-

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

Some applaud the agency's recent delay of the mandatory compliance date for a new Qualified Mortgage standard. Others say it leads to more uncertainty for lenders, opens the door to additional changes and enables some companies to loosen their underwriting.

March 7 -

The consumer bureau's revamp of criteria for "qualified mortgages," a special regulatory class of loans free from liability, emphasizes pricing instead of a borrower's debt-to-income ratio.

December 10 -

But existing deals are likely to experience issues resulting from higher defaults, faster prepayment speeds.

December 9 -

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

The ballot measure, which would allow local jurisdictions to expand rent control, had concerned mortgage companies who worried the law would result in a patchwork of different policies that could complicate underwriting and discourage lending.

November 4 -

The agency confirmed that loans backed by Fannie Mae and Freddie Mac can continue avoiding debt-to-income limits as the bureau completes a revamp of the Qualified Mortgage standard.

October 20 -

While using the 30-day SOFR as its index, Freddie Mac structured the deal so it could shift to a one-month term if and when that rate is approved.

October 19 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

Conditions have improved for the first time since November.

August 6 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

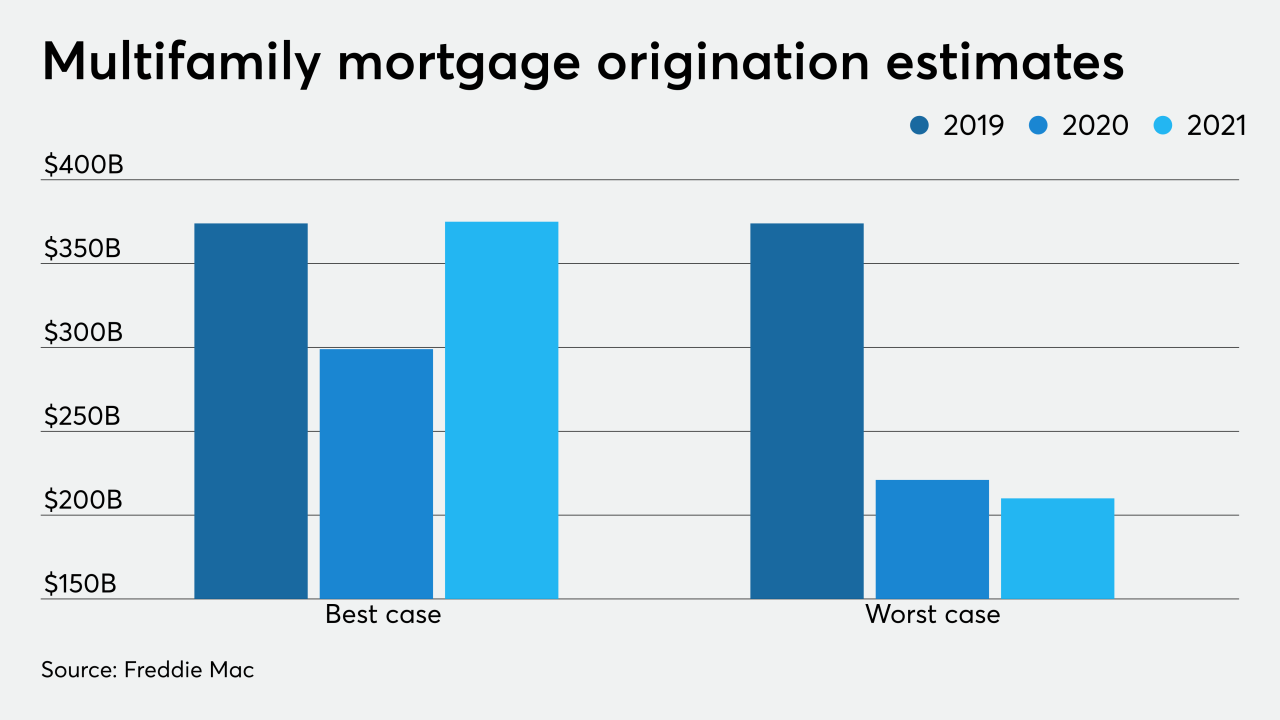

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3