Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

"We hold a positive outlook for RMBS issuance next year despite our expectation for a continued slowdown in U.S. home price appreciation and mortgage origination volume," researchers at the bank said in a recent report.

"Our positive issuance outlook for RMBS therefore reflects the fact that we expect PLS to increase its market share next year (as has

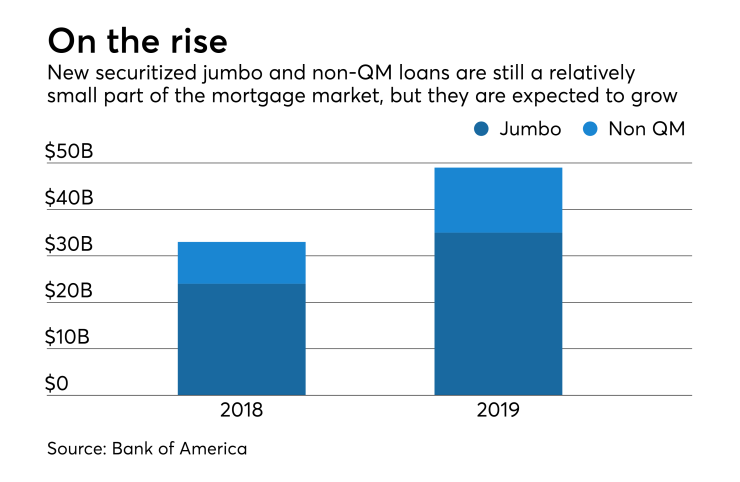

Although 51% of the PL RMBS market remains largely comprised of securitized legacy product, the share of issuance backed by new loans is growing. These include securitizations of post-crisis jumbos and loans made outside the parameters of the Qualified Mortgage safe harbor from ability-to-repay liability.

If jumbo 2.0 securitizations keep running at their current rate, they will total $24 billion this year and 20% of the private-label RMBS market. Non-QM issuance is expected to total $9 billion, according to Bank of America.

Next year, post-crisis jumbo RMBS issuance is expected to rise to $35 billion in 2019, fueled in part by the entry of new issuers like

New issuers are also expected to help fuel a rise in non-QM issuance to $14 billion in 2019. Issuers that have entered that market recently have included Starwood, Fortress, and Neuberger Berman. Longer-term issuers