-

The refinancing also extends the reinvestment period of the $410 million Garrison BSL CLO 2016-1 by two years; the deal is non-callable for two years as well.

March 19 -

Gleysteen's return builds on a recent trend of old-school issuers revving up new CLO platforms

March 19 -

The JFSA published a final rule outlining the hoops U.S. CLO managers will have to jump through if Japanese banks are to avoid a higher risk weighting on their holdings; it remains to be seen how much of a burden this will be.

March 19 -

There are six tranches of AAA rated notes, including fixed-rate, some variable rate, and even a rare tranche of AAA rated loans.

March 13 -

DBRS and Kroll Bond Rating Agency also rate commercial real estate collateralized loan obligations, as does Moody’s Investors Service, though Moody’s rates only the senior tranche of deals

March 12 -

Nick Robinson, a 15-year Milbank veteran in advising CLO arrangers, managers and investors, joins as a partner in the New York office of the London-based firm.

March 11 -

Bancorp 2019-CRE5 contains 46 loans on apartment buildings accounting for 82.4% of the collateral pool; that's up from 78.8% for the sponsor's prior deal.

March 8 -

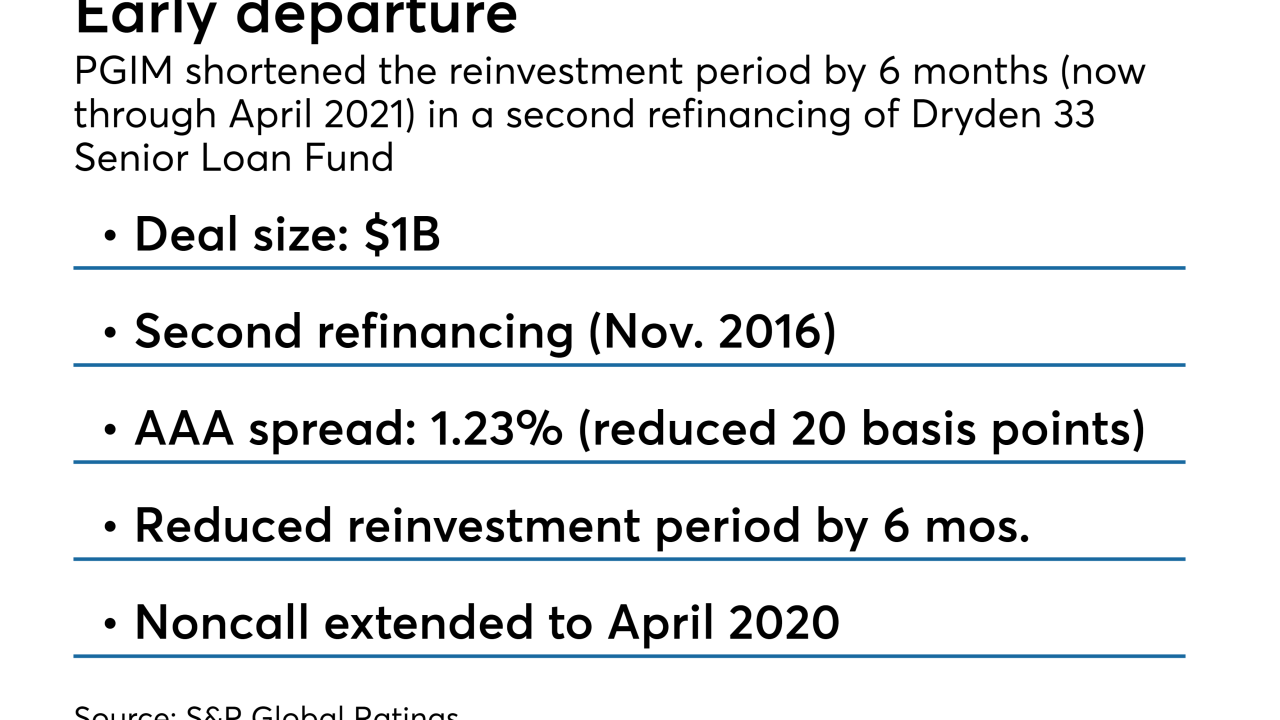

PGIM gains a 20 basis-point reduction in the AAA note coupon as it reduces the reinvestment period by six months

March 6 -

Investors appear to be willing to accept lower spreads in exchange for tying their money up for less time; CLO managers may be hoping to refinance when market conditions improve.

March 6 -

After waiting a decade to return to the CLO market, AIG now has taken less than three months to issue a second deal through its new "CLO 2.0" platform.

March 5 -

The $500.25 million Magnetite XXI has a three-year reinvestment period and can be called after just one year; it also priced inside most other deals that came to market in February.

March 4 -

Tobacco-industry loans are rare assets for CLOs, but Sound Point is ensuring none will go into its CLO XII portfolio for the remaining 20-month reinvestment period.

March 1 -

From financing driverless cars to dealing with Libor's demise, here are the highlights from the Structured Finance Industry Group's annual conference.

-

Concerns about risks in the leveraged loan market, as well as the potential impact of new capital rules for Japanese banks, continue to weigh on collateralized loan obligations.

February 27 -

Not every tranche of notes originally issued by ALM XIX has been upsized by the same amount; in fact, some of the lower-rated tranches have been cut in size.

February 26 -

Expect even more actively managed CRE CLOs to be issued this year as investors get more comfortable with the idea of managers using proceeds from the repayment of collateral to acquire new bridge loan.

February 25 -

The €400 million RRE 1 Loan Management DAC has a 4.5-year reinvestment period and two-year non-callable period, according to presale reports.

February 22 -

The selloff in the CLO market in the fourth quarter of last year may have caused Eagle Point Credit Co. some short-term pain, but the closed-end investment firm expects to profit from it in the long term.

February 21 -

The partnership with Hallows HalseyPoint to step up the pace of recruitment of analysts and traders and open a warehouse line for loan accumulation by the end of May.

February 21 -

OHA Credit Funding 2 offers nine classes of fixed- and floating-rate notes backed by corporate senior loans, including a rare tranche of single-B rated notes.

February 20