-

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14 -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

Dividing the transaction into two tranches allowed the GSE to tailor the transaction to the risk appetite of participants, lowering the cost of reinsurance.

December 17 -

The Federal Housing Administration's risk-sharing program with the Federal Financing Bank began as a temporary fix, but the agency is exploring how to make it more permanent.

November 27 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

The GSE recently transferred $166 million portion of risk on $11.1 billion of loans via contracts with seven reinsurers and insurers; it plans to come to market two or three time a year going forward.

September 6 -

Redwood Trust has priced a new stock offering that is aimed at increasing funding to new initiatives like investments in the single-family rental and multifamily sectors as well as routine business.

July 25 -

The security that was incorporated into the index is backed exclusively by loans on green building certified properties; the GSE is still working on acceptance of financing for green upgrades.

March 15 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

A $92 million portion of $194.4 million mortgage on a portfolio of 36 ExtraSpace Self Storage locations is the largest of 42 loans backed backing MSC 2017-HR2.

December 7 -

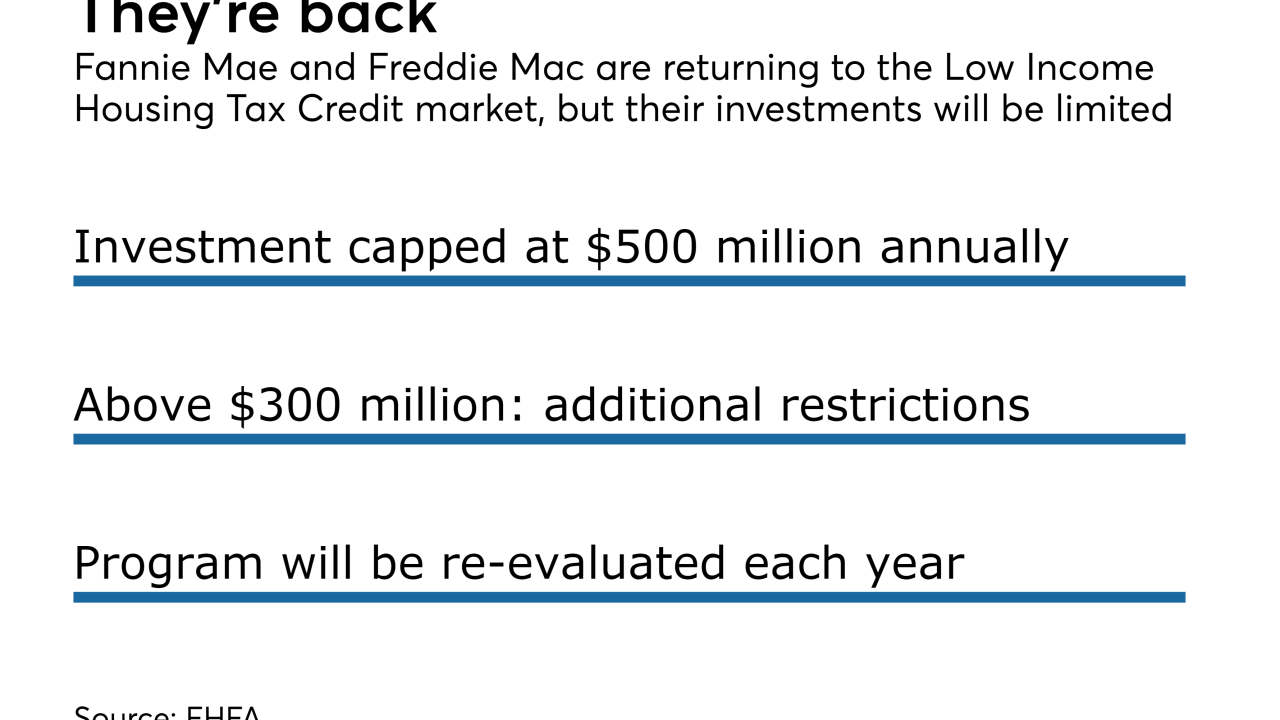

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

November 15 -

Commercial and multifamily originations are projected to surpass the 2007 market peak this year, according to the Mortgage Bankers Association.

October 27 -

The bill provides clarity to capital requirements to certain acquisition, development and construction loans are assigned a higher risk weighting under Basel III.

October 13 -

The amount of commercial and multifamily mortgage debt outstanding ticked up from April through June, yet the balance of loans in commercial mortgage-backed securities continued its decline.

September 27