-

Medical residents are considered to be good credits but have less free cash flow than fully practicing doctors; the loans did not have a big impact on overall credit metrics of the $900 million deal.

March 19 -

Moody’s expects net losses over the life of NAVSL 2018-2 to be about 0.95%; that's up slightly from 0.9% for Navient's prevous deal, NAVSL 2018-1 due to the longer remaining terms of the collateral.

March 15 -

The fintech lender's latest offering of $234 million bonds were priced at a 27-basis-point improvement from its previous deal; cheaper funding will allow it to better compete for borrowers in a rising rate environment.

March 12 -

Department of Education Secretary Betsy DeVos says the companies hired by the government to service its own loans should only be subject to federal oversight.

March 9 -

Previously, the rating agencies had capped their ratings at double-A, primarily due to CommonBond’s short operating history; it has only been making loans to borrowers with advanced degrees since 2013.

March 7 -

The Education Department reportedly has plans to shield student loan servicers from state regulators, but the Conference of State Banking Supervisors isn't ready to cede its authority.

March 6 -

Timothy Bowler, president of the ICE Benchmark Administration, which has been responsible for calculating the index since mid-2013, argues that there is a strong case for keeping it going.

February 26 -

So far, consumers have not had much voice in the discussion of a suitable replacement for the benchmark rate; lenders and servicers want to limit any harm, and their liability.

February 26 -

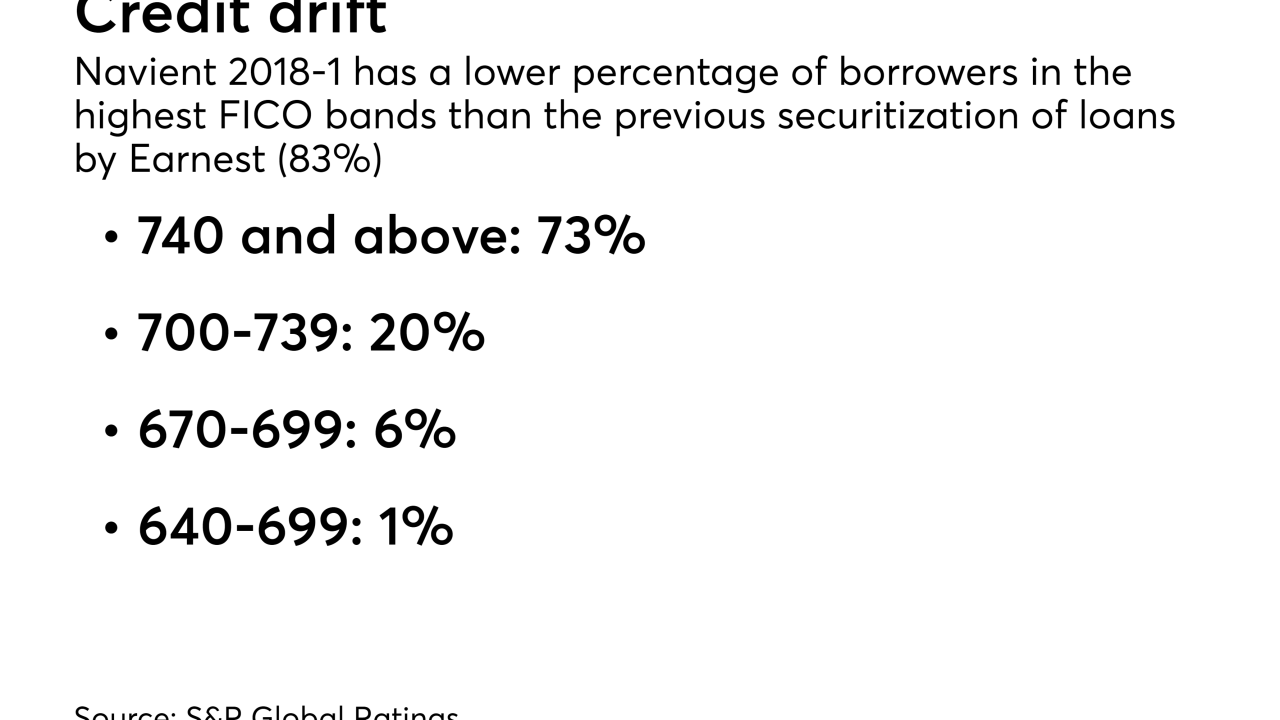

The collateral for Navient Private Education Refi 2018-1 is similar to that of Earnest's previous deal, completed in May, but it is rated two notches higher, at, AAA by S&P Global Ratings.

February 8 -

Refi loans that the servicing behemoth is making through Earnest do not require the same amount of seasoning as new in-school loans, and so can be securitized much sooner.

January 24 -

The nation's largest private student lender plans to use $30 million of its anticipated tax-cut windfall to speed up its diversification plan and strengthen its digital capabilities.

January 18 -

The $720.1 million SoFi Professional Loan Program 2018-A is only slightly smaller than its final deal of 2017, which was upsized in response to strong demand.

January 17 -

Marketplace lenders bringing securitization in-house seized the top spot in 2017; readers also focused on Blackstone's big entry into an esoteric corner of the CRE market and the PACE industry's embrace of consumer protections.

January 9 -

Navient and Nelnet avoided downgrades on $19.5 billion of bonds with the help of recent technological innovations; this helped restore investor confidence, allowing them to resume issuance.

January 3 -

At the end of September, the share of loans in MeasureOne’s private student loan database in forbearance was 2.88% of the outstanding balance, up 26.81% on the year.

December 20 -

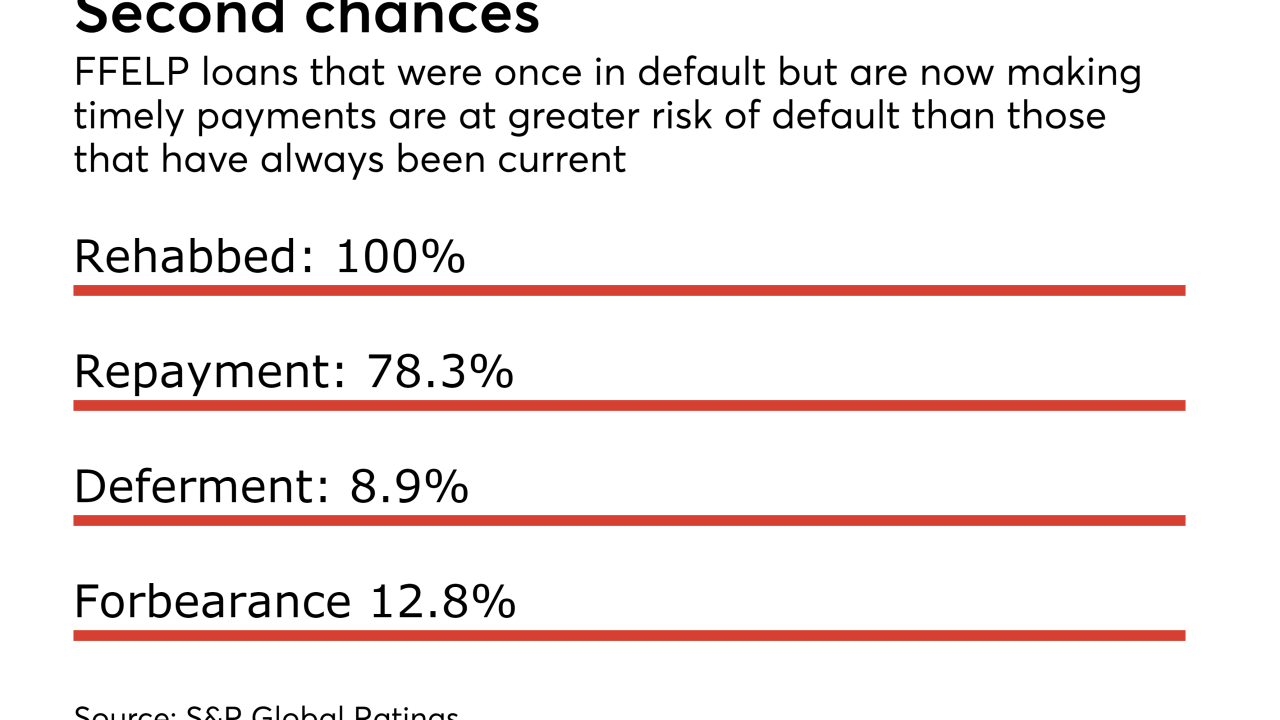

Risks include a high geographic concentration and a not insignificant exposure to loans that have either been rehabbed or are now delinquent.

December 18 -

The two Democratic lawmakers sent a letter Monday to the four largest servicing companies asking them to address borrower complaints.

December 18 -

ReliaMax is an unusual kind of marketplace lender that says it can help regional and community banks take advantage of business opportunities in private student lending.

December 11 -

By comparison, rehabilitated loans accounted for just 19.5% of the collateral for the servicer’s July offering and 10% of its May offering.

December 6 -

Introducing limits on federally guaranteed loans to graduate students, instead of letting them borrow whatever schools charge, would create a multibillion-dollar opportunity for private lenders.

November 30