Marketplace lenders bring securitization in-house

(Full story

TOP 10 of 2017: CRE-CLOs move into the mainstream

(Full story

PACE industry embraces consumer protection

(Full story

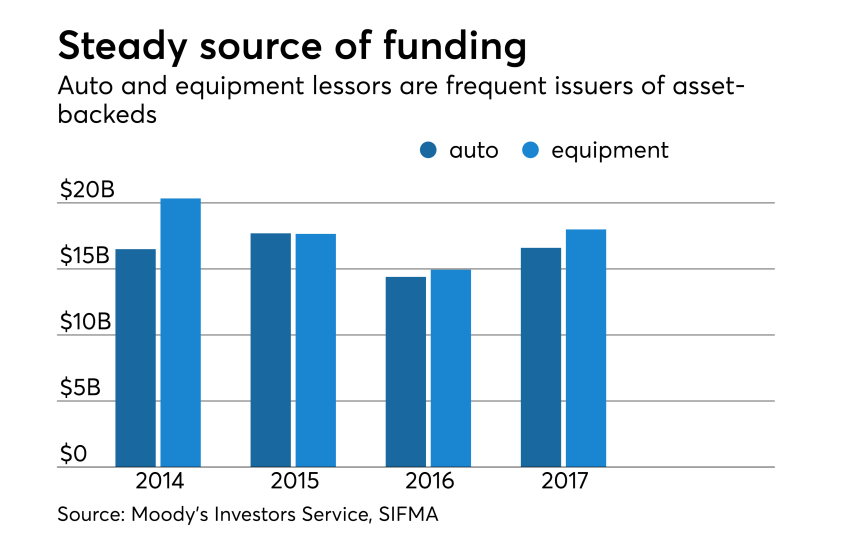

Tax reform could raise funding costs for lessors

(Full story

Carving up CMBS loans, but not risk

(Full story

FFELP back in investors’ good graces

(Full story

Global Jet's inaugural lease ABS grounded

(Full story

Whole Biz ABS moves beyond restaurant chains

(Full story

CLO managers come to grips with risk retention

(Full story

Santander dives back into subprime auto

(Full story