-

Annisa CLO was originally issued in August 2016, just before risk retention regulation took effect, but was the firm's first deal to be dually compliant with both U.S. rules (which no longer apply to CLOs) and European rules.

July 3 -

GoldenTree Loan Opportunties XII was one of nine CLOs that were reset or refinanced on Friday alone, as managers rushed to lower payment prior to July quarterly payments to investors; the tally for June as a whole is $30.9 billion.

July 2 -

The deal, which is expected to close this summer, would bring THL Credit’s assets in collateralized loan obligations under management to approximately $12 billion and its total assets under management to over $15.5 billion.

June 27 -

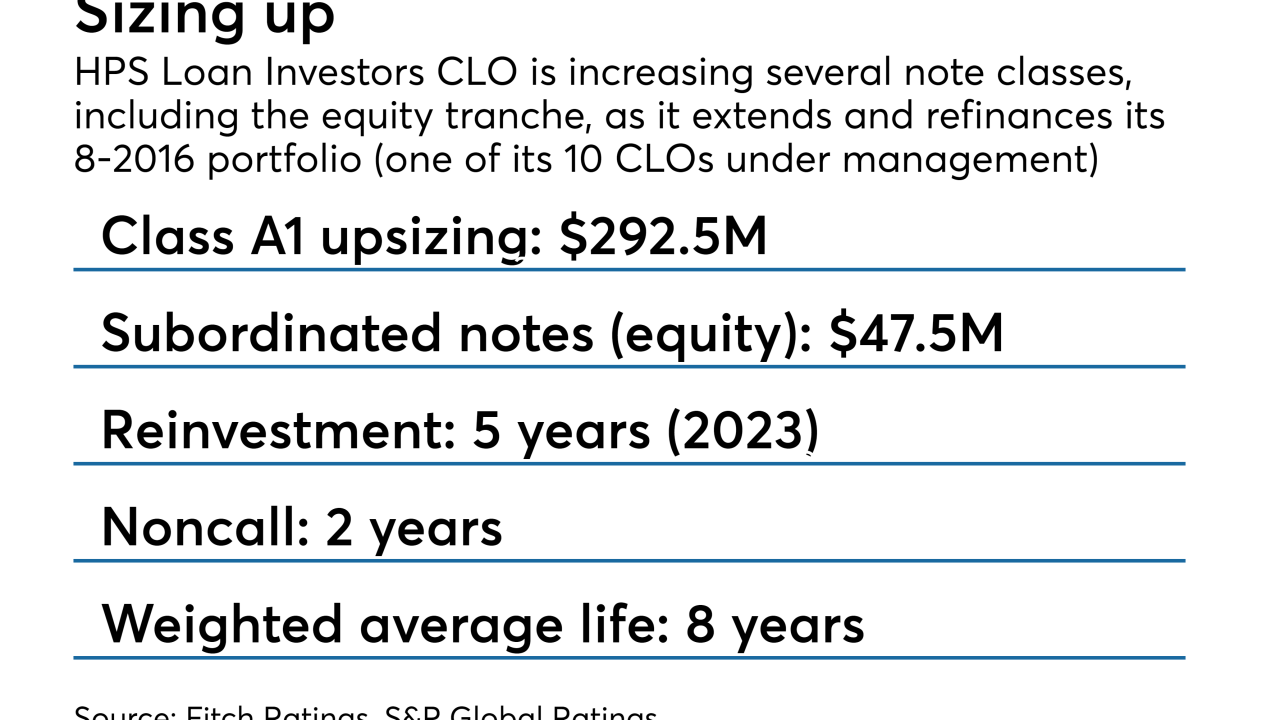

HPS Loan Management 9-2016 will be backed by a $750 million portfolio of broadly syndicated loans and other assets, up from $500 million originally; Moody's is only rating the two senior tranches of notes to be issued.

June 26 -

That level is wide of the six new-issue CLOs that priced last week at triple-A spreads of 110 basis spoints; CLO senior notes have widened 10 basis points, on average, over the past three months.

June 22 -

The $470 million transaction has some features rarely seen now that the market for bridge loan securitization has been rehabilitated, including a "blind ramp" and a "blind reinvestment" period.

June 21 -

It's another example of what appears to be tailoring tranches to meet the tenor and yield requirements of specific investors; the deal, GMS Euro CLO 2014-1, was also upsized to €508 million from €368.3 million originally.

June 20 -

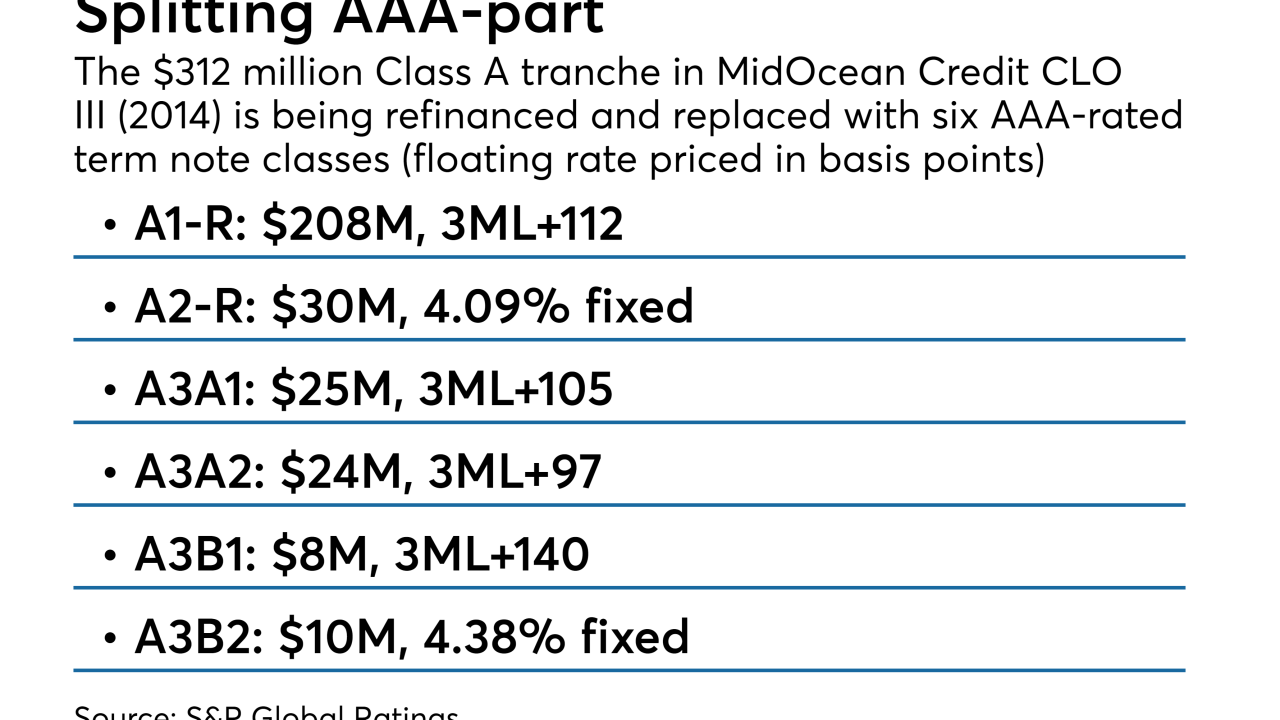

The original $312 million triple-A notes are being replaced with six separately priced Class A note tranches, including two fixed-rate securities classes

June 18 -

CLO securities pay out interest pegged to the three-month London interbank offered rate, but loans used as collateral are increasingly switching to one-month Libor and the spread between the two benchmarks has widened significantly.

June 14 -

The $278.3 million RCMF 2018-FL2 also has unusually heavy exposure to apartment buildings, offices and industrial properties that are either vacant or have low occupancy levels, according to Kroll Bond Rating Agency.

June 14 -

-

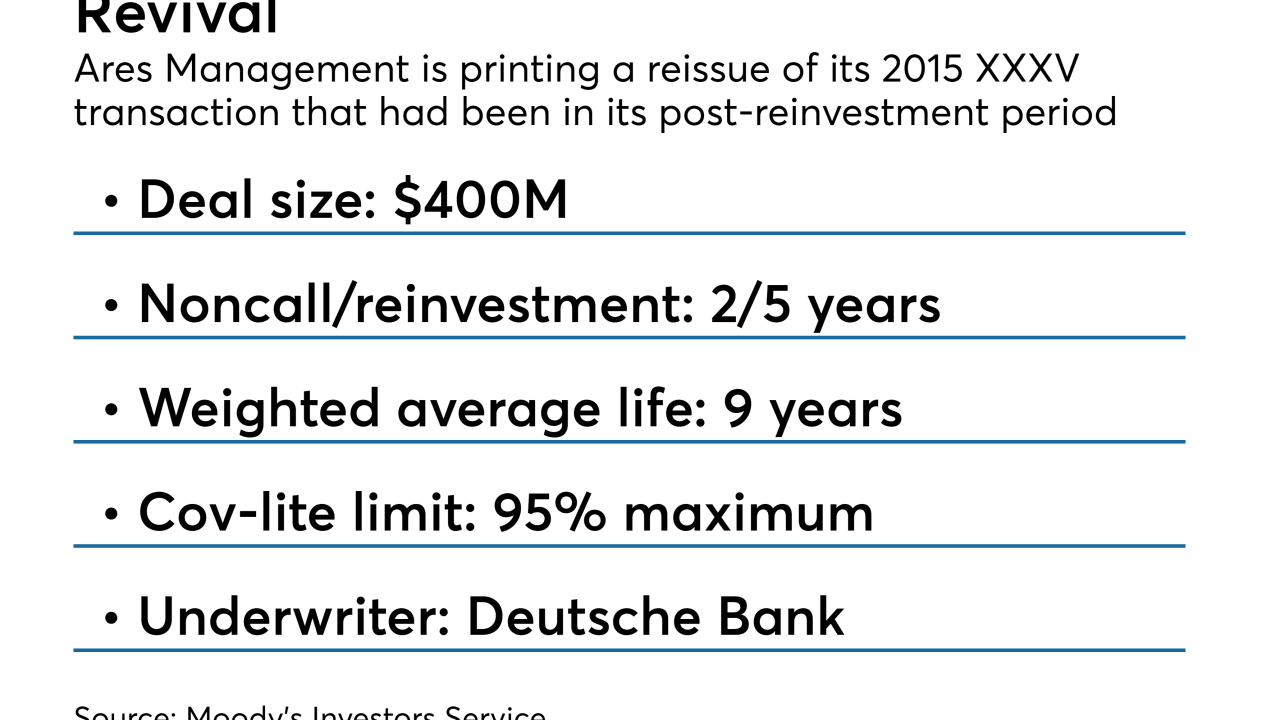

The $71.7 billion-asset manager is replacing notes from a 2015-vintage CLO that had been squeezed on asset quality prior to its October 2017 post-reinvestment period.

June 12 -

The Dallas-based money manager has launched a UCITS that invests in both U.S. and European loans, investment-grade CLO securities, and obligations and other kinds of structured products.

June 12 -

The $52 billion in year-to-date volume in resets of collateralized loan obligations is nearly outpacing new-paper issuance of $53.5 billion, reports LPC.

June 11 -

The new notes are not being distributed proportionally across the capital stack, however; instead the refinancing will result in slightly higher subordination for the senior, triple-A-rated Class A notes.

June 8 -

The holdings demonstrate “resiliency over several credit cycles, with low realized principal losses and robust returns for CLO equity,” managers say.

June 7 -

The .. also named David Williams as head of U.S. global structured credit solutions capital markets; both executives have been with the firm for over a decade.

June 7 -

Changes that federal regulators are contemplating to the Volcker Rule could pave the way for CLOs to resume investing in high yield bonds, which they currently cannot do without putting themselves off limits to banks.

June 6 -

The volume of "true" new-issue CLOs (excluding reissued deals of existing collateralized loan portfolios) have declined for four consecutive months after February's high-water 2018 mark of $14.7 billion. But JPMorgan maintains its $115 billion-$130 billion annualized forecast.

June 6 -

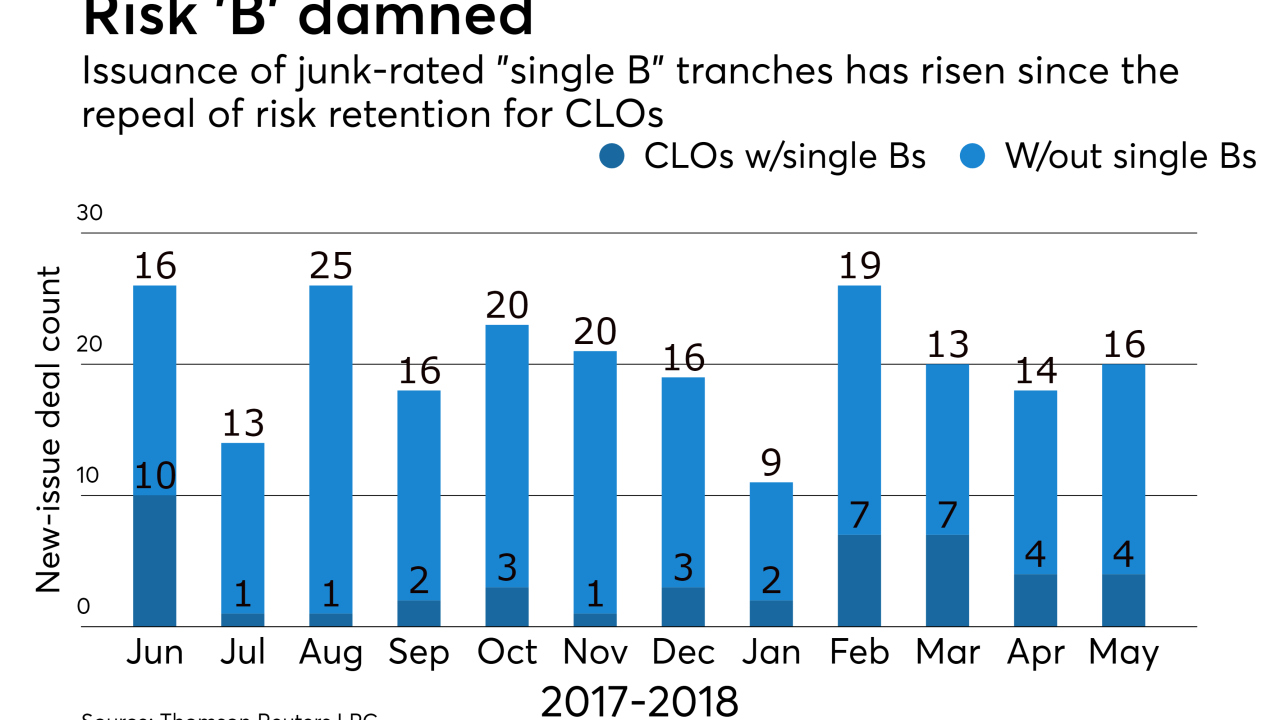

Exempting CLOs from “skin in the game” rules allows managers to unload more of the risk in these transaction; increasingly, they are doing this by issuing a second tranche of speculative- grade notes.

June 5