Regulation and compliance

Regulation and compliance

-

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

Trustmark Bank agreed to pay $9 million to resolve allegations that it discriminated against Black and Hispanic residents in Memphis, Tennessee. Attorney General Merrick Garland said the Department of Justice and other agencies will continue their crackdown.

October 22 - AB - Policy & Regulation

Federal and state banking agencies released a joint statement calling on financial institutions to conduct the "due diligence necessary" to select a new reference rate benchmark that is suitable for their risk profile.

October 20 -

Banks, credit card issuers and debt collectors all supported the Consumer Financial Protection Bureau’s revised regulations. But they face a steep learning curve in complying with the rules, which take effect Nov. 30.

October 11 -

In its initial message to the new head of the Consumer Financial Protection Bureau, the Community Home Lenders Association reiterated its call to require depository loan officers to be licensed.

October 4 -

Many banks are still making loans tied to the scandal-plagued benchmark despite years of preparation for its demise. The end of 2021 could prove hectic as bankers scramble to implement changes and explain them to commercial borrowers.

September 28 - AB - Policy & Regulation

Saule Omarova supports allowing the Federal Reserve to hold customer deposits and is skeptical of big-bank M&A. While those views are unpopular in the industry, banking critics hailed the choice to lead the Office of the Comptroller of the Currency.

September 23 -

The chair of the Federal Reserve said the backlash over the personal financial transactions of two Fed bank presidents — made when they were privy to discussions about the central bank’s coronavirus response — demonstrated that internal guidelines can be bolstered to avoid the appearance of conflicts.

September 22 -

The Federal Housing Finance Agency is looking to revise the framework intended for when Fannie Mae and Freddie Mac exit conservatorship in order to encourage the transfer of credit risk to private investors.

September 15 -

Changes made in the waning days of the previous administration limited the government-sponsored enterprises’ purchases of certain loan types, which drew criticism from lenders and community groups alike.

September 14 -

Elizabeth Warren asked the Federal Reserve this week to force the spinoff of the bank’s nonbanking operations. Wells, which was recently hit with another $250 million fine, countered that it has made significant progress in improving its risk management and addressing misconduct.

September 14 -

The agency’s enforcement action against Better Future Forward says the nonprofit’s income-share agreements — an alternative education finance product — must follow the Truth in Lending Act just like other forms of student loans.

September 7 -

This year’s stress tests examined 23 banks including JPMorgan Chase and Goldman Sachs, with the remainder of the firms on an “every other year” test cycle. The capital requirements for those remaining firms are unchanged from last year.

August 6 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

August 2 -

The bureau said two rules related to communications with debtors will go into effect as originally planned on Nov. 30. The agency had previously proposed an extension to consider consumer advocates' concerns about the regulations.

July 30 -

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

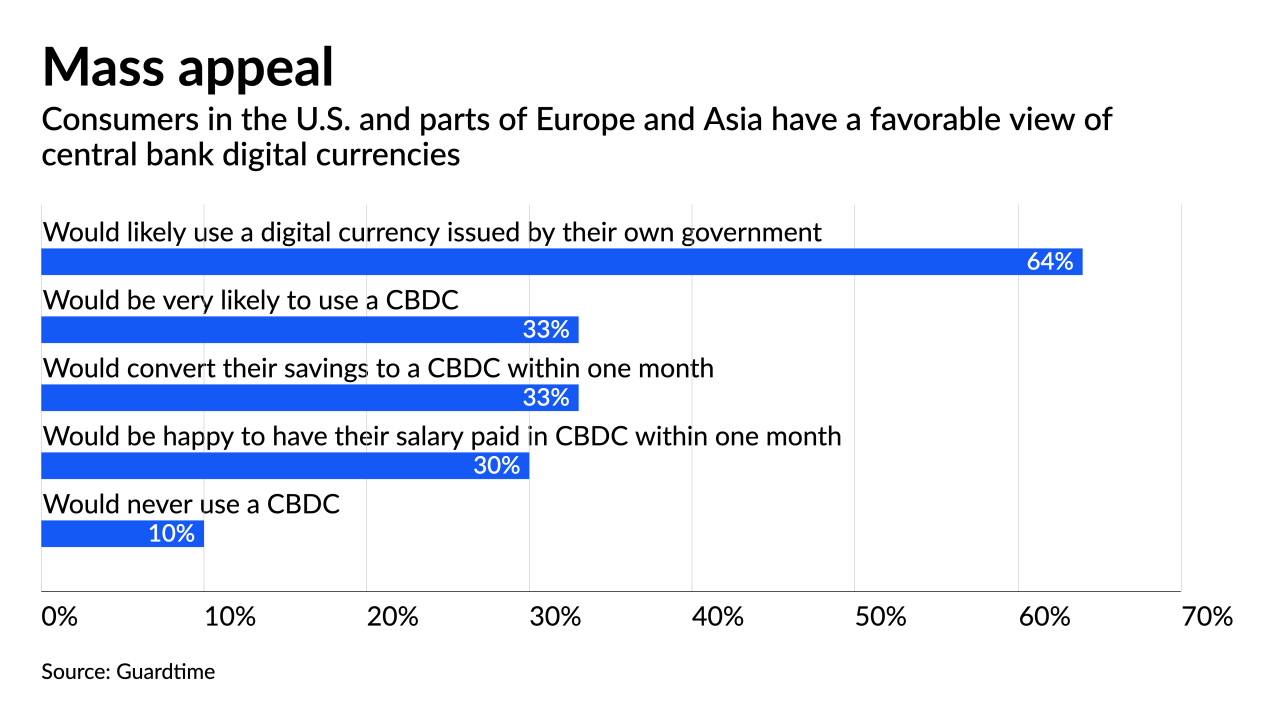

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12