-

Both transactions are the second this year for each of the automotive captive-finance firms, and will build on a tally of 19 prime auto loan ABS pools to date this year totaling $21.44 billion.

May 16 -

The lender has not sponsored an asset-backed transaction since 2007, according to presale reports.

May 15 -

Toyota Motor Credit is planning its second deal of the year, while Fifth Third is returning to the securitization market for the first time since 2017.

April 25 -

Recent transactions have been performing better than expected; S&P Global Ratings has set its expectations for cumulative net losses for COAT 2019-2 accordingly lower.

April 4 -

At 1%-1.2% of initial principal balance, the expected loss range for the $1.25 billion deal is the lowest ever for a GM Financial retail auto loan securitization.

April 3 -

The captive-finance lender's focus on higher-FICO borrowers since 2016 has "manifested" in ABS loss and delinquency improvements.

March 29 -

Approximately 68.4% of the collateral balance in Ford Credit Auto Owner Trust 2019-A derives from contracts that benefit from subsidized rates to well-qualified borrowers.

March 14 -

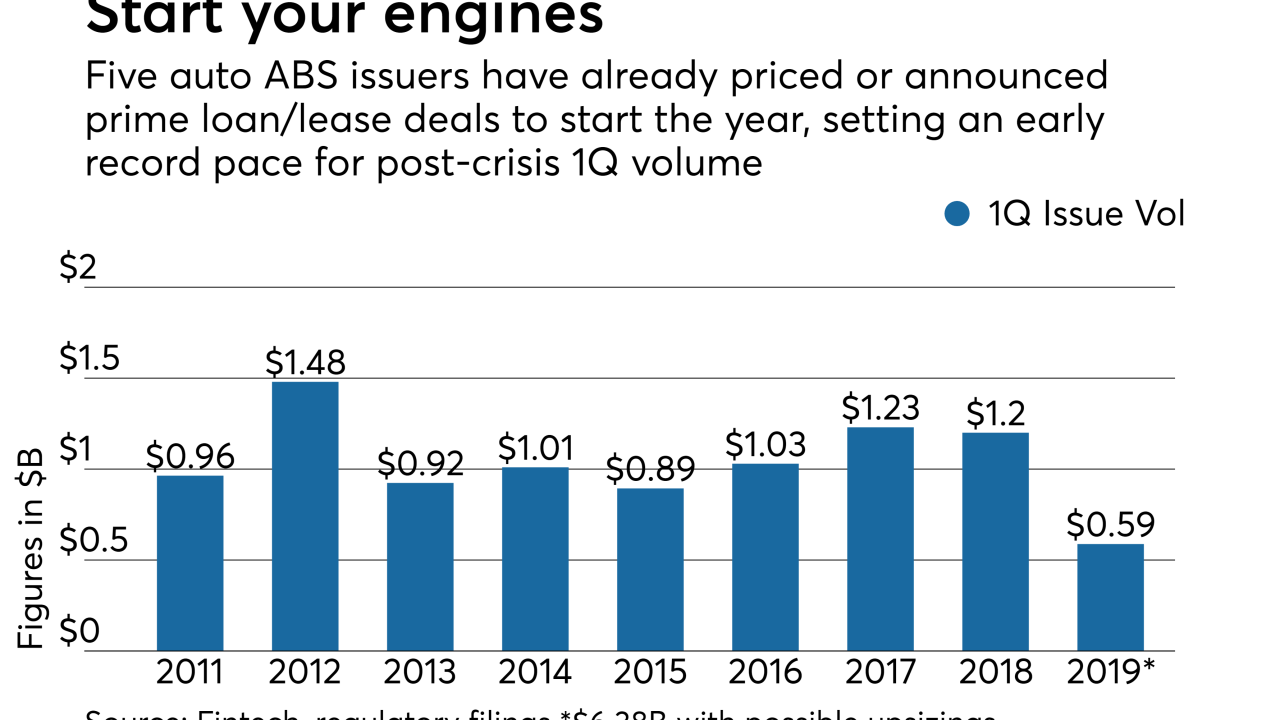

With an expected March 20 closing, BMW's next lease securitization brings first-quarter deal volume to $6.5 billion, the highest three-month total in four years.

March 11 -

From financing driverless cars to dealing with Libor's demise, here are the highlights from the Structured Finance Industry Group's annual conference.

-

The captive lender is already underwriting and managing leases for GM electric cars in China; it is also buying and managing fleets for GM’s Maven ride-sharing program launched in the U.S. in 2016.

February 25 -

Some 35% of vehicles backing Driver UK Master Compartment 5 have diesel engines; presale reports do not indicate the percentage that meet more stringent EU emission standards.

February 21 -

More than 83% of the vehicle-lease value in Ford Motor Credit's $1.1 billion lease securitization is tied into trucks, minivans and utility models.

February 15 -

The 24% concentration of 61-month or longer loans is American Honda Finance's lowest from its prime auto loan ABS shelf since late 2017.

February 14 -

GM Financial is front-loading the $1.2 billion deal with early maturities, according to presale reports; Hyundai Capital is also readying a $710 million transaction.

February 8 -

The three offerings launched Thursday add to the $3.9 billion of prime auto supply already issued this year by General Motors, Ford Motor Co. and CarMax.

January 31 -

The two latest transactions will push announced deal volume at or above $6 billion for the first two weeks of 2019.

January 17 -

Ford Motor Credit added a one-time seven-year revolving period to its previous open pool of auto loan receivables.

January 11 -

CarMax Superstores' first $1.2B-$1.5B prime loan securitization of 2019 has its lowest concentration to date of passenger vehicles in its nearly 20 years selling notes backed by receivables.

January 10 -

The collateral for GMCAR Trust 2019-1 features a higher weighted average borrower FICO than any prior GM Financial deal; it also sports a lower projected cumulative net losses from Fitch Ratings.

January 3 -

Loans with terms of more than five years represent around 65% of the pool of collateral, down from 67% and 68% for the two prior transaction - but still higher than exposure in 2017 and 2016 transactions.

November 30