-

Democrats on the House Financial Services Committee are expected to shine a spotlight on Trump-appointed regulators, but that light might shine brightest on one agency in particular.

December 5 -

The online lender has acquired NextGenVest, which uses AI and text messaging to advise high school and college students about getting loans. CommonBond’s goal is to better understand the distinctly different demographic group rising behind millennials.

December 4 -

Social Finance, the lending and refinancing startup valued at more than $4 billion, is cutting about 7% of its staff, according to a person familiar with the matter.

December 3 -

It’s a trend that bears watching, particularly for holders of the riskiest securities issued in subprime auto securitizations, according to S&P Global Ratings.

December 3 -

Seth Frotman oversaw the $1.5 trillion student loan market for the Trump administration. Now he's starting his own watchdog group to do what he says the government won't, and he's poaching former colleagues to do it.

November 28 -

The $175 million deal is backed by loans with an average balance of $2,365; fewer of them are "renewal loans" to existing borrowers who qualify to borrow more because of previous on-time payments.

November 28 -

Kathy Kraninger, who may get a confirmation vote as early as this week, has suggested a similar vision to that of the agency’s current acting chief. But some see signs she could bring a different approach to the job.

November 27 -

The Massachusetts senator said the government’s findings bolster allegations that the servicer steered borrowers into expensive student loan forbearance plans.

November 20 -

The agency alleges the subprime auto lender violated consumer finance laws by misrepresenting the level of guaranteed insurance protection.

November 20 -

The rating agency is now considering lowering its BBB rating on the class B notes. The rating agency also downgraded the class C notes issued in the deal, for a second time, to CC from CCC+.

November 20 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Flagship, Santander Consumer USA and AmeriCredit are printing $2.3 billion in new notes backed by subprime auto-loan originations.

November 8 -

The passage of Proposition 111, which also prohibits lenders from adding origination and monthly maintenance fees, makes Colorado the fifth state to impose caps on payday loans through a voter referendum.

November 7 -

The San Francisco company, which has racked up big losses over the last two and a half years, signaled Tuesday that it is on a path to profitability after resolving a series of longstanding regulatory problems.

November 6 -

Both Kroll and S&P expect losses on collateral in the subprime consumer lender's latest deal to be higher than its 2017 deals; Kroll alone assigned a lower rating to the senior tranche.

November 5 -

The deal comes a year after the captive finance company began excluding low-FICO loans from its primary auto loan ABS platform.

October 31 -

The Federal Trade Commission, which issued a formal complaint against SoFi, is urging other lenders to review their advertisements for false claims about the benefits of refinancing.

October 29 -

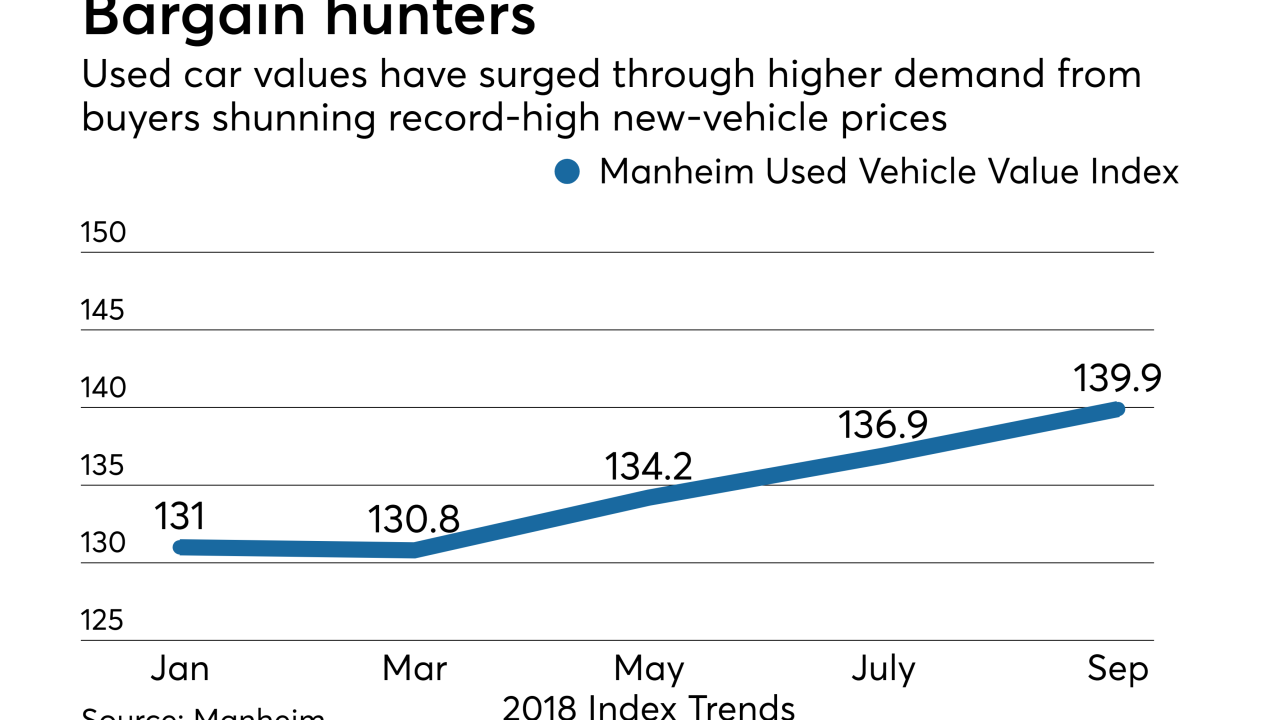

Sales of older vehicles are on the rise and prices are headed back up, so there's more collateral available and it is also performing better.

October 29 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Both S&P and Moody's have cut expected losses on $732 million deal, yet credit enhancement on the senior tranches is unchanged from the prior deal.

October 22