For several quarters, SLM Corp. has been playing down the threat of refinance lenders who cherry pick some of the best borrowers from its student loan portfolio, pointing out that margins on refinance lending are thin and likely to erode as interest rates rise.

In other words, why join them if they can’t beat you?

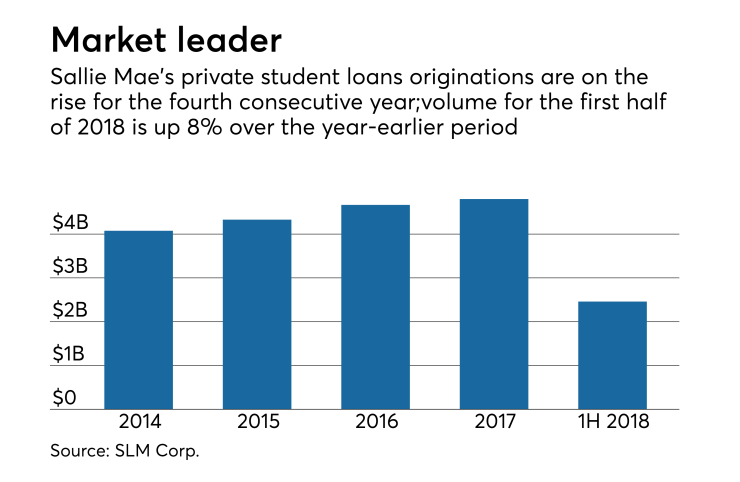

The company’s second-quarter earnings provided some support for this view. The amount of loans originated or serviced by Sallie Mae that were refinanced (or “consolidated,” in the company’s own lingo) by other lenders fell by $3 million, or 1%, on the quarter to $221 million.

“While modest, this represents the first sequential decline in two years,” Michael Tarkan, a managing director and co-director of research at Compass Point, wrote in a report published late Tuesday after Sallie Mae released its financial results.

Asked on a conference call Wednesday whether refi lenders were starting to raise interest rates on their products, Steven McGarry, the company's chief financial officer, replied, "Not as much as I would like to see."

Sallie Mae continues to tweak its existing loans in an effort to retain borrowers. McGarry said the company ran a pilot where it extended the terms of some loans, but it "did not have a significant impact." The company is also looking at potentially lowering the rate on at-risk customers. "But we will do it very carefully so that we don’t actually consolidate people that wouldn’t normally do so," McGarry said.

He then reiterated that the market "continues to move against the consolidators."

Just as well, since some of the products that Sallie Mae developed to compete with the likes of Social Finance and CommonBond are off to a slow start. The company developed six loans targeting borrowers in various graduate school degree programs, including business school, law school, medical school, dental and other health professionals and a general graduate school loan. They were launched last year in anticipation of a pullback in graduate student lending by the federal government under the Trump administration.

Last year, House Republicans introduced legislation that would impose limits on federally guaranteed loans to graduate students — a potential boon to private lenders. House Democrats this week countered with legislation that would preserve the ability of grad students to borrow whatever grad schools charge. It would also eliminate fees on all federal student loans, making them relatively more attractive.

While a pullback in federal lending has yet to occur, Sallie Mae believes its graduate student loans are already competitive because they lack origination fees and charge lower rates of interest.

Raymond Quinlan, Sallie Mae’s chief executive, decline to provide data on grad school loan originations on a conference call Wednesday.

“We think the grad opportunity is quite significant,” Quinlan said. However, the company is moving into this market “at a measured pace.” He would only say that second-quarter originations were up faster than 13% recorded for the overall portfolio, which saw $487 million in originations, bringing outstandings to $18.49 billion.

Meanwhile, Navient, which was spun off from Sallie Mae in 2014, is seeing strong growth in refinance lending since acquiring Earnest last year. On late Tuesday, it reported that second- quarter originations reached $629 million, a 26% increase from the first quarter. The company now expects to originate $2 billion for the year as a whole.

Navient’s refinance lending does not represent an immediate threat to Sallie Mae however, The company is precluded from refinancing any Sallie Mae loans until the end of 2019 under a noncompete agreement.

Sallie Mae did break out originations of personal loans, another new product area. It originated $93 million of its own product and acquired an additional $277 million. Compass Point expects Sallie Mae’s in-house personal loan originations to continue to ramp up as part of an effort to diversify its product lineup.

Sallie Mae also provided some color about its funding strategy. Consumer demand for fixed-rate student loans is rising as borrowers try to lock in lower rates. So Sallie Mae is offering more fixed-rate funding through its brokered deposit channel.

The company has also been issuing fixed-rate tranches of student loan asset-backeds; its most recent transaction, the $700 million 2018-B, has a fixed-rate tranche that totaled $335 million and has a weighted average life of just over six years. Executives on the call said that the pricing of the overall transaction, a blended rate of Libor plus 76 basis points, was Sallie Mae’s best to date.