-

Deals, trends and research in structured finance and asset-backed securities for the week of May 14-20

May 20 -

During a House Financial Services Committee hearing, Democrats largely praised the policy decisions of acting regulators named by the Biden administration and knocked their predecessors. But Republicans warned that moves to reverse Trump-era policies would leave financial institutions without a clear road map.

May 19 -

Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

May 18 -

With little transitional disruption, the bigger players on the non-agency side could gain a hefty share of non-owner-occupied mortgage volume as a result of Fannie Mae and Freddie Mac’s caps on such purchases, a KBRA analysis finds.

May 17 -

Analysts at HSBC Holdings PLC reported last month that 82% of employees globally say they’d like to work remotely at least one day a week in the future, citing Colliers International data. A separate CBRE survey showed a plurality seeking two to three days a week.

May 17 -

Some worry the Senate’s rejection of the OCC rule hampers efforts to clarify legal standards for banks selling loans to fintechs.

May 12 -

Three Republicans joined Senate Democrats in voting to overturn a rule issued by the Office of the Comptroller of the Currency that makes it easier for national banks to sell loans to nonbanks. A companion resolution has been introduced in the House.

May 11 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

Fannie and Freddie's regulator says the companies must comply with the new Qualified Mortgage standard by the summer, while the Consumer Financial Protection Bureau has extended the deadline to 2022. The conflicting timetables have stoked uncertainty in the market.

May 7 -

According to Moody’s Investors Service, nearly 73% of the 33-obligor pool for ACRES Commercial Realty 2021-FL1 are apartment buildings that lack current revenue streams due to property rehabilitation efforts or being under transition.

May 4 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

But the rate for those loan-payment deferrals remains elevated over pre-pandemic levels.

April 28 -

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

A new commercial-mortgage loan for seven facilities operated by the self-storage REIT is the largest of 41 loans in the conduit deal.

April 27 -

However, conditions for commercial mortgages overall worsened slightly due to persistent concerns in the hotel and office sectors, a Moody’s Investors Service report found.

April 26 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

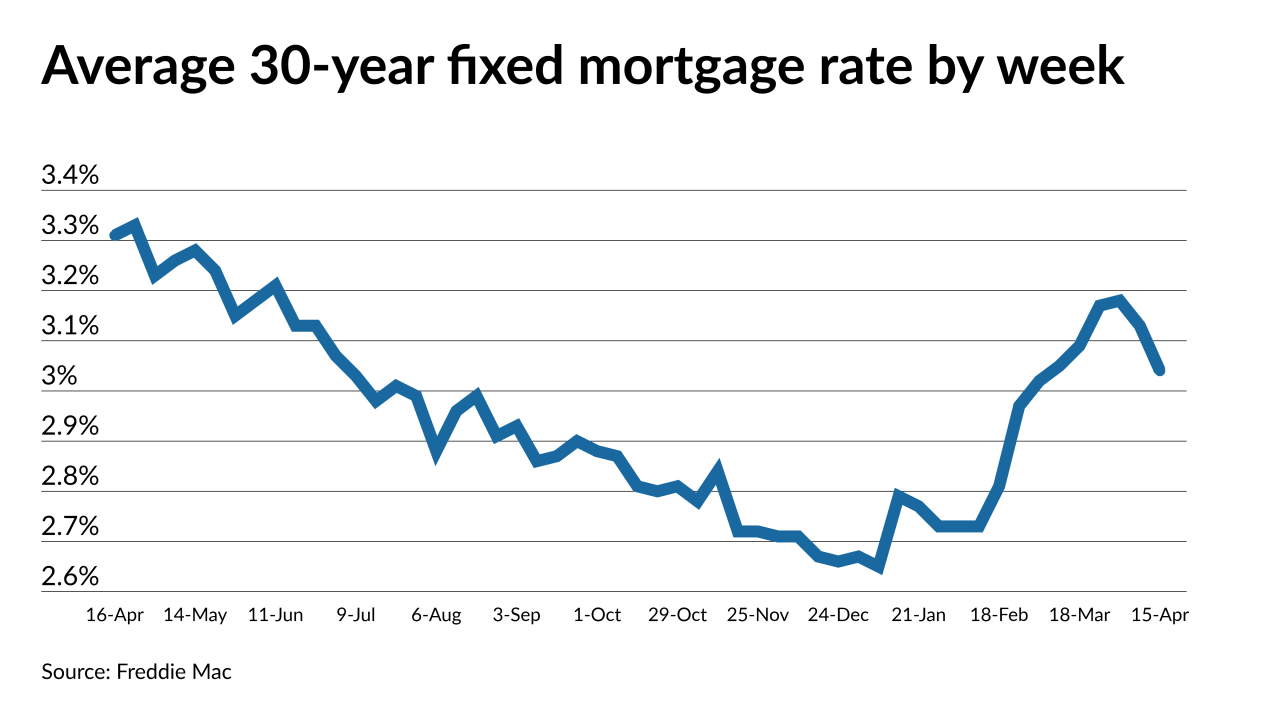

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8