-

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

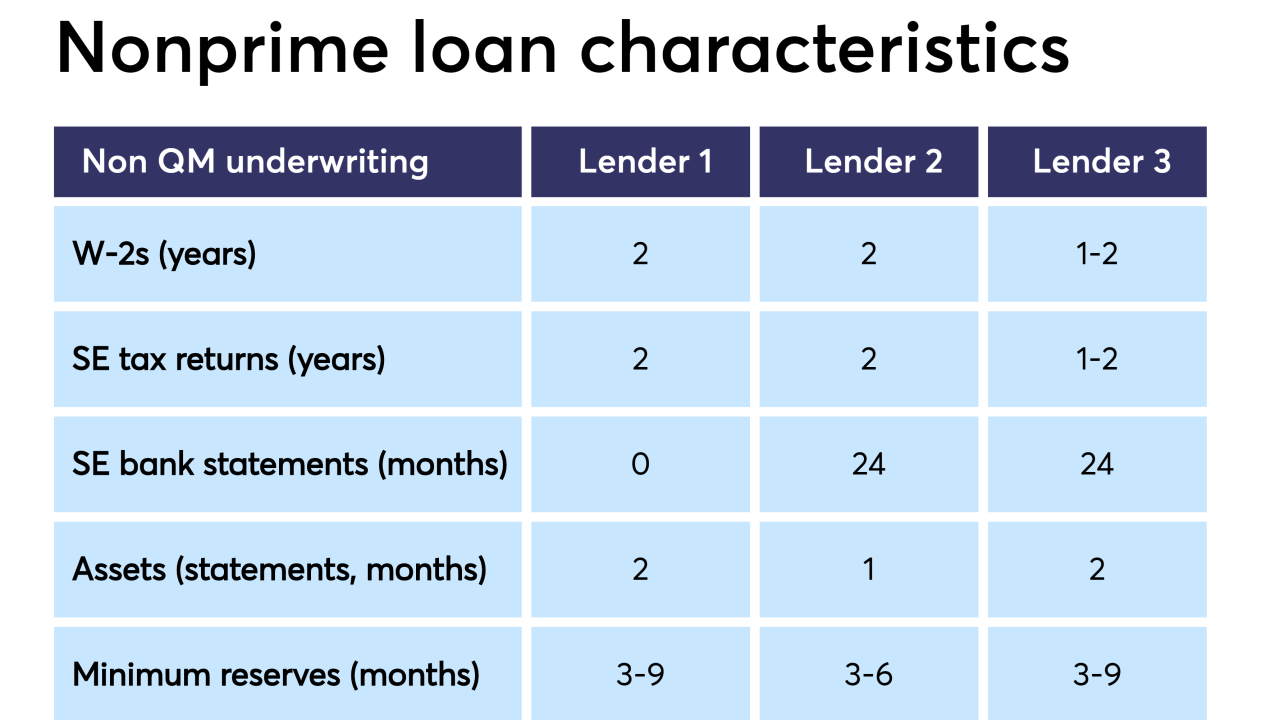

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

As lawmakers meet this week to discuss artificial intelligence, they should work with regulators to create universal and workable definitions.

June 25 Kabbage Inc.

Kabbage Inc. -

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

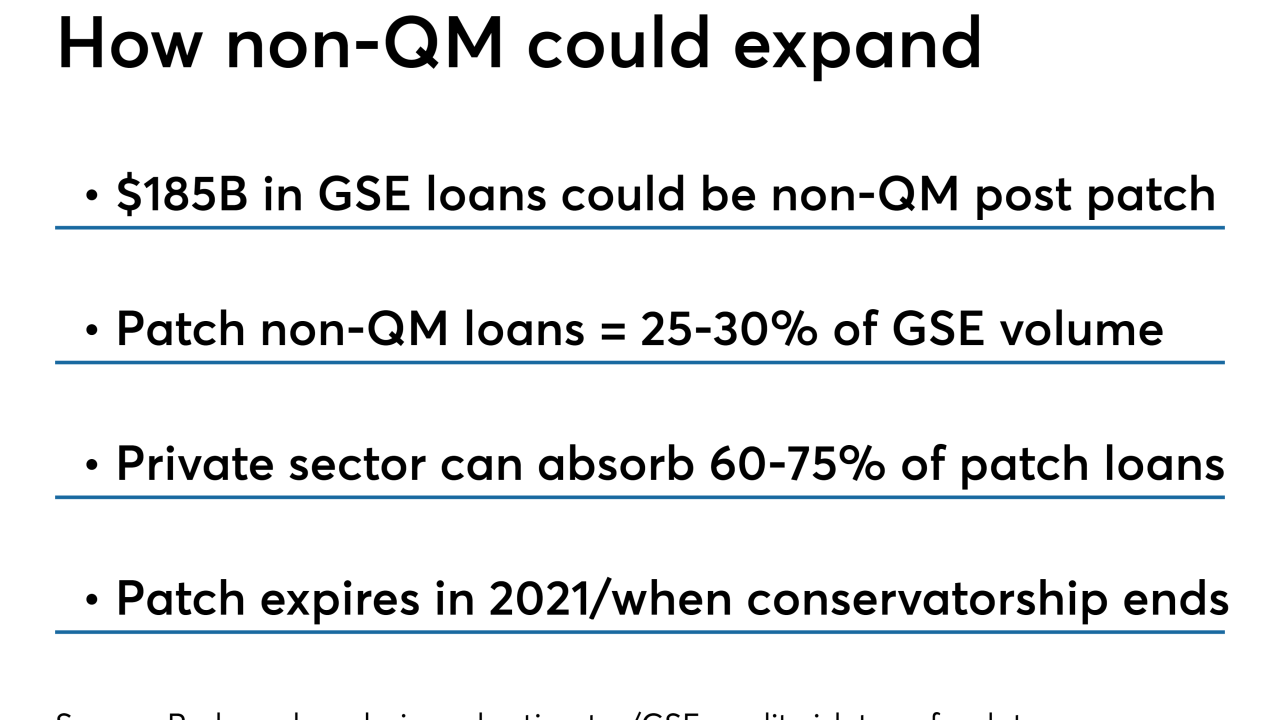

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

The state's tougher oversight has stripped Property Assessed Clean Energy of its go-to project financing status among contractors. That shift may result in adverse selection.

February 15