-

The report from an advocacy group that focuses on college affordability says that schools need to do a better job of educating students about their eligibility for federal loans, which typically carry lower interest rates than loans from banks and other private-sector lenders.

September 19 -

SoFi’s $577.5 million offering is the sponsor’s 23rd rated term student loan ABS transaction, while Massachusetts’ $164 million offering is only its second deal.

September 14 -

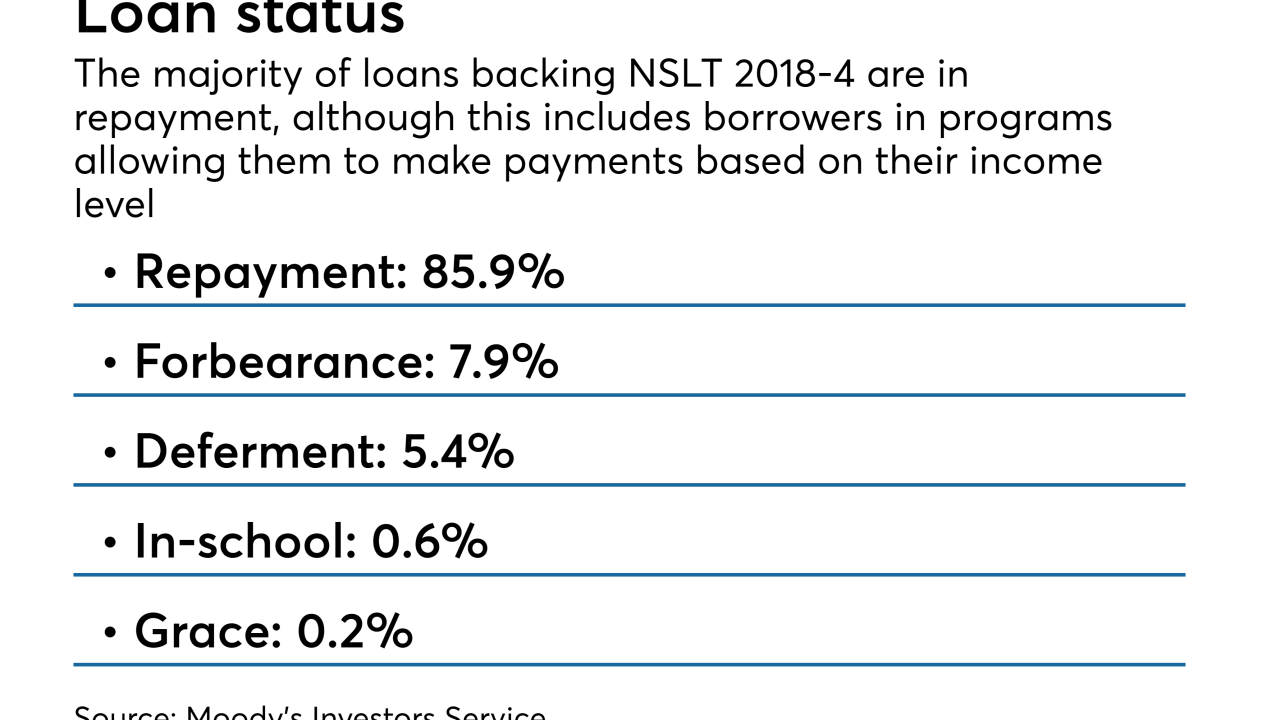

Nearly a third of borrowers, 29.5%, backing the $500 million transaction are making timely payments, up from 27.4% for the prior deal and higher than the lender’s previous two deals.

September 10 -

Seth Frotman, whose student lending unit had been gutted in May, said the bureau's current leadership "has abandoned its duty to fairly and robustly enforce the law.”

August 27 -

Cheap funding and marketing muscle could give it an advantage over existing lenders, but this corner of the market may not be big enough to move the needle for the bank.

August 23 -

Borrowers who were once delinquent but are now making timely payments account for a quarter of the collateral, more than the student loan servicer's past two deals.

August 22 -

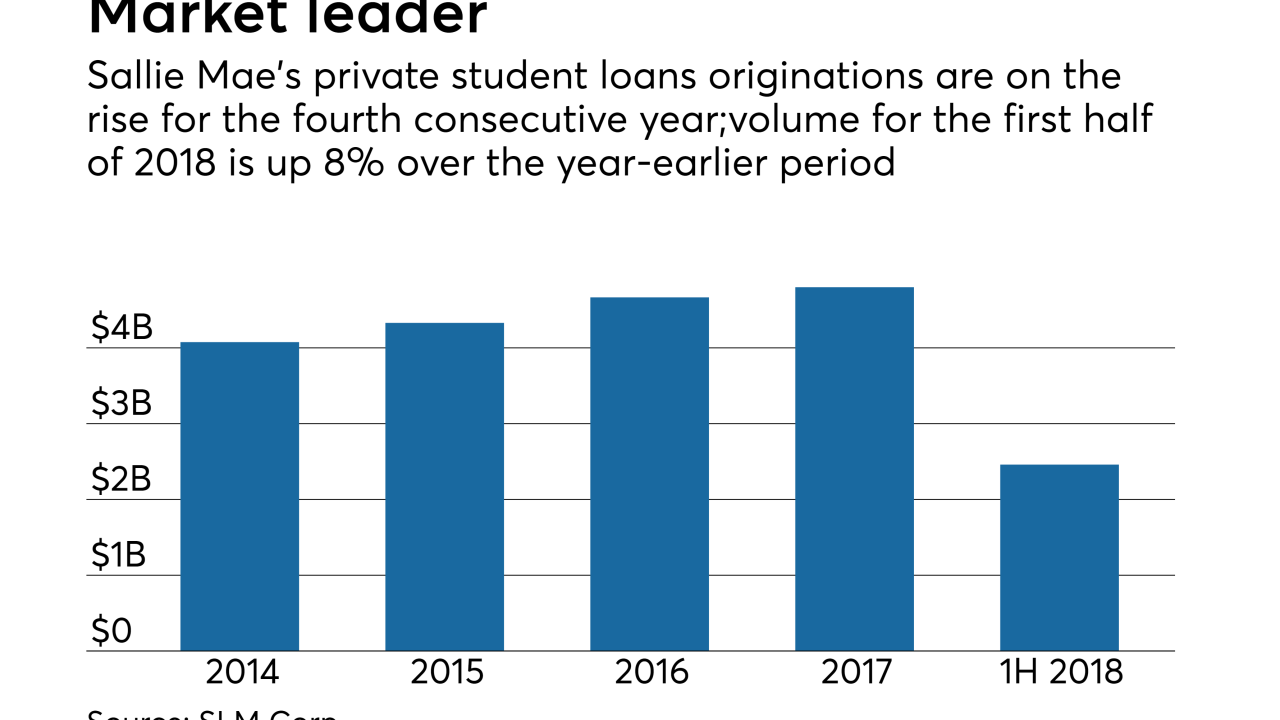

The amount of loans cherry picked by the likes of SoFi and CommonBond fell by 3%, to $221 million; just as well, since Sallie Mae's grad school loans are off to a slow start.

July 25 -

Evan as the broader securitization market takes a breather, unusual deals from off-the-run asset classes continue provide diversification – and the opportunity to pick up yield.

July 16 -

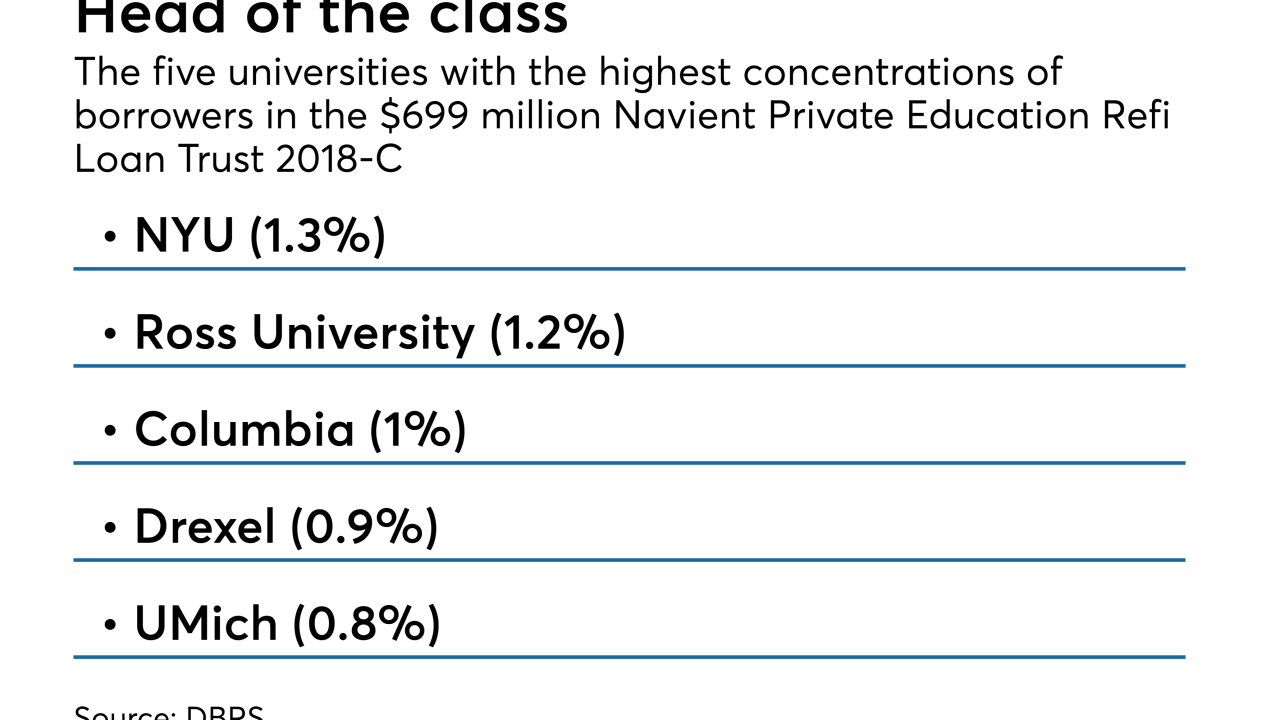

Just 66% of the collateral Navient Private Education Refi Loan Trust 2018-C consists of loans to borrowers with graduate, medical, law or other advanced degrees, down from 72% in a similar transaction in February.

July 11 -

Private student loans made before the financial crisis were once considered a toxic asset. A recent $414 million securitization by FirstKey, an affiliate of Cerberus Capital Management, shows how much things have changed.

July 9 -

That's a departure from the state student loan authority's previous offering, completed in 2017, which was backed by a mix of private and federally guaranteed student loans, and was rated one notch lower by S&P Global Ratings.

July 2 -

The $35 million offering of fixed-rate bonds comes from a new mater trust and will be taxable; previously, the state student loan authority has funded refinance loans with the same tax-free bonds used to fund in-school lending.

June 27 -

Just 16% of the collateral for the $522 million Nelnet Student Loan Trust 2018-2 consist of “rehabbed” Federal Family Education Loan Program loans.

May 28 -

Qualifying borrowers have their maximum monthly payment reduced to 15% of the total of the household income, but the maximum dollar amount that can be extended is capped at $4 million.

May 2 -

The Tennessee community bank garnered a triple-A from two credit rating agencies for its inaugural securitization this month of loans refinancing the debt of borrowers with advanced degrees and high-paying jobs.

April 20 -

Proceeds from the $75 million issuance, the 10th from a master trust created in 2009, will fund new loans and repay the remaining outstanding notes issued from a 2008 master trust.

April 11 -

Southeast Bank's Education Loan Finance division joins SoFi, Navient and Laurel Road in originating and securitizing the refinanced student loans of advanced-degree professionals.

April 4 -

Explosive growth in student lending was putting pressure on the capital ratios of the company, formerly Darien Rowayton Bank; a securitization got a big chunk of servicing strips off its books.

April 2 -

Are American college students using their student loan dollars wisely? A LendEDU study explored how those funds are spent.

March 22 -

DBRS has assigned a BBB rating to a single tranche of certificates issued in what may be the first-ever rated securitization of servicing fees left over after subcontracting payment collections.

March 20