Regulation and compliance

Regulation and compliance

-

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

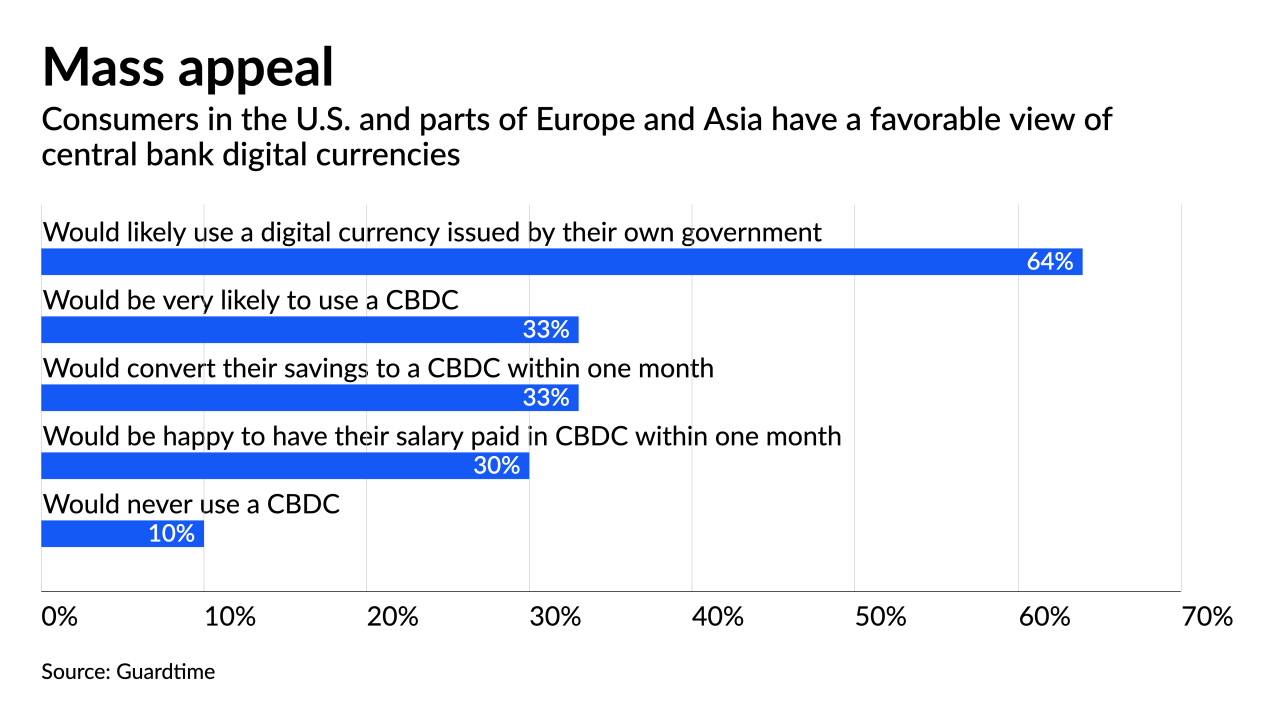

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12 -

A congressional resolution that invalidates the regulation issued last fall by the Office of the Comptroller of the Currency would help regulators crack down on so-called rent-a-bank schemes that promote predatory lending, the president said before signing the measure.

July 1 -

Six online lenders and the National Community Reinvestment Coalition have asked the Consumer Financial Protection Bureau for clarity on whether disparate-impact rules apply to lending decisions made by machines.

June 29 -

The Community Home Lenders Association has called for suspension of federal limits on the loan volumes that Fannie Mae and Freddie Mac can purchase from individual lenders. The demand came on the same day that the Biden administration fired FHFA Director Mark Calabria and started the process of nominating his successor.

June 24 -

The data also showed that more purchase loans were made to low- and moderate-income borrowers last year, but fewer refinances.

June 18 -

Federal Reserve Chairman Jerome Powell said the market dislocations of the past year resulting from the pandemic had changed the impact that the supplementary leverage ratio was having on the largest banks. After temporarily easing the requirement, the central bank is considering longer-term reforms.

June 16 -

Financial institutions spent nearly $214 billion last year — an 18% jump from 2019 — to meet regulatory requirements for fighting financial crimes, a new study says. The spending included more staffing to manage risks posed by customer growth.

June 9 -

For two decades, Alfred Pollard served as the general counsel for Fannie Mae and Freddie Mac’s regulator. He had a front-row seat for the establishment of the Federal Housing Finance Agency, the government’s subsequent seizure of the mortgage giants amid mounting losses in 2008 and the more recent legal dispute over the FHFA’s authority.

June 7 -

Sen. Pat Toomey of Pennsylvania, the Banking Committee's top Republican, is talking up the prospects of a bipartisan deal to overhaul Fannie Mae and Freddie Mac. But Democratic leaders sound less motivated to change the status quo for the government-sponsored enterprises.

June 4 -

The departures of Bryan Schneider and Peggy Twohig come as the Biden administration's nominee to run the consumer bureau awaits Senate confirmation.

June 3 -

DMB Financial, a debt-settlement firm near Boston that operates in 24 states, agreed to pay $5.4 million in restitution to consumers for allegedly charging upfront fees before providing any service, the CFPB said.

May 17 -

Financial institutions said they needed more time to weigh in on issues such as how they use artificial intelligence for fraud prevention and underwriting.

May 17 -

Some worry the Senate’s rejection of the OCC rule hampers efforts to clarify legal standards for banks selling loans to fintechs.

May 12 -

Acting Comptroller of the Currency Michael Hsu said he plans to prioritize "solving urgent problems and addressing pressing issues" until the Biden administration selects a permanent head of the agency.

May 10 -

Critics say the regulation issued by the Office of the Comptroller Currency is a gift to predatory lenders. But the trade organizations warned lawmakers that invalidating it will make it difficult for the agency to create an improved framework in the future.

May 6 -

Cordray, named this week to lead the Education Department's office of federal student aid, cracked down on banks, student loan servicers and for-profit colleges when he was director of the Consumer Financial Protection Bureau.

May 4