-

Bancorp 2019-CRE5 contains 46 loans on apartment buildings accounting for 82.4% of the collateral pool; that's up from 78.8% for the sponsor's prior deal.

March 8 -

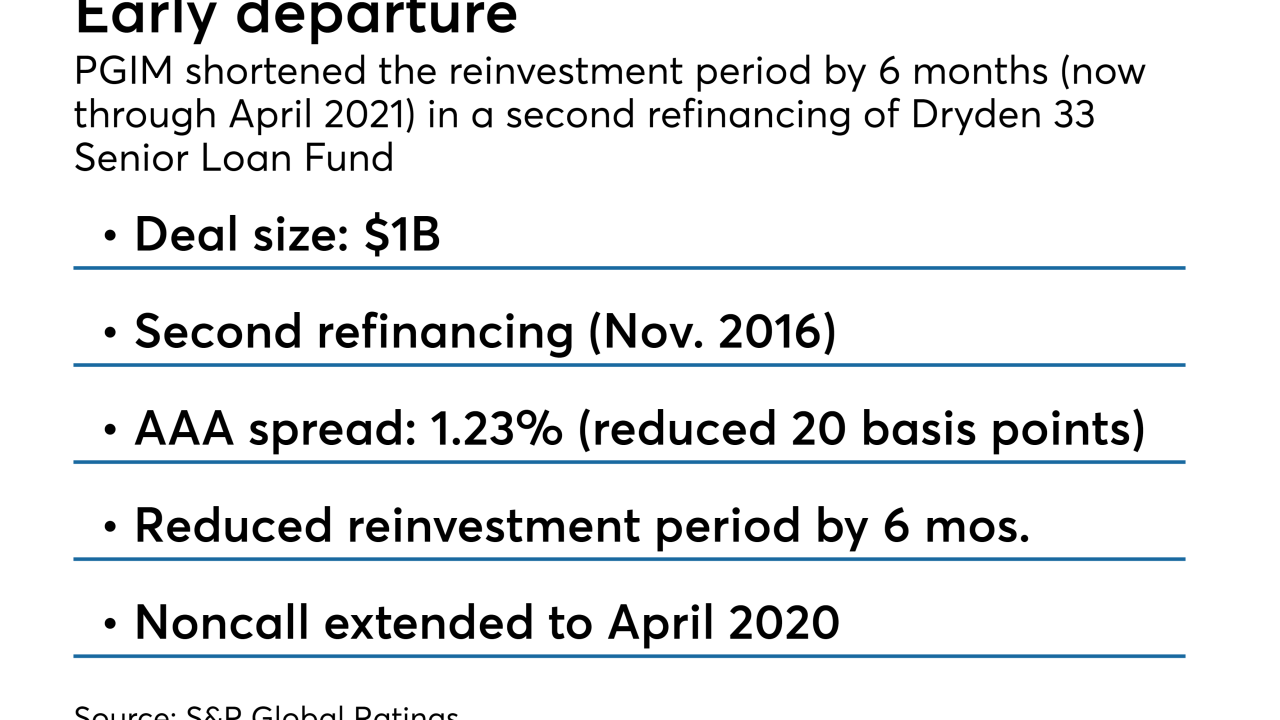

PGIM gains a 20 basis-point reduction in the AAA note coupon as it reduces the reinvestment period by six months

March 6 -

Investors appear to be willing to accept lower spreads in exchange for tying their money up for less time; CLO managers may be hoping to refinance when market conditions improve.

March 6 -

After waiting a decade to return to the CLO market, AIG now has taken less than three months to issue a second deal through its new "CLO 2.0" platform.

March 5 -

The $500.25 million Magnetite XXI has a three-year reinvestment period and can be called after just one year; it also priced inside most other deals that came to market in February.

March 4 -

Tobacco-industry loans are rare assets for CLOs, but Sound Point is ensuring none will go into its CLO XII portfolio for the remaining 20-month reinvestment period.

March 1 -

Arch Capital’s next offering of credit risk transfer notes features heavy exposure to residential mortgages that have been modified by Fannie Mae or Freddie Mac.

March 1 -

From financing driverless cars to dealing with Libor's demise, here are the highlights from the Structured Finance Industry Group's annual conference.

-

Concerns about risks in the leveraged loan market, as well as the potential impact of new capital rules for Japanese banks, continue to weigh on collateralized loan obligations.

February 27 -

Credit risk transfer does more than just reduce exposure to a downturn in the housing market. It also provides them with information about how others view mortgage credit risk.

February 27