Regulation and compliance

Regulation and compliance

-

The Federal Housing Finance Agency is looking to revise the framework intended for when Fannie Mae and Freddie Mac exit conservatorship in order to encourage the transfer of credit risk to private investors.

September 15 -

Changes made in the waning days of the previous administration limited the government-sponsored enterprises’ purchases of certain loan types, which drew criticism from lenders and community groups alike.

September 14 -

Elizabeth Warren asked the Federal Reserve this week to force the spinoff of the bank’s nonbanking operations. Wells, which was recently hit with another $250 million fine, countered that it has made significant progress in improving its risk management and addressing misconduct.

September 14 -

The agency’s enforcement action against Better Future Forward says the nonprofit’s income-share agreements — an alternative education finance product — must follow the Truth in Lending Act just like other forms of student loans.

September 7 -

This year’s stress tests examined 23 banks including JPMorgan Chase and Goldman Sachs, with the remainder of the firms on an “every other year” test cycle. The capital requirements for those remaining firms are unchanged from last year.

August 6 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

August 2 -

The bureau said two rules related to communications with debtors will go into effect as originally planned on Nov. 30. The agency had previously proposed an extension to consider consumer advocates' concerns about the regulations.

July 30 -

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

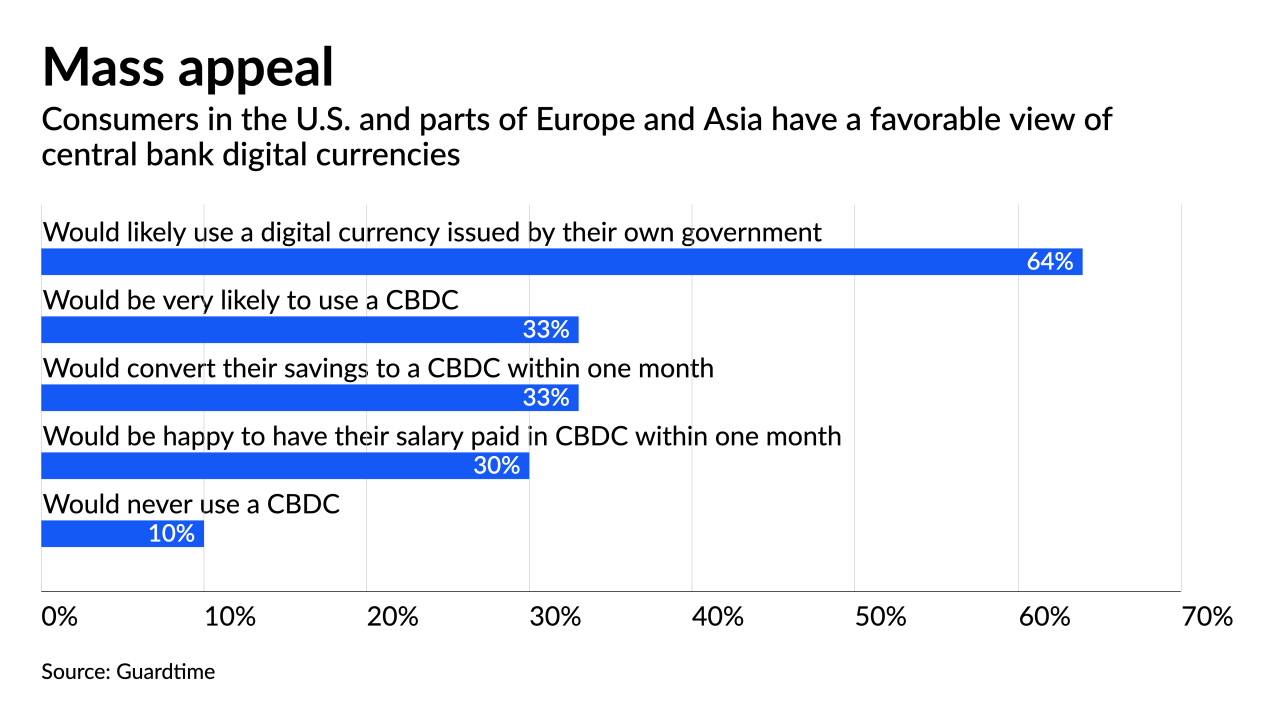

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12 -

A congressional resolution that invalidates the regulation issued last fall by the Office of the Comptroller of the Currency would help regulators crack down on so-called rent-a-bank schemes that promote predatory lending, the president said before signing the measure.

July 1 -

Six online lenders and the National Community Reinvestment Coalition have asked the Consumer Financial Protection Bureau for clarity on whether disparate-impact rules apply to lending decisions made by machines.

June 29 -

The Community Home Lenders Association has called for suspension of federal limits on the loan volumes that Fannie Mae and Freddie Mac can purchase from individual lenders. The demand came on the same day that the Biden administration fired FHFA Director Mark Calabria and started the process of nominating his successor.

June 24 -

The data also showed that more purchase loans were made to low- and moderate-income borrowers last year, but fewer refinances.

June 18 -

Federal Reserve Chairman Jerome Powell said the market dislocations of the past year resulting from the pandemic had changed the impact that the supplementary leverage ratio was having on the largest banks. After temporarily easing the requirement, the central bank is considering longer-term reforms.

June 16 -

Financial institutions spent nearly $214 billion last year — an 18% jump from 2019 — to meet regulatory requirements for fighting financial crimes, a new study says. The spending included more staffing to manage risks posed by customer growth.

June 9 -

For two decades, Alfred Pollard served as the general counsel for Fannie Mae and Freddie Mac’s regulator. He had a front-row seat for the establishment of the Federal Housing Finance Agency, the government’s subsequent seizure of the mortgage giants amid mounting losses in 2008 and the more recent legal dispute over the FHFA’s authority.

June 7 -

Sen. Pat Toomey of Pennsylvania, the Banking Committee's top Republican, is talking up the prospects of a bipartisan deal to overhaul Fannie Mae and Freddie Mac. But Democratic leaders sound less motivated to change the status quo for the government-sponsored enterprises.

June 4