-

The spread on the AAA rated notes issued by KKR 23 CLO is unchanged from the manager's prior deal, but three of four subordinate tranches are priced wider than the June transaction.

October 1 -

Four new repriced portfolios from BlueMountain, CIFC, GoldenTree and HPS each exceeded 10x debt-to-equity ratio, compared to a three-month prior average of 9.16x on S&P rated deals.

September 28 -

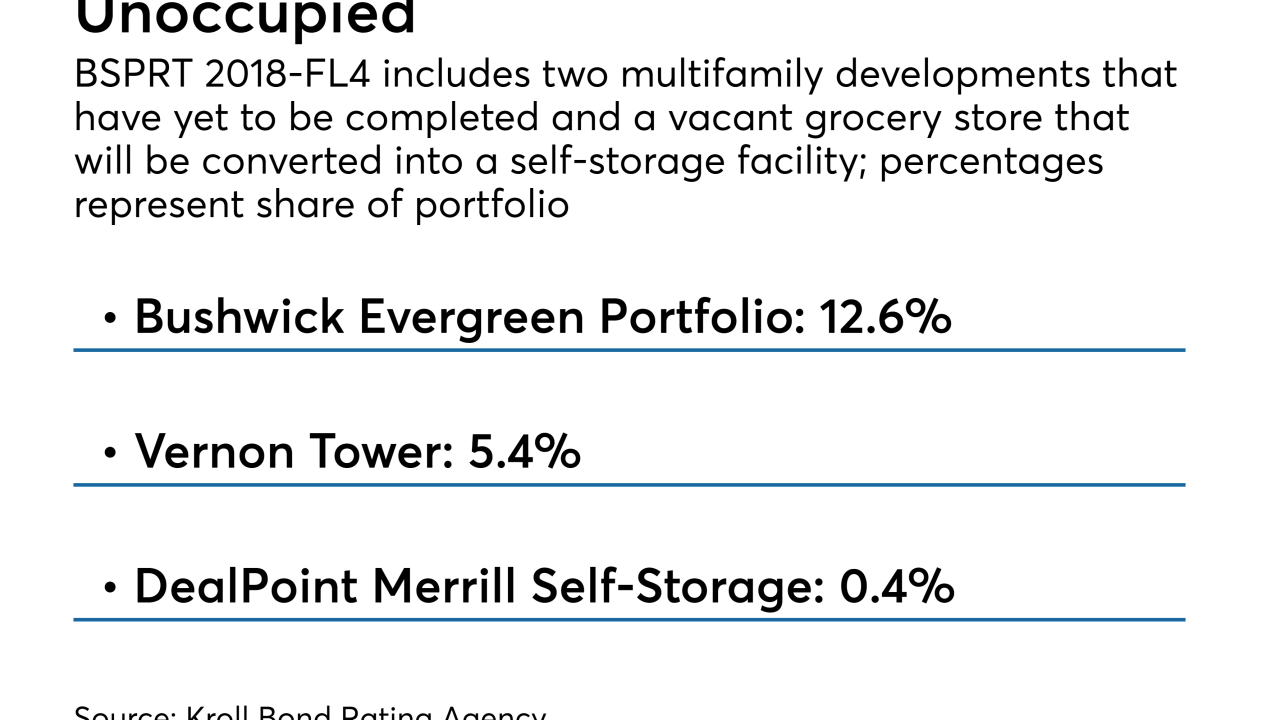

Three of the loans backing the $868.4 million BSPRT 2018-FL4 representing 18.4% of the collateral are either still under construction or have yet to be redeveloped, according to Kroll Bond Rating Agency.

September 24 -

While banking regulators are currently looking the other way when corporate debt packages exceed 6.0 leverage, that could easily change under a new administration or Congress.

September 24 -

A conflict between risk retention rules and prohibitions against self-dealing were limiting options for some lenders to hold skin in the game; a no-action letter issued to Golub Capital creates a "clear path" to compliance.

September 20 -

Tetragon Credit Income Partners is considering a move outside its niche CLO equity investment strategy in expanding its portfolio management team.

September 19 -

The Boston-based firm has refinanced two existing deals within the last 10 months, but hasn't printed a new deal since October 2015, well before U.S. risk retention rules took effect.

September 17 -

The deal will be managed through its BDC, which formed a joint venture last December to fund PE-sponsored firms with unitranche corporate loans.

September 14 -

The deal, which Fitch did not name in its report, appears to be VCO CLO 2018-1. The agency said the transaction might not even merit a single-A rating, given the high single-sector concentration.

September 12 -

J.P. Morgan Asset Management is not disclosing why it is retiring the $1B Palm Lane Credit Opportunities Fund; the fund was previously being considered for a spinoff.

September 11 -

The $300 million transaction has a six-month prefunding period during with the last $50 million of loans will be acquired; it can be actively managed for three years.

September 10 -

TCI Capital assigned two CLO deals totaling $1 billion that it was managing for Columbia Management Investment Advisers, after Columbia resigned its subadvisory role.

September 7 -

Collateralized loan obligations denominated in pounds sterling were once a tough sell; two recent deals from Barclays and PGIM indicate that this is changing.

September 4 -

The credit arm of the $24 billion asset H.I.G. Capital is marketing a $458.1 million BSL CLO, its first deal since April 2015.

August 31 -

The $408.4M Anchorage Capital CLO 2018-10 adds to the $5.2B-asset manager's 2018 tally of three re-issues and a refinancing — not to mention a debut European CLO.

August 29 -

The percentage of CCC "buckets" in CLOs increased in the second quarter and they are now at levels similar to 2016, when managers struggled with concentrations of troubled energy-sector assets.

August 28 -

The first two transactions were initiated in March, just a few days before skin-in-the-game rules were lifted for this asset class; this time, the CLO manager is not exactly sticking its neck out.

August 28 -

Jeff Weinstein and Patrick Lampe join from the Chicago office of Sidley Austin; Morgan Lewis partner Philip Russell is relocating from the firm’s New York office.

August 28 -

DFG Investment Advisers, led by former Goldman and HVB Group veterans, will exceed $4.2B in CLO assets under management with the latest deal.

August 26 -

The $502 million Diamond CLO represents the first securitization of small/medium enterprise loans since Blackstone in the second quarter relaunched a direct lending business.

August 21