-

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

A three-month drought in CRE CLO issuance came to an end this week with new deals from Exantas and A10 Capital.

September 9 -

Many commercial property owners are locked out of existing coronavirus relief by financing terms that bar them from taking new loans. Under a House bill, they would receive government-backed equity investments.

July 22 -

As revenue-starved retailers fall further behind on rent payments, landlords' cash flow will be strained, and defaults on commercial real estate loans could rise.

June 10 -

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

The falling rates continue a three-year trend of improving performance across numerous commercial mortgage sectors including multifamily, office and retail.

March 10 -

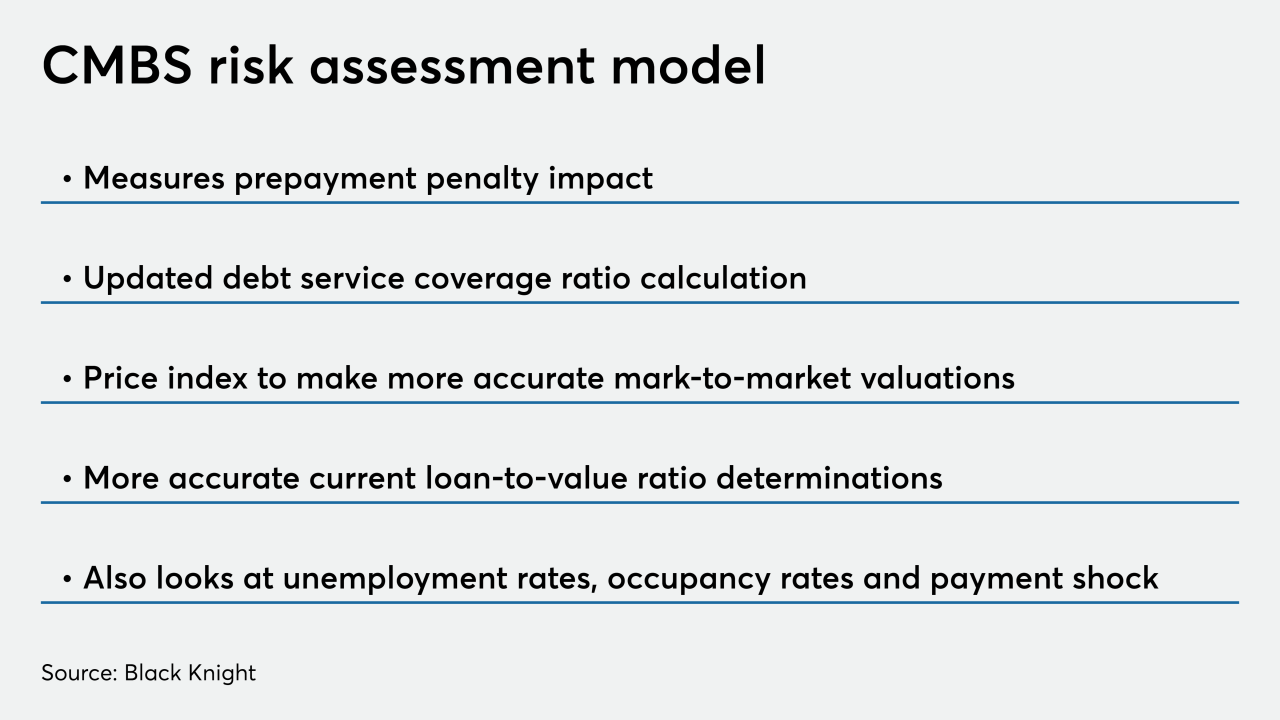

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

Brick-and-mortar retail isn’t dead yet. Though the trend of retailers closing stores in the face of stiff competition from e-merchants is certainly troubling to commercial real estate lenders, it would be a mistake to conclude that all retail loans are risky. Here's a look at which ones are the safest and, potentially, the scariest.

March 5 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

A joint venture between the REIT and two Chinese investors obtained a $364 million five-year, fixed-rate loan on the portfolio from Column Financial.

December 6 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The removal of costly appraisal requirements on tens of thousands of smaller commercial properties could help community banks better compete for loans they say they have been losing to nonbank lenders.

May 4 -

Borrowers can get better rates elsewhere, so they're repaying ahead of schedule, leaving banks in the lurch. The steps lenders would have to take to keep the business could be prohibitively expensive.

April 27 -

First the House and now the Senate have included provisions in their regulatory relief bills that bankers say would go a long way toward clearing up confusion over how to treat high-volatility commercial real estate loans.

March 15