-

Citing the dim financial outlook for a business it entered just six years ago, the Wayzata, Minn., company will stop making auto loans on Dec. 1.

November 27 -

The British banking giant has been testing its new online lending platform with a handful of its U.S. customers and plans to roll it out in full force next year. It's all part of a broader effort to expand its U.S. consumer business beyond credit cards.

November 21 -

Fed researchers purported to show that consumers who use peer-to-peer loans have bad financial outcomes, but questions quickly emerged about the data they used.

November 19 -

More stringent underwriting is the likely reason banks and credit unions are seeing relatively low levels of delinquencies on car loans to high-risk borrowers.

November 14 -

Nearly one-third of the vehicles in CIG Financial's $172 million transaction have mileage above 100,000; the highest-mileage car financed has 197,387.

November 13 -

Consumers who have borrowed from online lenders owe more and have lower credit scores than similarly situated consumers who have not used online lenders, according to a study released Thursday by the Cleveland Fed. The provocative findings seem likely to spark intense debate.

November 10 -

The San Francisco firm is the latest U.S. lender to tighten credit standards amid concerns that consumers are shouldering too much debt.

November 8 -

The company increased the concentration of sub-550 Beacon score borrowers to more than 13%, and cut the share of prime 700-plus loans by more than two-thirds from its prior deal.

November 8 -

The San Francisco-based lender still posted losses in its portfolio, although those declined considerably from the year-ago period.

November 7 -

Residents' low incomes usually disqualify them for standard student loan refinancings, but SoFi and other lenders describe these borrowers as strong credits with high earnings potential who could offset some of the risks lurking in student loan pools.

November 7 -

Amid the rise of online lending earlier this decade, banks were derided as being too slow to adapt. But over time it's become clear that banks hold key advantages over lending startups.

November 6 -

GS Bank will take the name of Goldman's nascent consumer-lending business, Marcus.

November 3 -

The Consumer Financial Protection Bureau said 42% of car loans issued in the last year had a repayment term of six years or more, a huge leap over the 26% with such terms in 2009.

November 1 -

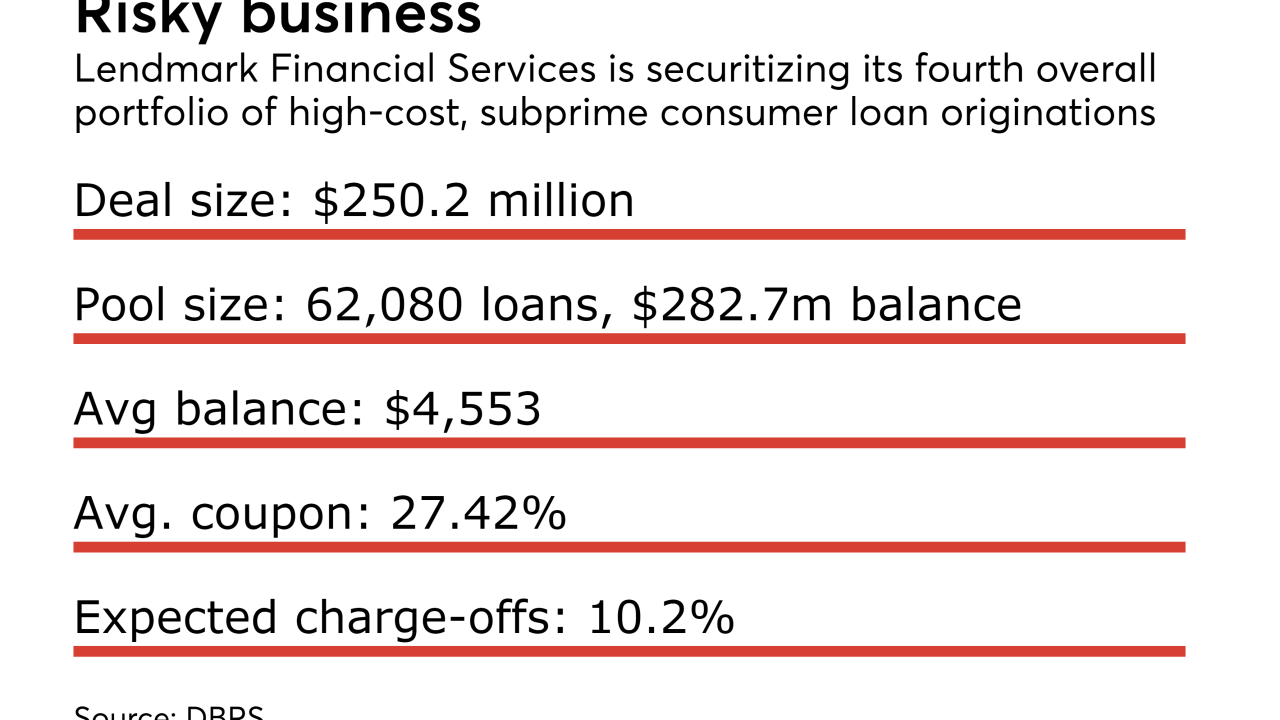

Initial credit enhancement on the senior notes to be issued has risen to 17.5% from 16.8% for the lender's previous securitization, but the target level is unchanged at 30%.

October 30 -

The Dallas consumer lender says it plans to boost subprime originations again after retooling its portfolio and taking stock of the economy.

October 27 -

The tighter spreads on the fintech student lender's latest securitization should help offset a rise in the underlying benchmark rates, keeping its funding costs low — and helping it compete more effectively.

October 27 -

The deal, known as Bayview Opportunity Master Fund IVb Trust 2017-RT6, pools 2,745 current loans, of which nearly 58% have been clean for at least two years, and 55.2% have been modified.

October 26 -

The hurricanes destroyed hundreds of thousands of cars, and banks are significantly boosting their reserves in anticipation of higher defaults on auto loans. But there is also a silver lining for auto lenders.

October 25 -

The company is lending less and issuing smaller securitizations this year, but investors keep flocking to the subprime lender's paper.

October 24 -

As more loans go bad across the credit card industry, the Riverwoods, Ill.-based company boosted its provision for loan losses by 51%.

October 24