-

But with rates turning back up this past week, activity could fall in February, Black Knight Optimal Blue said.

February 13 -

However, a tiered pricing system will limit an inflation-driven increase to under 10% for a small group of originators.

November 28 -

The change, effective Dec. 21, is being put into place two years after it was first proposed.

November 21 -

The development, touted as an industry-first, is the latest move by the government-sponsored enterprises to expand housing opportunities for first-time and underserved homebuyers.

October 18 -

Rate and term refinance activity has practically disappeared compared with 12 months ago, and volume for the less rate sensitive cash-out product is much lower.

September 12 -

Historically tight underwriting reinforced by regulation and third-party reviews could be buffers, so long as manufacturing standards for production and servicing hold up as residential mortgage companies downsize, according to KBRA.

September 9 -

Even though a Compass Point report states the pair have validated the credit scoring model and could implement it in the first quarter of 2023, interested parties would not verify it.

September 2 -

Delinquencies are likely to rise if both interest rates and inflation continue their upward movements, a DBRS Morningstar report said.

July 18 -

The 18.5% increase in Fannie Mae's and Freddie Mac's purchase authority was the driver of a 41% decrease in higher balance originations between December and January.

July 8 -

The former lender’s abrupt closure Wednesday and First Guaranty’s recent bankruptcy filing highlight difficulties in the current mortgage environment despite nonbanks being on stronger financial footing than their counterparts of 14 and 24 years ago.

July 7 -

The move builds on the government-sponsored enterprise’s previous program that facilitated the collection of more rent payment records from tenants who work with its multifamily borrowers.

June 29 -

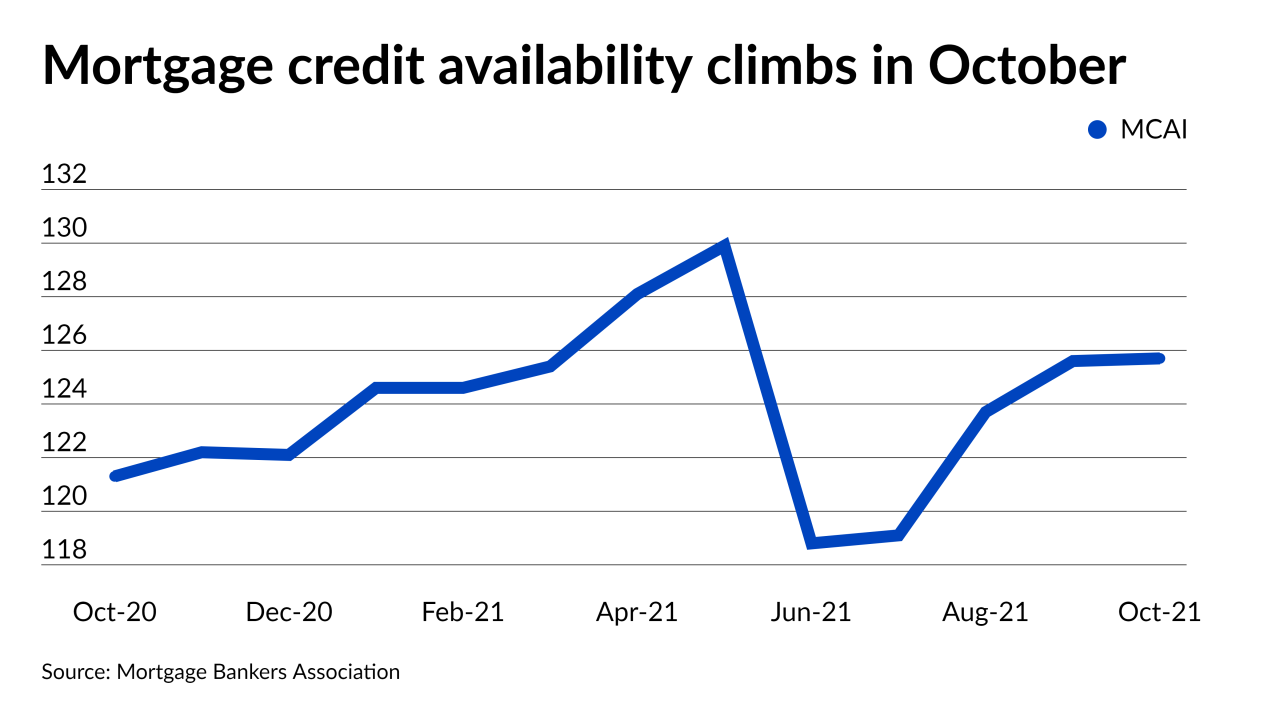

Originators offered fewer high loan-to-value and lower credit-score products, but jumbo offerings increased for the 10th time in 12 months, the Mortgage Bankers Association said.

April 7 -

Rohit Chopra, the director of the Consumer Financial Protection Bureau, has cautioned banks, credit unions and fintechs about fair-lending violations that may stem from reliance on artificial intelligence. His comments threaten to discourage financial firms from using the technology to crunch nontraditional data about borrowers, experts say.

February 1 -

Error findings related to income and employment reached a high point since Aces Quality Management started its report in 2016.

December 14 -

Activity is down 20% from one year ago, driven by a 65% falloff in rate and term refinancings, Black Knight said.

December 13 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1 -

The filing by Tamara Richards also accused the founder and other execs of encouraging a "frat house" environment that mistreated women.

September 24 -

Despite “color blind” underwriting algorithms, loan denial rates on mortgages that were not backed by the Federal Housing Administration and the VA skewed heavily toward minority groups, according to a study by The Markup.

August 27 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11