans, sparked concerns about servicers’ capacity to handle the expected crush of missed payments, and even raised questions about their ability to stay afloat.

March 17 -

Members of the House Financial Services Committee chastised Kathy Kraninger for not supervising student loan servicers and failing to examine firms for compliance with the Military Lending Act.

February 6 -

The two agencies said they will exchange student loan complaint data after their information-sharing efforts had been in limbo for over two years.

February 3 -

Sallie's first student-loan securitization of the year comes a week after SLM Corp. announced plans to sell more loans from its portfolio to fund a share buyback program.

January 30 -

Democracy Forward filed the lawsuit Monday against the consumer bureau, Director Kathy Kraninger, the U.S. Department of Education and Education Secretary Betsy DeVos.

November 25 -

The online lender said it applied insights from its partnership with Fifth Third Bancorp in developing a new digital platform it’s marketing to other large financial services companies.

November 20 -

CommonBond is coming to the securitization market again with another trust that uses the highly selective prefunding period feature to issue notes backed by private, refinanced student loans.

October 23 -

CFPB Director Kathy Kraninger faced a barrage of questions from Democrats on the House Financial Services Committee over why the agency has not demanded refunds for consumers in recent settlements.

October 16 -

Robert G. Cameron, a former official at the Pennsylvania Higher Education Assistance Agency, will succeed Seth Frotman as the bureau's point person on student lending complaints.

August 16 -

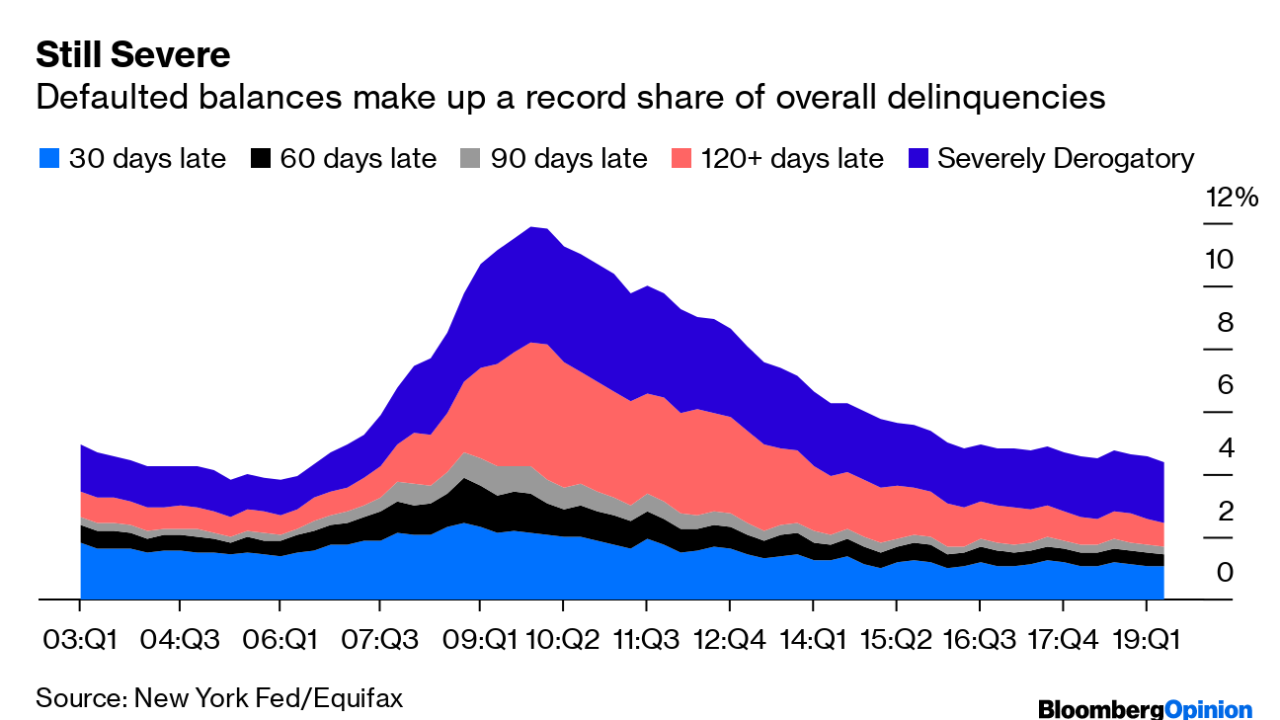

Of the roughly $250 billion severely derogatory outstanding balance, defaulted student loans make up 35%, a New York Fed report found. That’s a new phenomenon.

August 14 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22 -

The executives were hired for their focus on loan origination, portfolio management and securitization.

June 17 -

The collateral will include $147.3 million in well-seasoned loans that were part of HESAA’s 2009 issuance, as well as up to $155 million in new loans that the trust will originate through an Oct. 31, 2020 prefunding and recycling period for the next academic calendar year.

May 28 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

Navient Corp. is returning to all fixed-rate collateral for its next securitization of refinanced private student loans issued via its Earnest affiliate to high-earning college graduate professionals.

May 1 -

Democratic presidential candidate Elizabeth Warren proposed eliminating student-loan debt for an estimated 42 million Americans with a wealth tax

April 22 -

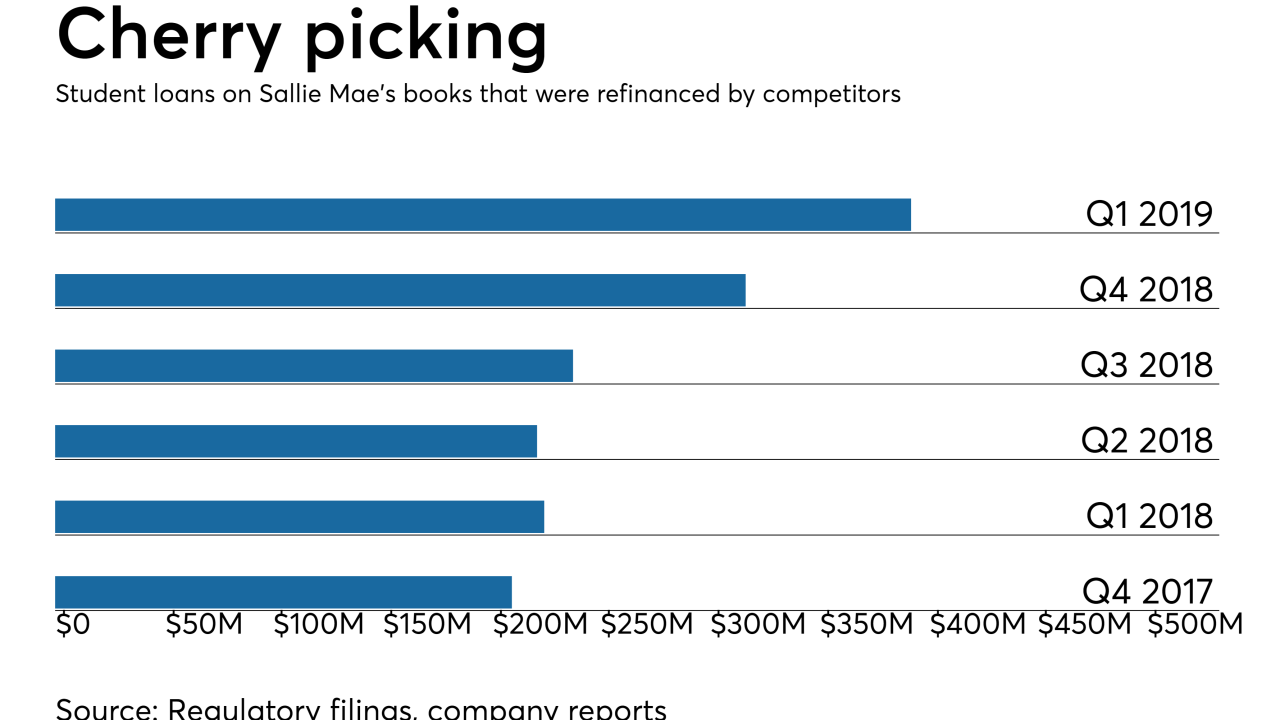

SLM Corp. wants to "target the people our competitors are targeting and bring on their federal balances" CFO Steven McGarry said during an earnings call.

April 18