-

Neuberger Berman’s new CLO will map credits to UN targets that aim to drive international progress toward action on climate, equality and poverty by 2030.

February 12 -

Deals, trends and research in structured finance and asset-backed securities for the week of Feb. 5-11

February 11 -

The rise in sales comes as risk premiums for new transactions have tightened to pre-pandemic levels, marking a stark turnaround in a sector with heavy exposure to company bankruptcies caused by the lockdowns.

February 8 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.29-Feb. 4

February 4 -

A consensual deal cuts legal costs and hastens a Chapter 11 exit, but plans block possible restructuring proposals that can curb cash payouts to lower-ranking creditors.

February 3 -

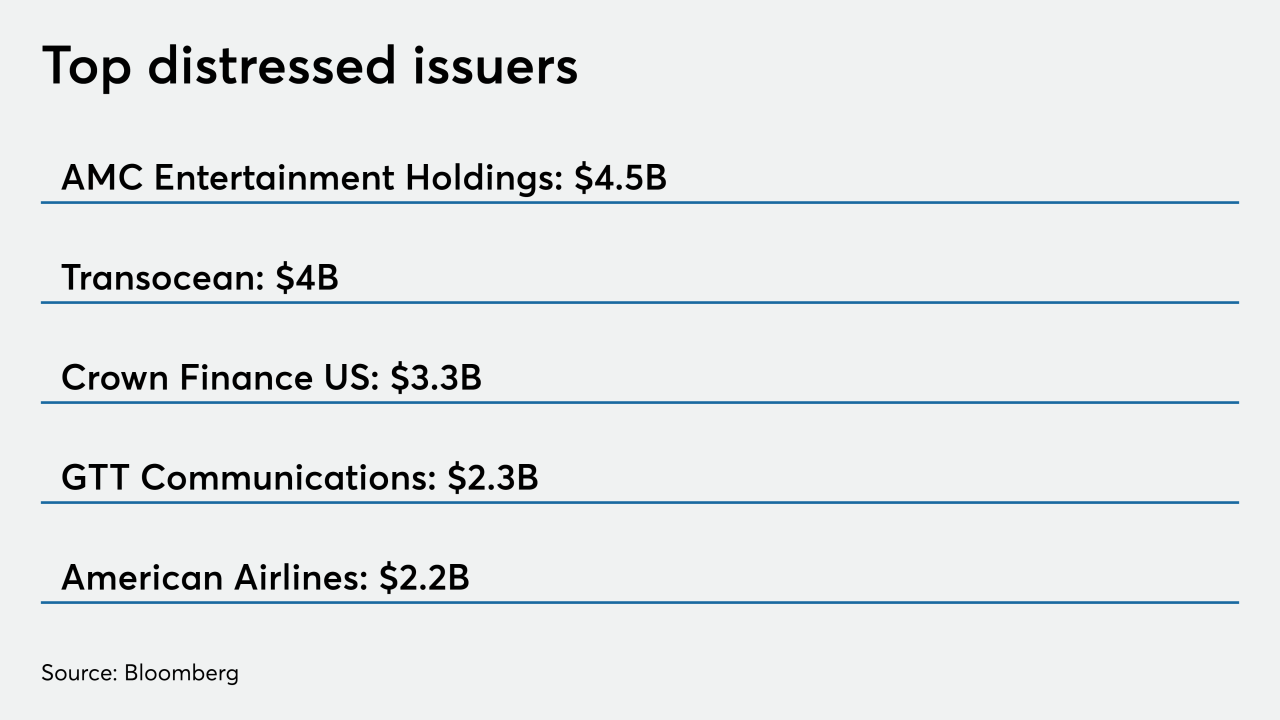

AMC and American Airlines took advantage of surprise stock-price surges to cash out shares and raise liquidity for possible debt reduction — a massive stroke of good fortune for the companies as well as their creditors.

February 1 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.22-28

January 28 -

Cheap funding costs have extended a lifeline to many troubled companies, slowing the pace of U.S. bankruptcy filings, but shops, offices and hotels have been particularly vulnerable to the pandemic this month.

January 27 -

About $16 billion across 43 deals in both new-issue and refinancing has prompted analysts into making early revisions to raise their initial volume forecasts.

January 26 -

More may be on the horizon as lenders lose patience with defaulting property owners.

January 19 -

Distressed debt funds on average gained 11.4%, according to Hedge Fund Research Inc., compared to the riskiest corporate bonds rising 2.3%.

January 11 -

Although returns may be lower than in recent years, CLO securities (particularly the senior-rated tranches) remain very attractive compared to alternative investments.

January 8 -

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

Bausch, formerly Valeant Pharmaceuticals, has paid down more than $24 billion of the $32 billion in leverage it owed five years ago from a debt-driven acquisition spree — which ended after a drug-pricing scandal.

January 4 -

The buyout industry has about $3 trillion of unrealized value on its books, according to Preqin. And it’s tapping that to land loans for bolt-on deals, to refinance debt or bail out struggling companies in their portfolios.

December 31 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 18-23

December 23 - LIBOR

The likely extension of support of Libor until June 30, 2023 is a major plus for the securitization market, fending off potential market disruption the buying and trading of $1.8 trillion in outstanding asset-backed securities because of the planned cessation of the benchmark rate by the end of 2021.

December 22 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 11-17

December 18 -

Investment firms and hedge funds are increasingly engineering bankruptcy loans and side deals to take control of Chapter 11 reorganizations from the outset, locking in rich rewards for themselves while potentially locking out rivals and lower-ranking creditors with little transparency. The trend is sure to speed up cases, but it also forces judges to make quick decisions that may shortchange some valid claims.

December 17 -

Promising vaccines may not reach the general public fast enough to save a number of struggling companies next year, and workout professionals and distressed investors are expecting smaller private companies will search for cash in 2021. They’re also anticipating that businesses of all sizes may struggle to adjust to changing consumer habits in a post-pandemic world.

December 16