-

More than 83% of the vehicle-lease value in Ford Motor Credit's $1.1 billion lease securitization is tied into trucks, minivans and utility models.

February 15 -

The 24% concentration of 61-month or longer loans is American Honda Finance's lowest from its prime auto loan ABS shelf since late 2017.

February 14 -

GM Financial is front-loading the $1.2 billion deal with early maturities, according to presale reports; Hyundai Capital is also readying a $710 million transaction.

February 8 -

The three offerings launched Thursday add to the $3.9 billion of prime auto supply already issued this year by General Motors, Ford Motor Co. and CarMax.

January 31 -

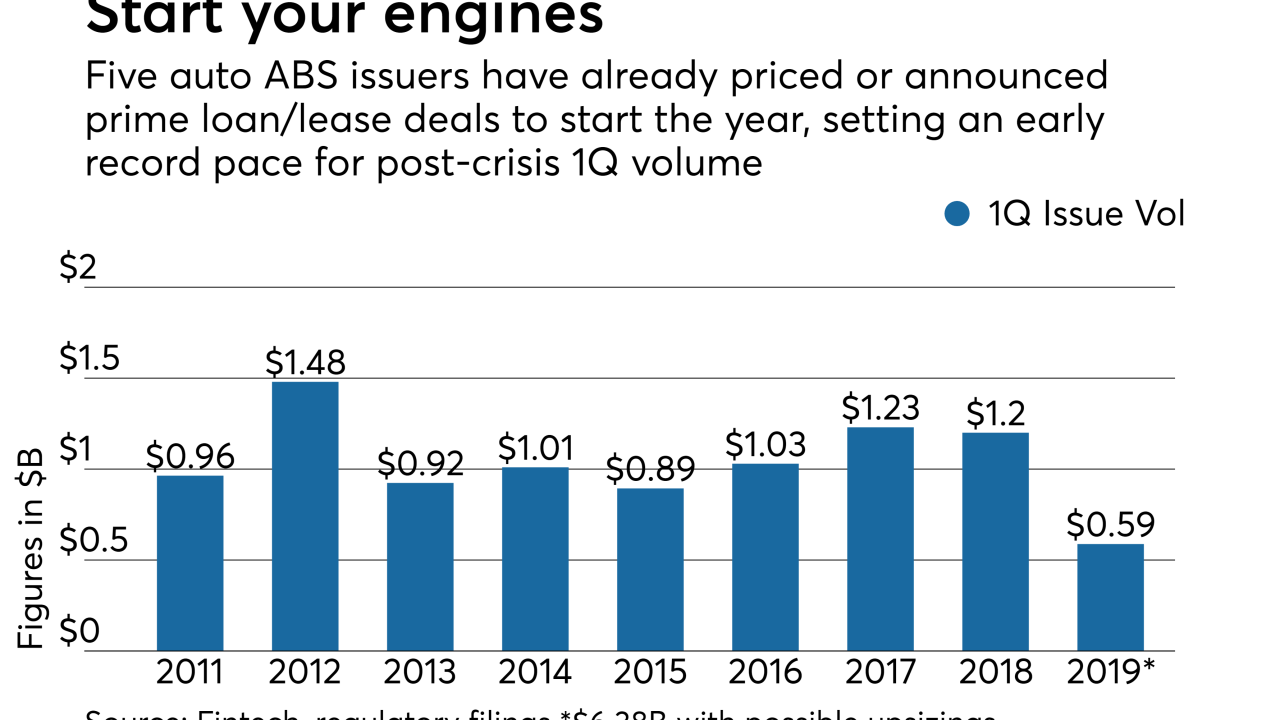

The two latest transactions will push announced deal volume at or above $6 billion for the first two weeks of 2019.

January 17 -

Ford Motor Credit added a one-time seven-year revolving period to its previous open pool of auto loan receivables.

January 11 -

CarMax Superstores' first $1.2B-$1.5B prime loan securitization of 2019 has its lowest concentration to date of passenger vehicles in its nearly 20 years selling notes backed by receivables.

January 10 -

The collateral for GMCAR Trust 2019-1 features a higher weighted average borrower FICO than any prior GM Financial deal; it also sports a lower projected cumulative net losses from Fitch Ratings.

January 3 -

Loans with terms of more than five years represent around 65% of the pool of collateral, down from 67% and 68% for the two prior transaction - but still higher than exposure in 2017 and 2016 transactions.

November 30 -

American Honda Finance's fourth auto-loan securitization of the year also features borrowers with higher scores and larger loans.

November 16