-

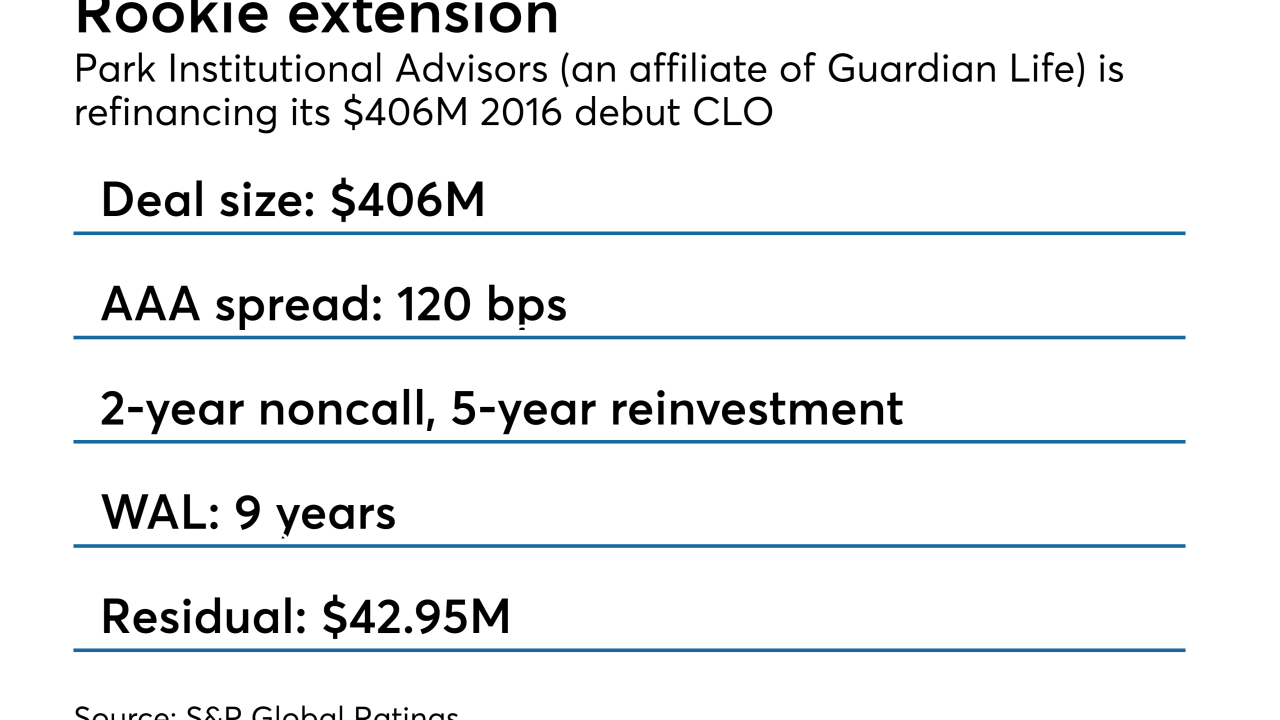

Once refinanced, the $406 million Park Avenue Institutional Advisors CLO 2016-1 will be non-callable for two years and can be actively managed for up to five years.

August 17 -

The $449.2 million Carlyle Direct Lending CLO 2015-1R is the 11th deal the global alternative asset manager has refinanced this year.

August 16 -

Execs at both closed-end funds say expectations for an eventual rise in defaults are driving their strategy to extend reinvestment periods on CLOs in their portfolios.

August 15 -

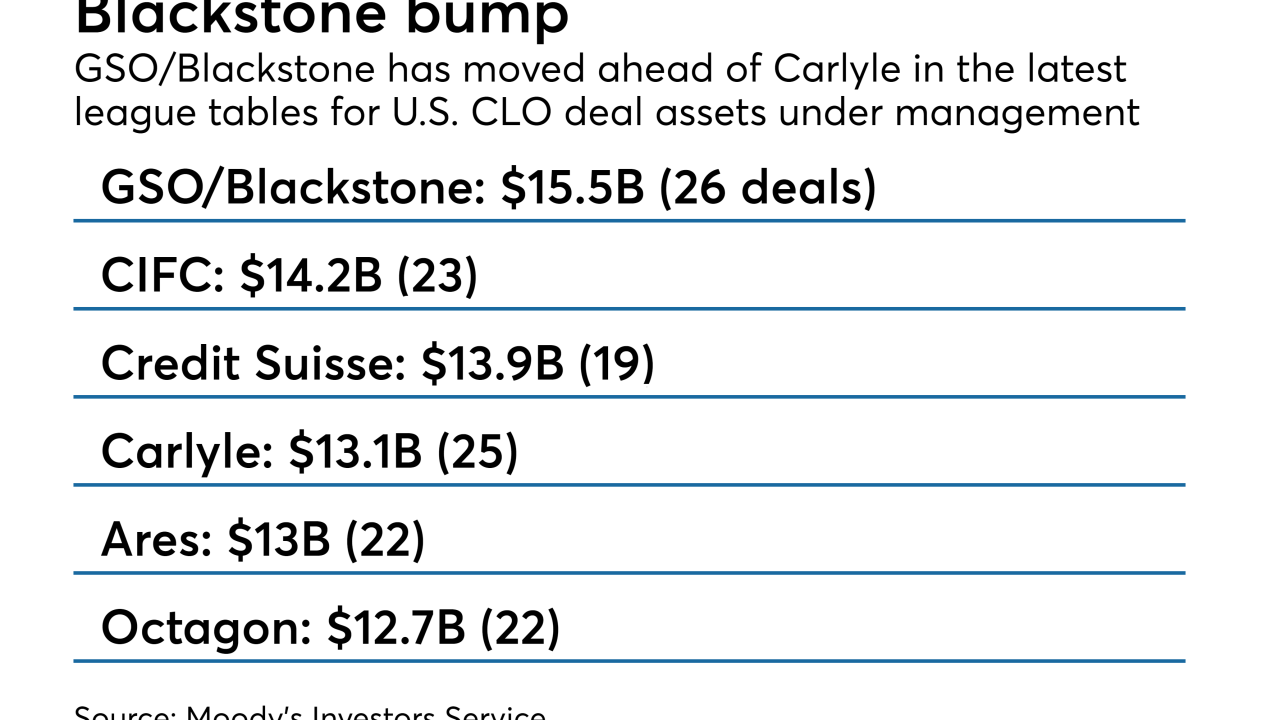

The distressed-debt manager now manages 26 U.S. CLOs totaling $15.5 billion, the most of any domestic CLO market manager.

August 13 -

The £325 million Dryden 63 CLO, sponsored by PGIM, will issue six classes of sterling-denominated notes; Barclays’ £4.5 billion Sirius Funding is issuing three tranches in three different currencies.

August 6 -

The eligibility criteria for loans that can be acquired are “more liberal” than recent CRE CLOs rated by Kroll; they are also more liberal than those of Hunt’s initial CRE CLO, completed last year.

August 3 -

While Carlyle has been judicious with new issuance, it had a busier second quarter in refinancing older deals; several more will be ripe for refinancing in the third quarter.

August 2 -

Mindful Wealth, an investment firm based in Singapore, is raising money to put to work in some of the riskier tranches of U.S. collateralized loan obligations, those rated BBB and B.

August 1 -

Recent documentation tweaks that afford "excessive amounts of flexibility" to CLO managers can introduce "material, and even unquantifiable, risks" into transactions, according to the rating agency.

July 27 -

The Chicago-based corporate small-business lender and CLO management firm also reduced the cost in subordinate notes as it chose to maintain the existing reinvestment and maturity periods limiting the deal's shelf life.

July 24 -

The triple-A rated senior tranche of Ares European CLO X has a coupon of 85 basis points above Euribor, an indication that a four-month widening trend in Europe CLO spreads continues; the deal is expected to close in September.

July 23 -

The transaction, Shelter Growth CRE 2018-FL1, is backed by 22 properties with a total balance of $415.1 million; it is static, meaning the only new loans to be added to the trust will be "companion” interest in loans secured by existing assets.

July 23 -

The New York State Supreme Court has ruled that Sound Point is within its rights to enforce a 90-day noncompete agreement with a manager who joined GoldenTree two weeks after his resignation.

July 22 -

That's a departure from the firm's existing fund, which acquires controlling stakes in CLOs through "equity" holdings; the new fund will be advised by the same principals, Tom Majewski, Daniel W. Ko and Daniel M. Spinner.

July 18 -

Tikehau CLO IV B.V. will control €400 million (UA$466.5 million) in mostly European leveraged loans and high-yield bonds (with an allowance for up to 25% of non-euro-denominated assets), according to Fitch Ratings.

July 17 -

Unusually for a debut transaction, the $329.7 million M360 2018-CRE1 will be actively managed: For the first 12 months after the closing date, funds from repaid principal can be used to purchase new loans, subject to eligibility criteria.

July 17 -

When the transaction closes on July 23 it will be renamed Fortress Credit VSL VI; additional collateral, nearly half (48%) of the total, in fact, will come from another CLO, Fortress VI.

July 17 -

The €414.2 million CVC Cordatus Loan Fund XI will issue exchangeable shares for four classes of notes; this allows the fund to hold bonds without putting itself off-limits to U.S. banks.

July 12 -

The lack of concrete lobbying victories had become an issue with some members in the group, possibly leading to a splintering of support among members and the board for continuing the executive director's tenure.

July 9 -

Most managers are looking to add three to five years of investable life through CLO resets and refis, but Apollo is sticking with a four-year reinvestment window in a refinancing of its 2016 ALM XVII portfolio.

July 6