-

The agency confirmed that loans backed by Fannie Mae and Freddie Mac can continue avoiding debt-to-income limits as the bureau completes a revamp of the Qualified Mortgage standard.

October 20 -

While using the 30-day SOFR as its index, Freddie Mac structured the deal so it could shift to a one-month term if and when that rate is approved.

October 19 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

Conditions have improved for the first time since November.

August 6 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

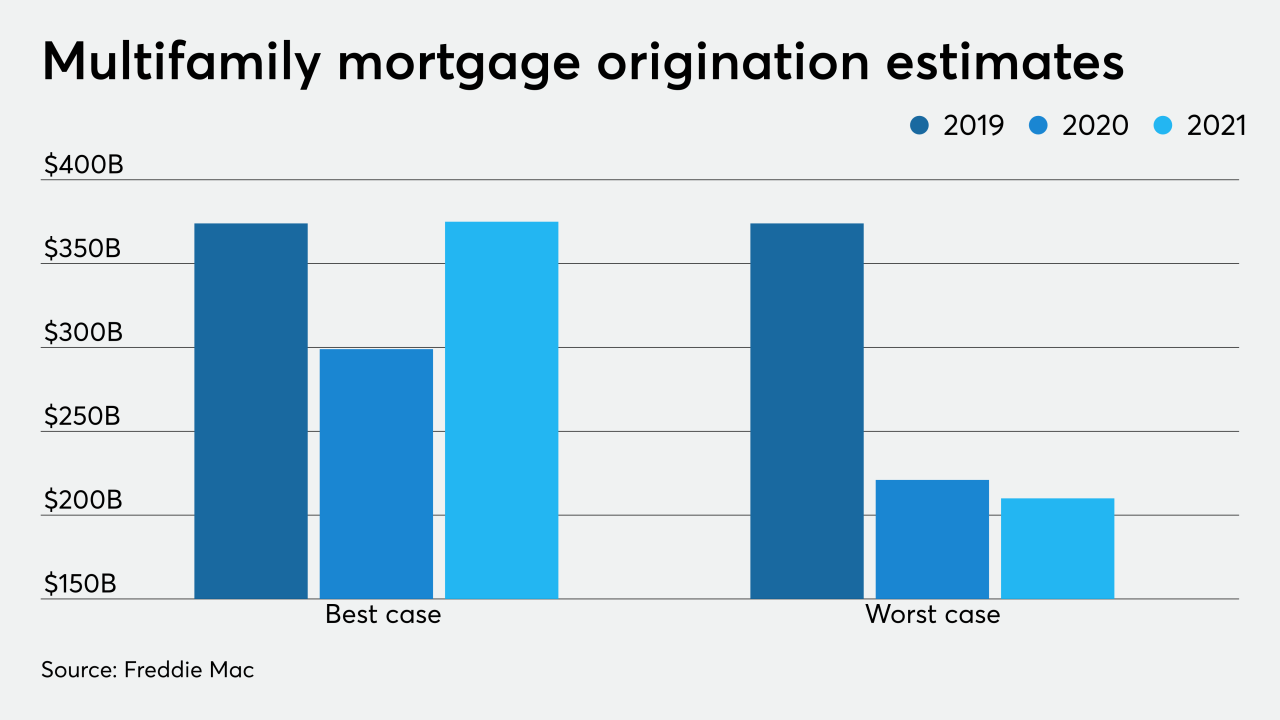

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

The measures extended by the Federal Housing Finance Agency include alternative methods used for certain appraisals and for verification of employment.

June 11 -

The coronavirus made it particularly tough for independent contractors and independent business owners to get home mortgages, but there are some signs that market may recover soon.

May 27 -

Loans with coronavirus-related forbearance have to be reported as current to the credit bureaus but there’s a ripple effect from them that has implications for credit reports and underwriting.

May 22 -

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8 -

Many originators stopped making riskier products, including jumbo loans and low credit score offerings, during April.

May 7 -

The government-sponsored enterprises have set new temporary limits on mortgage sales while extending processing flexibilities related to COVID-19.

May 6 -

The other parts of the Day 1 Certainty program regarding income and asset verifications remain in effect.

May 6 -

Correspondent loan sellers are hoping the new GSE purchases will help to open a market frozen by coronavirus-related risk — but the prices offered so far aren't too promising.

April 24 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9