-

That's a departure from the state student loan authority's previous offering, completed in 2017, which was backed by a mix of private and federally guaranteed student loans, and was rated one notch lower by S&P Global Ratings.

July 2 -

The $35 million offering of fixed-rate bonds comes from a new mater trust and will be taxable; previously, the state student loan authority has funded refinance loans with the same tax-free bonds used to fund in-school lending.

June 27 -

Just 16% of the collateral for the $522 million Nelnet Student Loan Trust 2018-2 consist of “rehabbed” Federal Family Education Loan Program loans.

May 28 -

Qualifying borrowers have their maximum monthly payment reduced to 15% of the total of the household income, but the maximum dollar amount that can be extended is capped at $4 million.

May 2 -

The Tennessee community bank garnered a triple-A from two credit rating agencies for its inaugural securitization this month of loans refinancing the debt of borrowers with advanced degrees and high-paying jobs.

April 20 -

Proceeds from the $75 million issuance, the 10th from a master trust created in 2009, will fund new loans and repay the remaining outstanding notes issued from a 2008 master trust.

April 11 -

Southeast Bank's Education Loan Finance division joins SoFi, Navient and Laurel Road in originating and securitizing the refinanced student loans of advanced-degree professionals.

April 4 -

Explosive growth in student lending was putting pressure on the capital ratios of the company, formerly Darien Rowayton Bank; a securitization got a big chunk of servicing strips off its books.

April 2 -

Are American college students using their student loan dollars wisely? A LendEDU study explored how those funds are spent.

March 22 -

DBRS has assigned a BBB rating to a single tranche of certificates issued in what may be the first-ever rated securitization of servicing fees left over after subcontracting payment collections.

March 20 -

Medical residents are considered to be good credits but have less free cash flow than fully practicing doctors; the loans did not have a big impact on overall credit metrics of the $900 million deal.

March 19 -

Moody’s expects net losses over the life of NAVSL 2018-2 to be about 0.95%; that's up slightly from 0.9% for Navient's prevous deal, NAVSL 2018-1 due to the longer remaining terms of the collateral.

March 15 -

The fintech lender's latest offering of $234 million bonds were priced at a 27-basis-point improvement from its previous deal; cheaper funding will allow it to better compete for borrowers in a rising rate environment.

March 12 -

Department of Education Secretary Betsy DeVos says the companies hired by the government to service its own loans should only be subject to federal oversight.

March 9 -

Previously, the rating agencies had capped their ratings at double-A, primarily due to CommonBond’s short operating history; it has only been making loans to borrowers with advanced degrees since 2013.

March 7 -

The Education Department reportedly has plans to shield student loan servicers from state regulators, but the Conference of State Banking Supervisors isn't ready to cede its authority.

March 6 -

Timothy Bowler, president of the ICE Benchmark Administration, which has been responsible for calculating the index since mid-2013, argues that there is a strong case for keeping it going.

February 26 -

So far, consumers have not had much voice in the discussion of a suitable replacement for the benchmark rate; lenders and servicers want to limit any harm, and their liability.

February 26 -

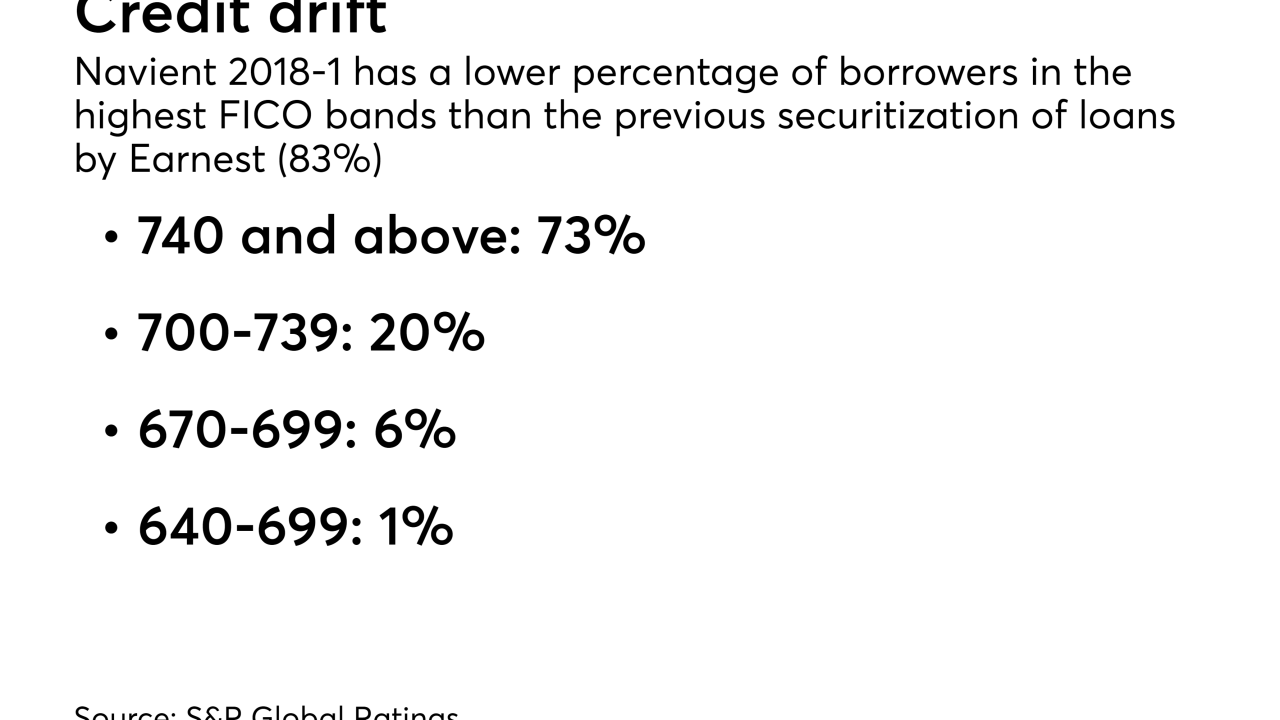

The collateral for Navient Private Education Refi 2018-1 is similar to that of Earnest's previous deal, completed in May, but it is rated two notches higher, at, AAA by S&P Global Ratings.

February 8 -

Refi loans that the servicing behemoth is making through Earnest do not require the same amount of seasoning as new in-school loans, and so can be securitized much sooner.

January 24