-

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

Foreclosure activity fell 21% in July compared to a year ago and rose 6% from June after twelve consecutive months of declines, according to Attom Data Solutions.

August 26 -

Increased consumer debt and the threat of an economic downturn increase the default risk for government-sponsored enterprise mortgages during the first quarter, according to Milliman.

August 7 -

While seasonal factors were attributed to the monthly rise in mortgage delinquencies for June, the jump was still much higher than last year's fairly steady increase, according to Black Knight.

July 23 -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

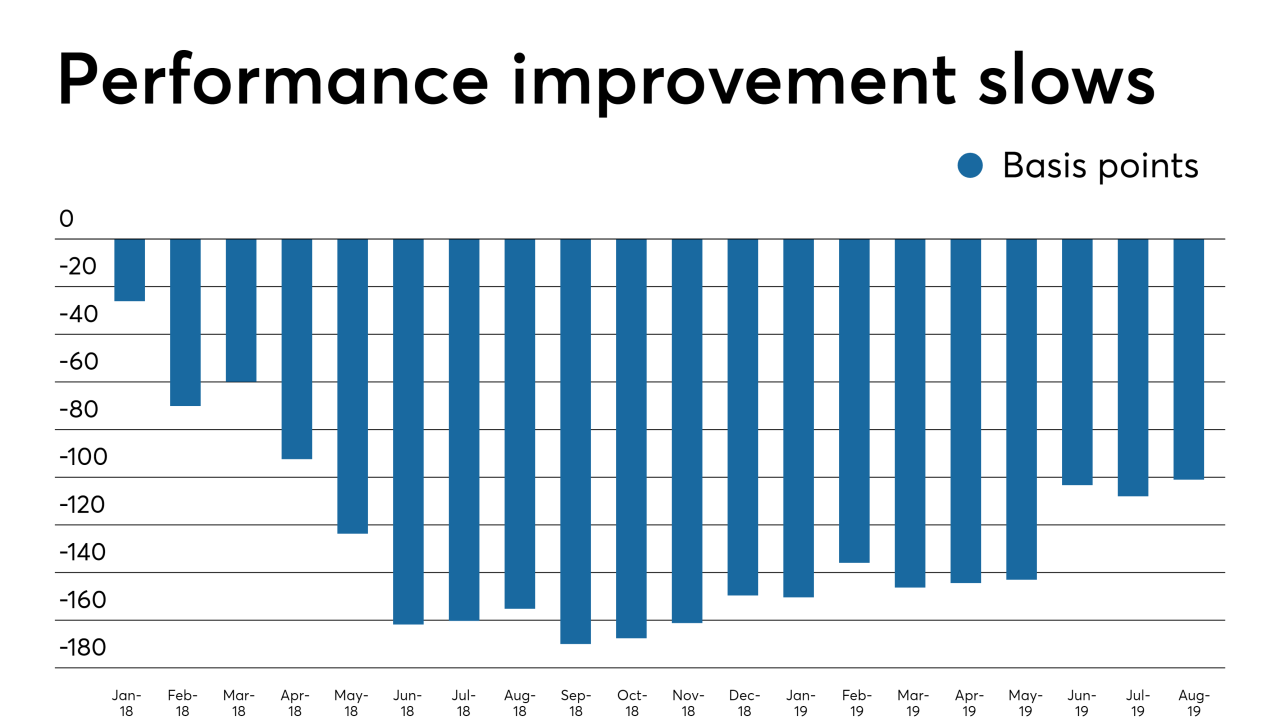

Although the performance of the government-sponsored enterprises' single-family loans continues to improve, the deeply delinquent totals remain significant in states with court-processed foreclosures.

June 21 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

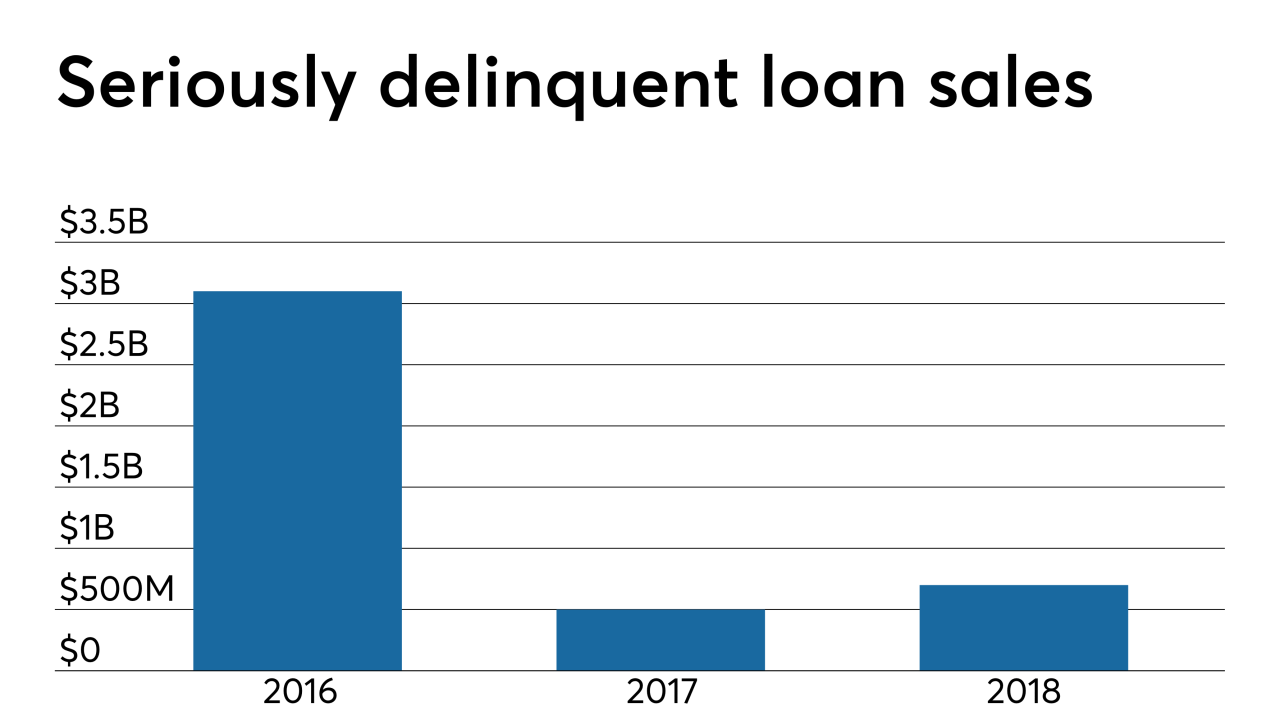

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

Caliber Home Loans settled a grievance with the Massachusetts attorney general over allegations of providing distressed borrowers with unaffordable loan modifications.

April 11