-

The move builds on the government-sponsored enterprise’s previous program that facilitated the collection of more rent payment records from tenants who work with its multifamily borrowers.

June 29 -

Originators offered fewer high loan-to-value and lower credit-score products, but jumbo offerings increased for the 10th time in 12 months, the Mortgage Bankers Association said.

April 7 -

Rohit Chopra, the director of the Consumer Financial Protection Bureau, has cautioned banks, credit unions and fintechs about fair-lending violations that may stem from reliance on artificial intelligence. His comments threaten to discourage financial firms from using the technology to crunch nontraditional data about borrowers, experts say.

February 1 -

Error findings related to income and employment reached a high point since Aces Quality Management started its report in 2016.

December 14 -

Activity is down 20% from one year ago, driven by a 65% falloff in rate and term refinancings, Black Knight said.

December 13 -

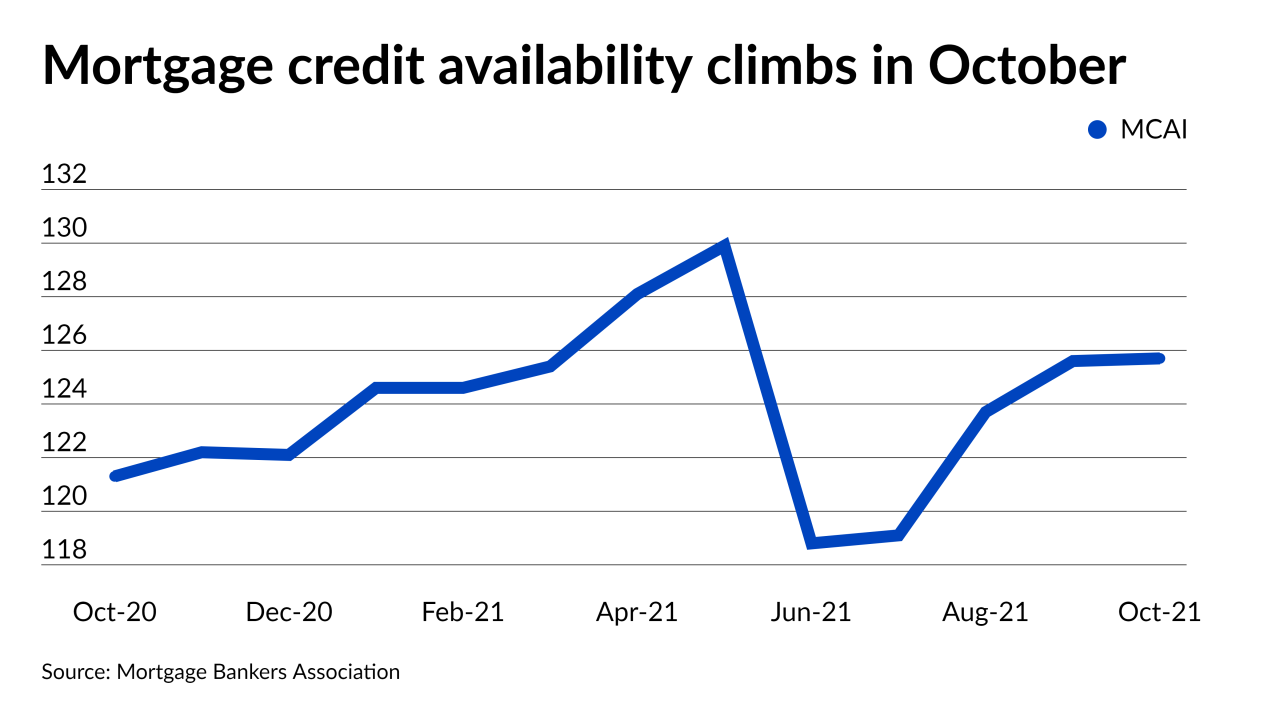

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1 -

The filing by Tamara Richards also accused the founder and other execs of encouraging a "frat house" environment that mistreated women.

September 24 -

Despite “color blind” underwriting algorithms, loan denial rates on mortgages that were not backed by the Federal Housing Administration and the VA skewed heavily toward minority groups, according to a study by The Markup.

August 27 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

Some applaud the agency's recent delay of the mandatory compliance date for a new Qualified Mortgage standard. Others say it leads to more uncertainty for lenders, opens the door to additional changes and enables some companies to loosen their underwriting.

March 7 -

The consumer bureau's revamp of criteria for "qualified mortgages," a special regulatory class of loans free from liability, emphasizes pricing instead of a borrower's debt-to-income ratio.

December 10 -

But existing deals are likely to experience issues resulting from higher defaults, faster prepayment speeds.

December 9 -

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

The ballot measure, which would allow local jurisdictions to expand rent control, had concerned mortgage companies who worried the law would result in a patchwork of different policies that could complicate underwriting and discourage lending.

November 4