-

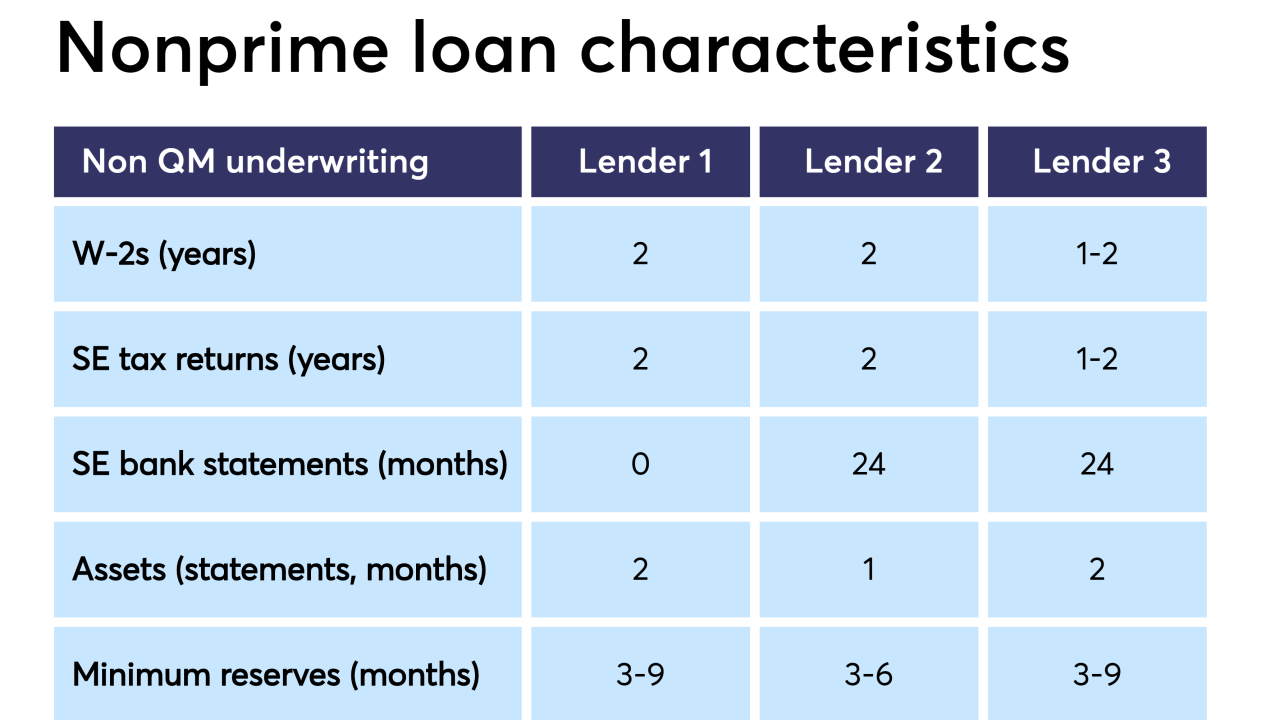

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

New FHFA Director Mark Calabria isn't just charting a future for Fannie Mae and Freddie Mac, but also fixing problems resulting from the "qualified mortgage" exemption for the GSEs and taking a "deep dive" into problems in the mortgage servicing market.

April 25 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

Absent some policy change, nearly a third of the loans backed by Fannie Mae and Freddie Mac could be in violation of the Consumer Financial Protection Bureau's Qualified Mortgage rule in two years.

February 4 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Fund manager Varde Partners wants to grow its partnerships with lenders and servicers interested in selling off their excess mortgage servicing rights.

September 11 -

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

Some collateral attributes, such as non-full documentation and a high percentage of non-QM and HPQM loans, fall slightly outside the credit box seen in other recent prime transactions, according to Fitch.

July 26 -

The collateral includes both QM and non-QM loans; however, certain loans are designated as QM even though the borrower’s DTI may be above 43%, due to a temporary exemption for GSE-eligible loans.

July 13 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

Acting CFPB Director Mick Mulvaney suggested that digital mortgages should be held to different standards than ones originated by credit unions and banks.

May 15 -

After originating more than $1 billion in loans outside the ability-to-repay rule's Qualified Mortgage safe harbor last year, Angel Oak is planning to originate at least twice that in 2018.

May 14 -

Lenders should not get so desperate chasing volume by originating lower credit non-qualified mortgage products that they are inviting the next regulatory crackdown, said David Stevens, the Mortgage Bankers Association's CEO.

March 28 -

The acting head of the Consumer Financial Protection Bureau can utilize "look-backs" of mortgage servicing and underwriting rules to push for significant changes.

January 29 -

The $401.2 million COLT 2018-1 is the eighth overall securitization of non-qualified jumbo mortgages issued by the Lone Star Funds affiliate.

January 12 -

Impac Mortgage Holdings' nonqualified mortgage origination volume increased 248% year-over-year in the third quarter as the company accumulates loans for a planned securitization next year.

November 9 -

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21