-

Fitch’s list of loans with growing risks of downgrades reached $110 billion in December, up 53% year-to-date.

December 13 -

First Eagle, with $99 billion AUM, will expand its presence in structured finance-based direct lending to middle-market firms through the acquisition by uniting the two firms’ credit-business platforms, according to a release.

December 9 -

While undeterred from the market, CLO investors may be skittish enough over price volatility and quality in loans to be more discerning of which managers' BB notes they'll take on.

December 9 -

TPG Sixth Street Partners' Alan Waxman warns investors are turning a blind eye to an epidemic of fake corporate earnings projections.

December 6 -

Shizuoka Bank Ltd. plans to step up its search for yield by buying more U.S. collateralized loan obligations, according to its top executive.

November 27 -

Investors have been demanding significantly higher yields to lend to junk-rated companies in recent weeks - so much so that spreads in an index of the riskiest tier of junk, known as CCC, just breached 1,000 basis points for the first time in more than three years.

November 25 -

Tetragon's announcement reveals the firm will complement its equity strategy by also focusing on the debt-note structure of deals, in hopes of gaining returns on the performance lowest-rated mezzanine and subordinate tranches.

October 29 -

S&P's review of leveraged-loan deals across multiple sectors found only 17% of lenders have provisions that would disallow borrowers from transferring collateral assets to unrestricted subsidiaries outside lender reach.

October 21 -

According to Kroll, this is the middle-market lender's first securitization of growth-opportunity loans made to venture-capitalized software firms that have yet to develop earnings or substantial assets.

October 18 -

The $5 billion financing package may also include around $1 billion of secured debt that would be sold to investors, as well as about $1.7 billion in letters of credit that would be split among participating banks

October 14 -

Members of the House Financial Services Committee cited leveraged lending, cybersecurity and the switch to a new interest rate benchmark among potential systemic risks that keep them up at night.

September 25 -

Natalya Michaels, recently of Artisan Partners, will be a managing director with a focus on marketing, investor relations as well as expanding the firm's investor and product base.

September 25 -

Collateralized loan obligations in Europe are running low on fuel, prompting some investors to seek greater protection that may slow the market even further.

September 20 -

Ratings agencies have argued recently that the population of loans whose ratings fall below the lowest single-B rating – the lowest rung above the highly speculative triple-C ratings layers – will grow significantly in an economic downturn.

September 18 -

Modifiable and splittable/combinable tranches are part of a new feature emerging in the CLO market which is intended to partially set off the negative impact to holders of CLO debt associated with the call feature.

September 16

-

CBAM Partners announced the hiring away from AXA Investment Managers an executive with significant experience in the CLO and European debt markets to assist in the launch of its European credit strategies business.

September 12 -

Managers appear to be increasingly safeguarding portfolios from a potential downturn by dumping distressed assets.

September 6 -

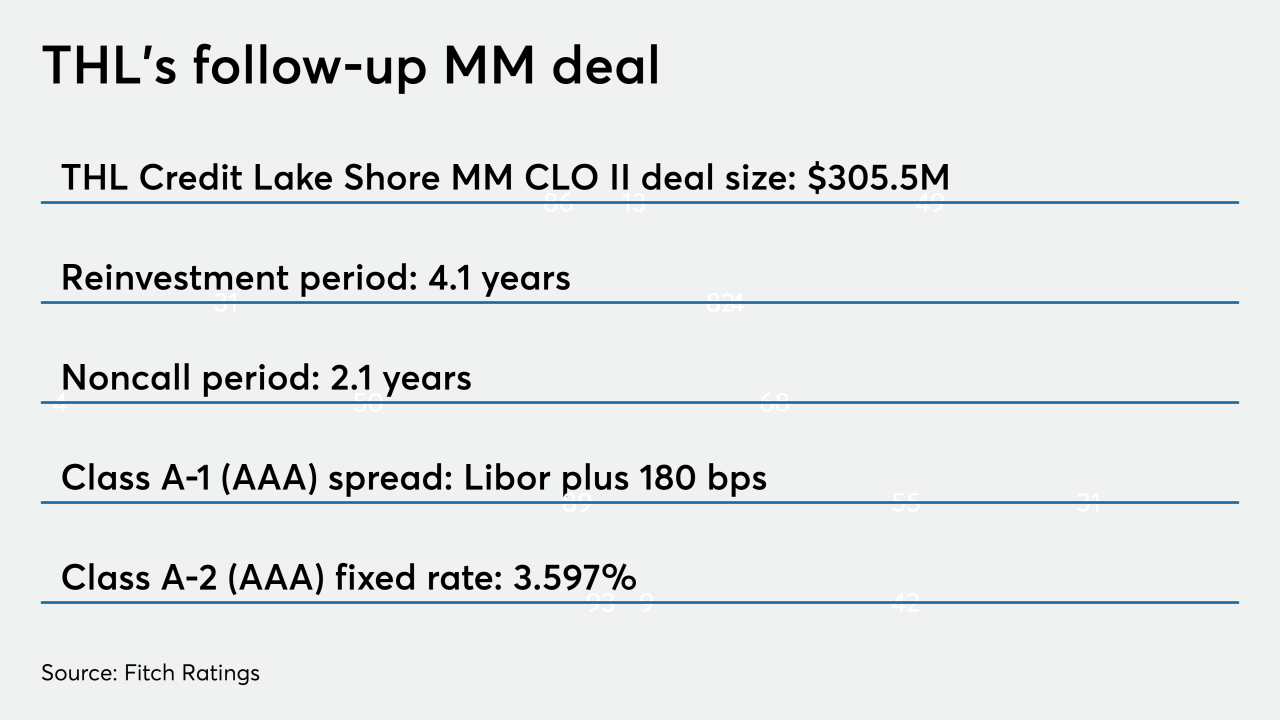

The manager will have four years to actively buy and trade loan assets in THL Credit Lake Shore MM CLO II, compared to two in THL's debut deal from March.

August 21 -

The $435.5 million Crown Point CLO 8 is a broadly syndicated collateralized loan obligation that has a “significantly below average” WARF of 2678, indicating a portfolio with a greater share of safer leveraged loans than other CLOs.

August 13 -

Assured Guaranty will pay $160 million to buy out majority shareholder Affiliated Managers Group Inc. and the founders. The insurer will also invest an additional $590 million in the firm and its funds.

August 8