-

Default risks in retail and media leveraged loans have also risen to the forefront of CLO manager concerns, which a few years ago were centered on oil and gas exposure.

May 24 -

Despite concerns about credit quality, the only constraints on new issuance appear to be the supply of loan collateral and the capacity of warehouse facilities and rating agencies.

May 24 -

Issuance is strong and defaults remain low; yet CLO market participants are concerned about heavy debt loads of the companies they invest in, as well as the lack of investor protections.

May 23 -

Sean Solis has been a partner at Dechert since 2014, advising collateralized loan obligation managers and arrangers through the hoops on U.S. and European risk-retention regulations.

May 21 -

A continued "oversupply" of CLO deals, along with expectations for new debut or returning managers in the absence of risk-retention requirements, is expected to keep activity flowing.

May 21 -

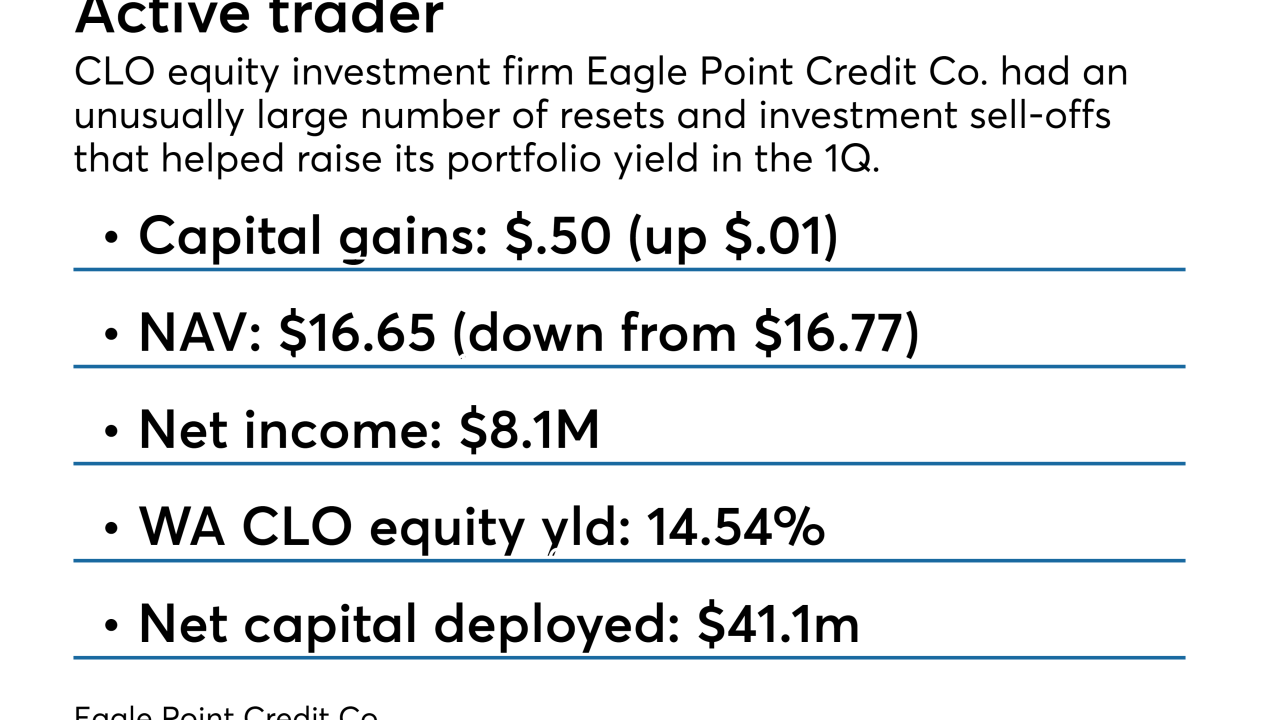

The closed-end fund, a major investor in CLO equity. directed resets of four deals that it controls in the first quarter; this helped end a yearlong slide in its weighted average portfolio yield.

May 18 -

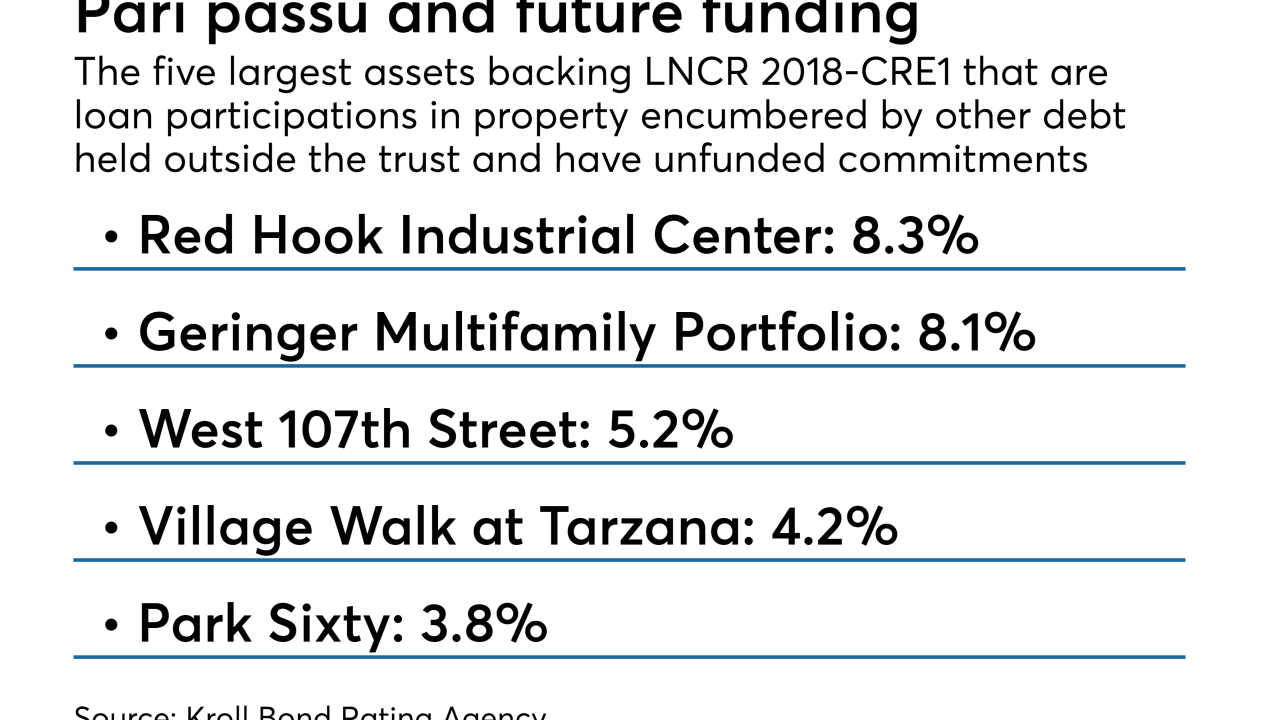

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

May 17 -

According to Morgan Stanley, seven of 15 new European CLOs in the pipeline are debut or re-entry deals involving U.S. asset managers.

May 16 -

The London interbank offered rate has its faults, but at least it compensates for counterparty risk; not so the benchmark being touted as a replacement.

May 14 -

A federal appeals court overturned part of the 2010 law’s risk retention rule earlier this year. The legal battle highlights mistakes to be avoided during the next reform fight.

May 10 Loan Syndications & Trading Association

Loan Syndications & Trading Association -

PHH Corp. took a net loss in the first quarter but was able to surpass minimums for net worth and available cash necessary for Ocwen Financial to acquire the company.

May 9 -

The average AAA note coupon of 103 basis points above Libor widened from 98.4 in March, which had been the tightest CLO spread level in approximately five years.

May 8 -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

“We’re comforted by the fact our position in the market is so strong, and our ability to gain [loan] allocation is quite important," co-CEO Kewsong Lee says.

May 2 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

Hunton Andrews Kurth LLP (formerly Hunton & Williams and Andrews Kurth Kenyon) has named Robert A. Davis Jr. as special counsel in its tax and ERISA practice.

April 30 -

Nearly four in five expect spreads to widen this summer, which is not good news for spec-grade U.S. companies that binged on borrowing levels over the last two years.

April 19 -

After the second-busiest quarter for primary European CLO issuance to start 2018, a two-week April lull in the market was ended with deal pricings by Intermediate Capital and Investcorp.

April 16 -

Jay Huang, a longtime Citigroup veteran who joined in January, is developing a high-tech trading-desk operation to enhance the company's portfolio of CLO investments.

April 16 -

The total volume of CLO refinancings for the month to date has reachd $11.3 billion, as managers continue to take advantage of the repeal of skin-in-the-game rules for this asset class.

April 13