-

The government mortgage securitization guarantor flagged the goal back during the first Trump administration, warning then that it would be a long-term project.

January 26 -

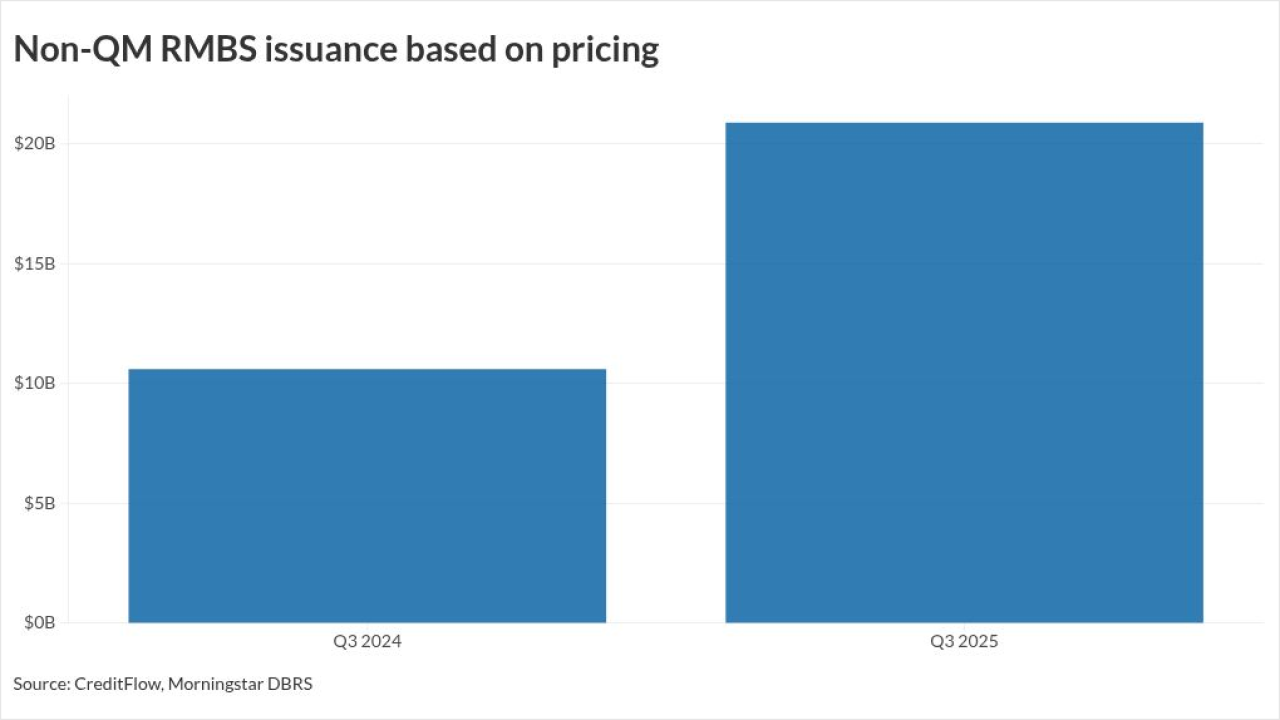

Hot securitization sectors such as non-qualified mortgages and home equity are set to expand further amid market shifts this year, recent forecasts suggest.

January 20 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

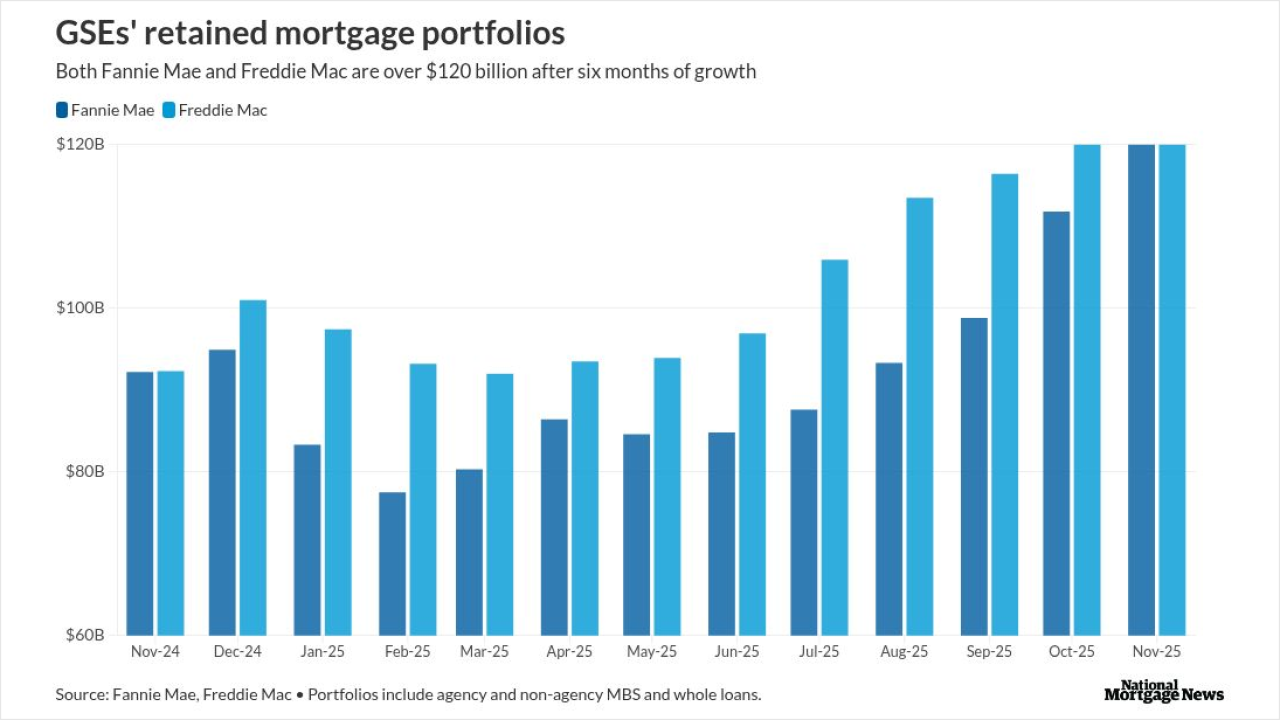

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

December 18 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16 -

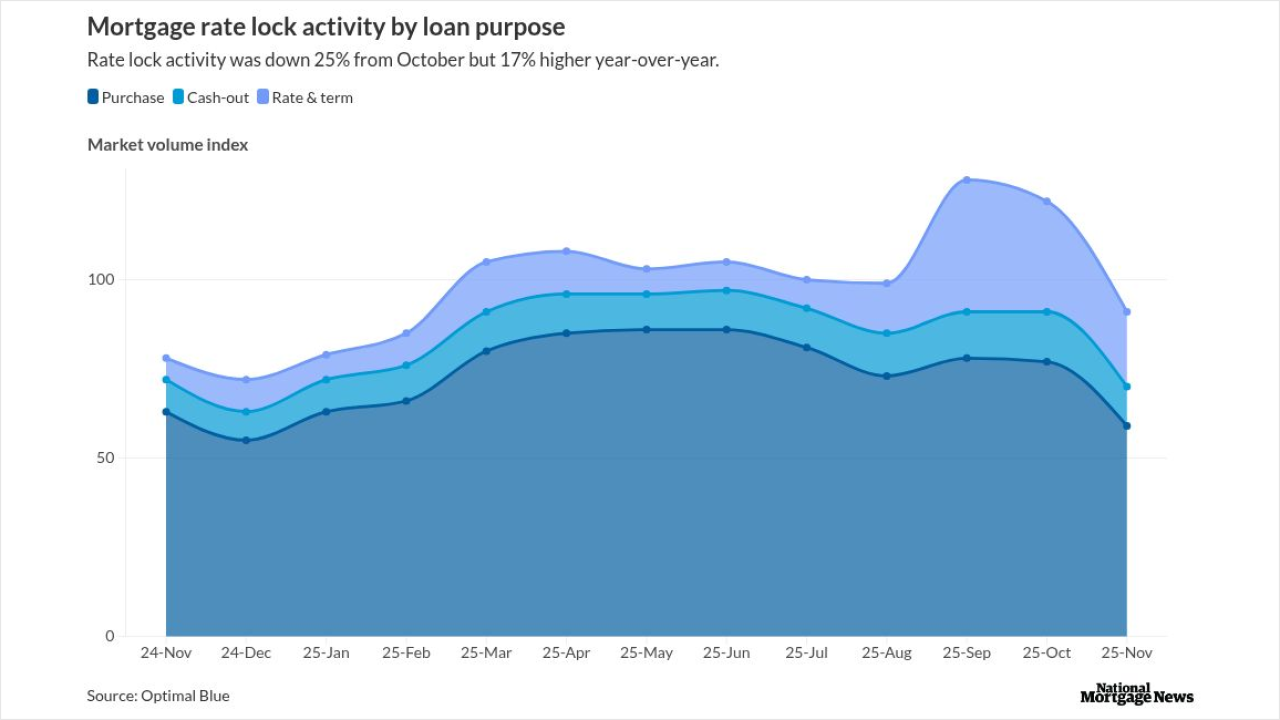

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Hildene, which partners with Crosscountry Mortgage for non-QM securitizations, is doing this deal as part of its buy of an annuity provider, SILAC.

December 8 -

At issue is the CFPB's weekly publication of Average Prime Offer Rate tables, a key benchmark enabling the smooth operation of the $13 trillion residential mortgage market.

December 3 -

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

December 3 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

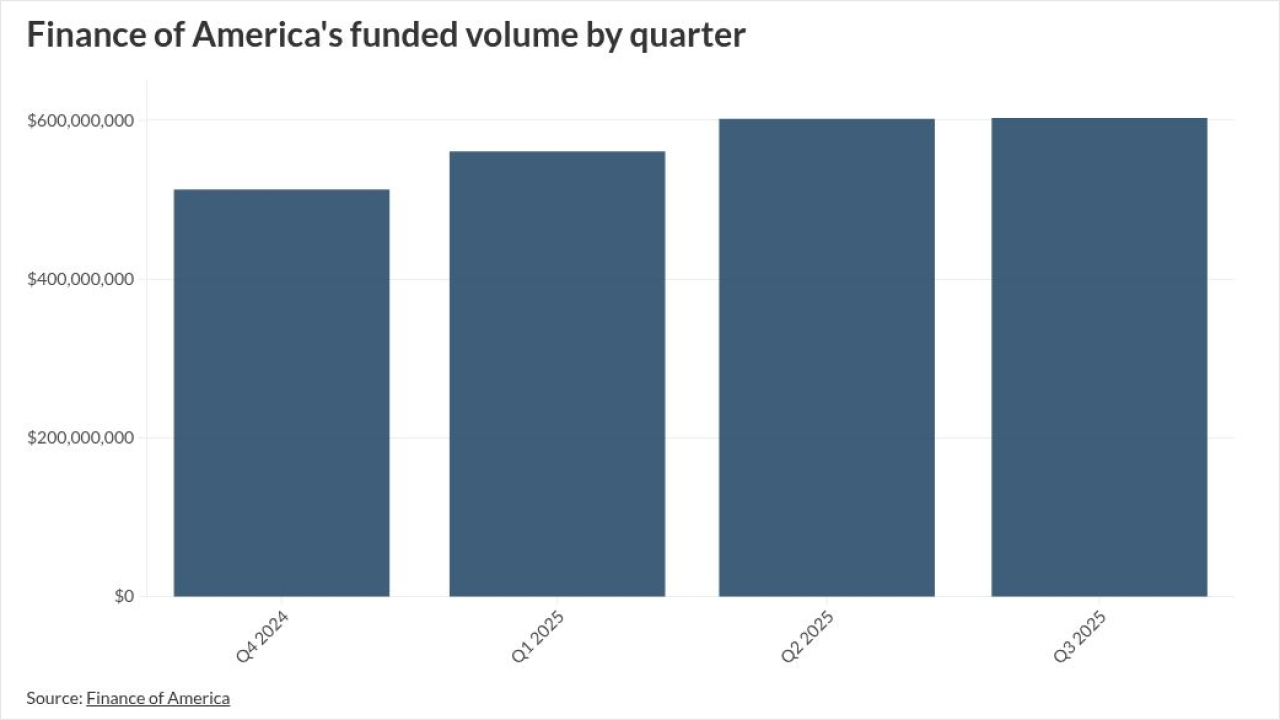

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4