-

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

A $92 million portion of $194.4 million mortgage on a portfolio of 36 ExtraSpace Self Storage locations is the largest of 42 loans backed backing MSC 2017-HR2.

December 7 -

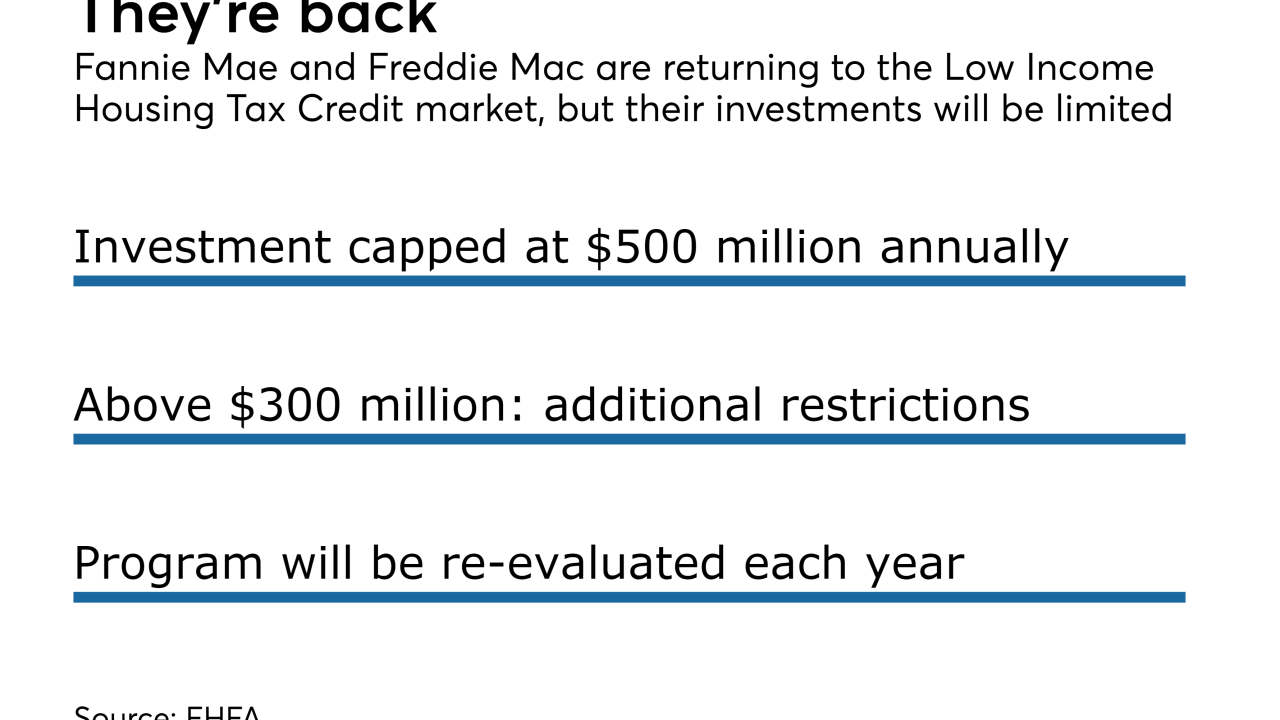

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

November 15 -

Commercial and multifamily originations are projected to surpass the 2007 market peak this year, according to the Mortgage Bankers Association.

October 27 -

The bill provides clarity to capital requirements to certain acquisition, development and construction loans are assigned a higher risk weighting under Basel III.

October 13 -

The amount of commercial and multifamily mortgage debt outstanding ticked up from April through June, yet the balance of loans in commercial mortgage-backed securities continued its decline.

September 27 -

So-called transitional lending has traditionally been kept on balance sheet; but it’s become attractive to bundle the loans for transactions called (take a deep breath) commercial real estate collateralized loan obligations. Can investors stomach the features these deals sported before the crisis?

August 2 -

Insurers are seeing modest gains in market share as banks, facing increased scrutiny from regulators, lightly tap the brakes.

August 1