-

This year saw elation over the rollback of risk retention for CLOs give way to concerns about leveraged lending, the 1st post-crisis downgrade of a subprime auto deal, the 1st AAA for commercial PACE, and much, much more.

December 31 -

They differ slightly from those released earlier by the Fed-convened ARRC, including language making it easier to ditch a SOFR-derived benchmark in favor of a new benchmark that has yet to be developed.

December 26 -

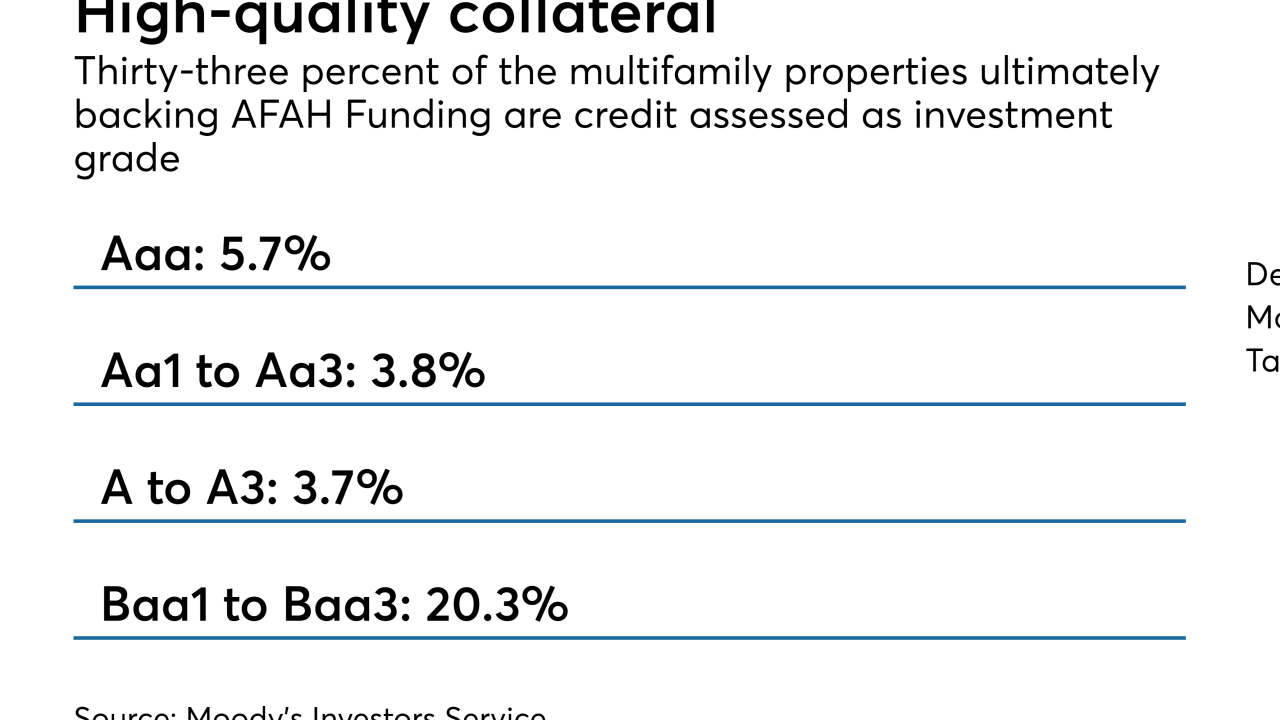

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

A Wells Fargo report this week shows that market spreads for the triple-A notes backed by collateralized loan obligation assets are at 128, a level not seen since May 2017.

December 21 -

The $500 million AIG CLO 2018-1, AIG's first deal since selling off its asset management business in 2010, is priced at 132 basis points over three-month Libor.

December 20 -

The €350 million Providus CLO II is backed exclusively by loans to mid-market firms that meet the private equity firm's sustainability criteria; at closing, 90% of the collateral has been identified.

December 20 -

The LA-based manager is pricing the replacement AAA notes of Oaktree EIF III Series 1 inside recent market averages through a limited, brief noncall extension.

December 17 -

Stuart Morrissy, a leveraged finance specialist, joins the law firm from the New York office of Milbank, Tweed, Hadley & McCloy.

December 16 -

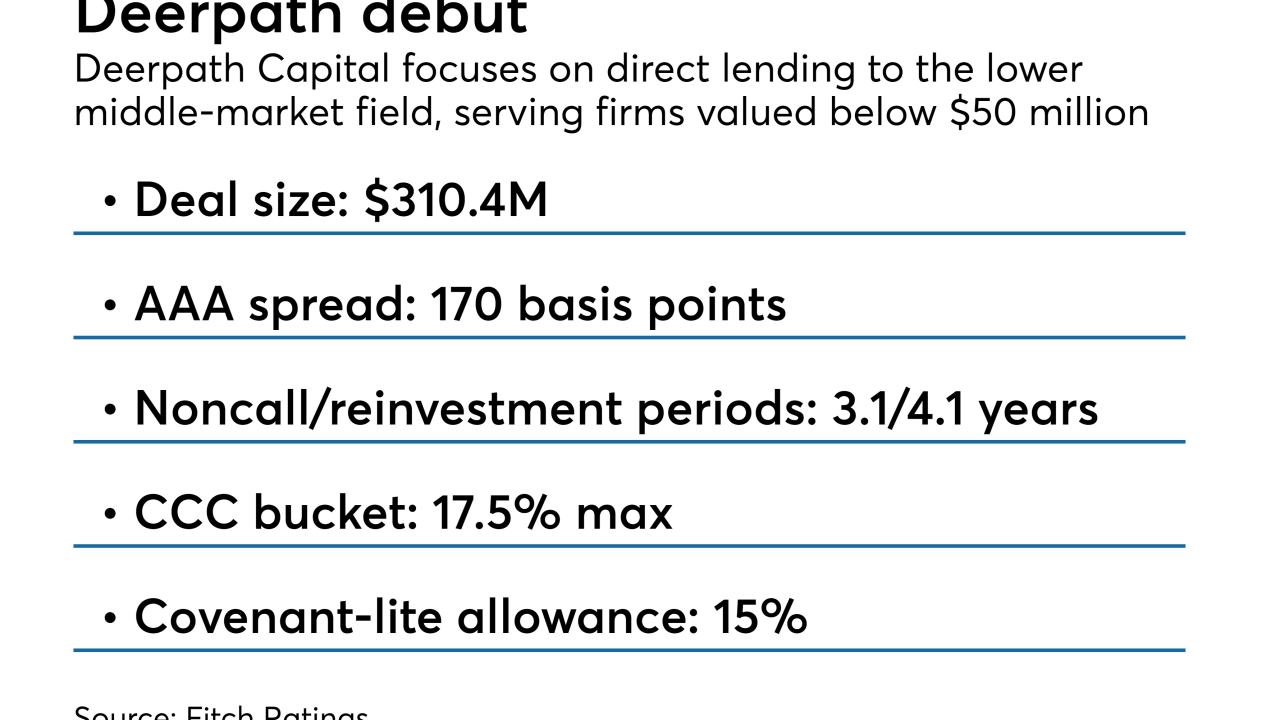

The $308 million Deepath CLO 2018-1 has an unusually large allowance for riskier triple-C loans of up to 17.5% of the portfolio.

December 11 -

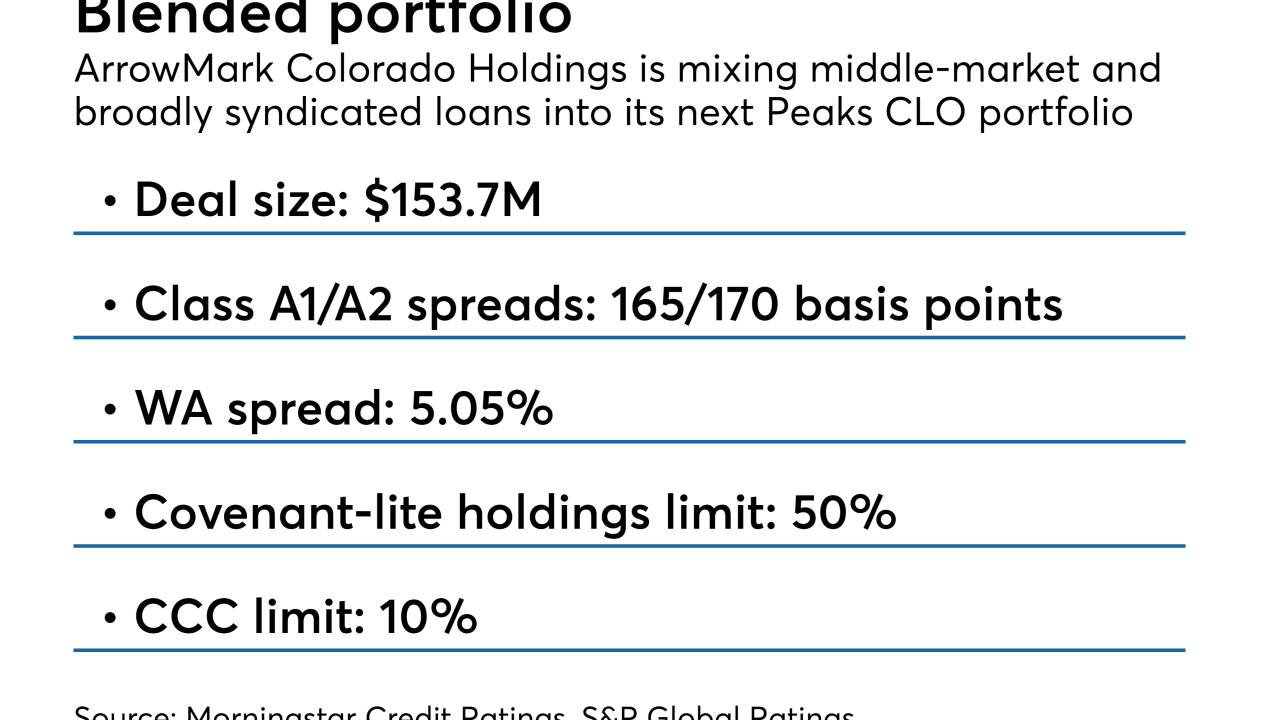

The $153.7 million Peaks CLO 3 also features a high ceiling for triple-C-rated loans and for "current-pay" loans that meet one or more criteria for default.

December 10 -

FORT CRE 2018-1 will include four loans recycled from the prior deal, including one that Kroll has identified as a loan of concern due to weak operating performance.

December 5 -

The sponsor appears to be paying for the privilege; the deal is structured with a super senior tranche of notes that benefits from considerably more subordination than the senior tranche of its prior deal.

December 4 -

Both managers are pricing their 3rd CLOs of 2018; the 135 basis point spread on Zais' is among the widest this year for a deal backed by broadly syndicated loans.

November 27 -

The pool includes loans for 23 new construction, converted or acquired assets, each in a pre-stabilization phase awaiting refinancing through a permanent agency takeout loan.

November 21 -

Guggenheim joins GSO/Blackstone and Bain Capital as longtime CLO managers expanding into the SME space this year.

November 21 -

We are one year deeper into an already extended credit cycle, so it’s even more important to focus on market complacency.

November 20 Fitch Ratings

Fitch Ratings -

More collateralized loan obligations are failing weighted-average lift tests due to the dearth of available loans whose near-term maturities could provide some relief to portfolios.

November 20 -

Eagle Point's CEO criticized "hyperbole" about growing risks in leveraged loans and CLOs, noting the benefits that price volatility can present to equity buyers.

November 15 -

The structured credit specialist will more than double its $2.9 billion in assets by acquiring a portfolio of three collateralized loan obligations that Trimaran Advisors runs from KCAP Financial.

November 12 -

The $600 million FORT CRE 2018-1 is more highly leveraged than the private equity group's debut transaction in August 2016, it is also actively managed and includes a $50 million tranche of revolving notes.

November 12