-

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

April 24 -

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

April 9 -

ABS participants saw markets freeze and were bracing for worse when federal aid provide a short-term respite. The question now: How much trust can anyone put in the medium-term and beyond?

April 3 -

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

April 1 -

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

Mark Calabria said Fannie Mae and Freddie Mac are currently equipped to handle elevated delinquencies, but they might need congressional or Federal Reserve help if fallout from the coronavirus persists.

March 19 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

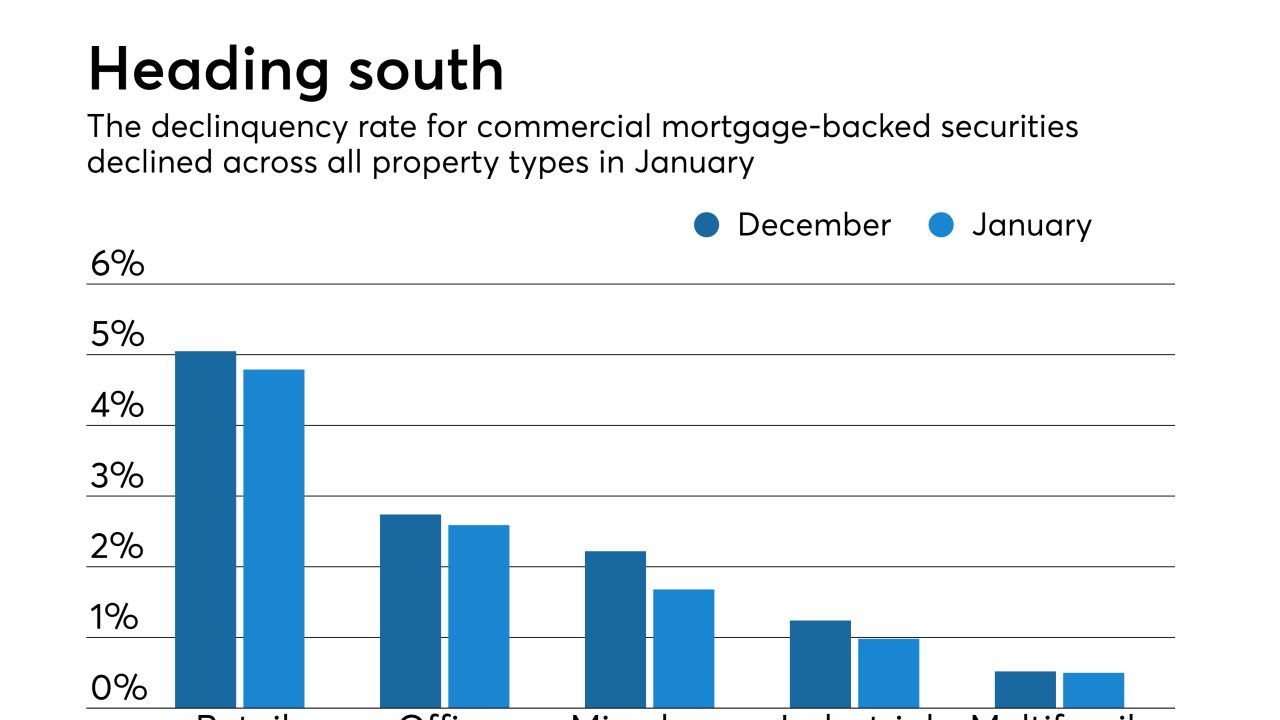

The falling rates continue a three-year trend of improving performance across numerous commercial mortgage sectors including multifamily, office and retail.

March 10 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

According to Moody's, Ally's latest auto-loan ABS will not require the issuer to repurchase loans with modified terms or maturities.

December 3 -

According to Moody's, Ally's latest auto-loan ABS will not require the issuer to repurchase loans with modified terms or maturities.

December 2 -

Kroll Bond Rating Agency has tracked rising levels of annualized net losses in marketplace-loan securitizations except for, ironically, the riskiest pools it tracks from unsecured subprime lenders: both losses and delinquencies for subprime lenders' outstanding securitizations have fallen from September 2018 levels.

October 11 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

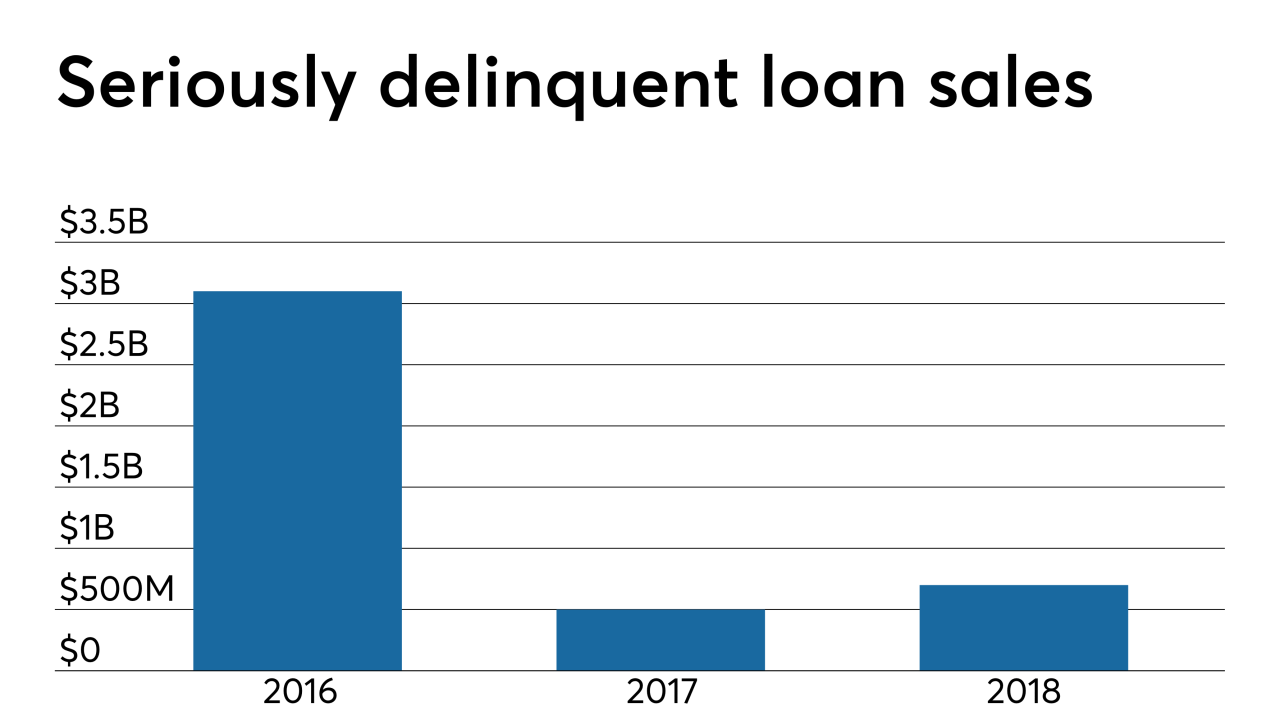

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

More consumers were late in paying two major types of loans in the latest figures from the American Bankers Association, but it appears to be a relatively isolated problem.

April 11 -

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Rising wages and savings rates resulted in a decline in past-due payments in the second quarter, the American Bankers Association said in its quarterly report on delinquency trends in consumer lending.

October 4 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24