-

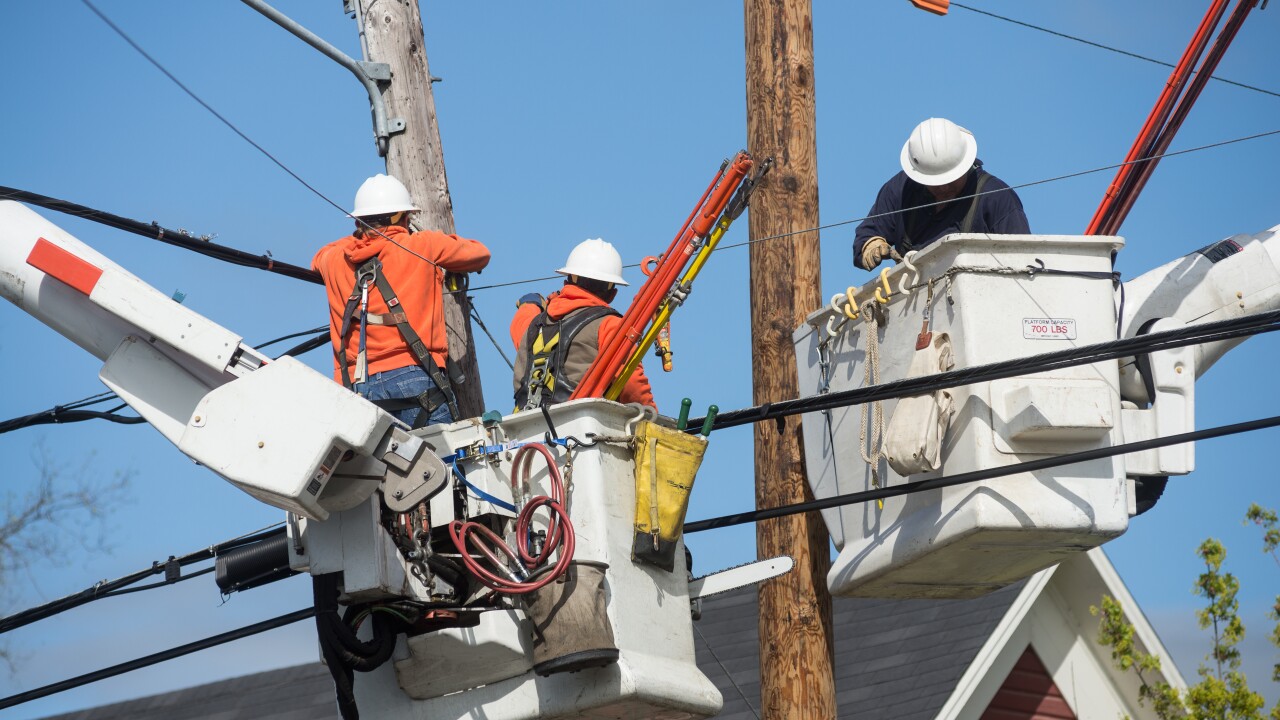

RG&E, series 2025-A, is the second utility cost recovery securitization this week, and is another first-time issuer.

February 6 -

Completed foreclosure auctions should be 8% lower this year, but if home value and unemployment expectations change, all bets are off, Auction.com said.

February 5 -

Residential customers made up 70.1% of NYSEG's sales revenue, while commercial and industrial customers account for the other 30% of sales. The latter is a relatively high exposure for such deals.

February 4 -

Debt service coverage ratio triggers, including cash trapping and rapid amortization, will provide much of the credit enhancements to the notes.

February 3 -

Deal production has been a bright spot, but delinquencies could soon reach record highs, especially for office CMBS.

January 28 -

Just 2.15% of the loans in the pool financed properties in Los Angeles County, and the surrounding areas that have been impacted by the recent wildfires.

January 23 -

Valley National Bank and Dime Community Bancshares expect a better balance of deposit costs to help boost their net interest margins in 2025.

January 23 -

Higher mortgage rates will persist through 2026, affecting sales and refinancings. Those expectations led Fannie Mae to cut its volume outlook for the next two years.

January 22 -

Obligors are slightly more concentrated but the percentage of obligors in higher credit quality grades—2 through 5—increased to 56.9%, from 41.3% from the previous deal.

January 21 -

Sunsetting the federal oversight of Fannie Mae and Freddie Mac could ease the cost of renewing President Trump's 2017 tax act, but doing so is an uphill battle.

January 21